We do the research, you get the alpha!

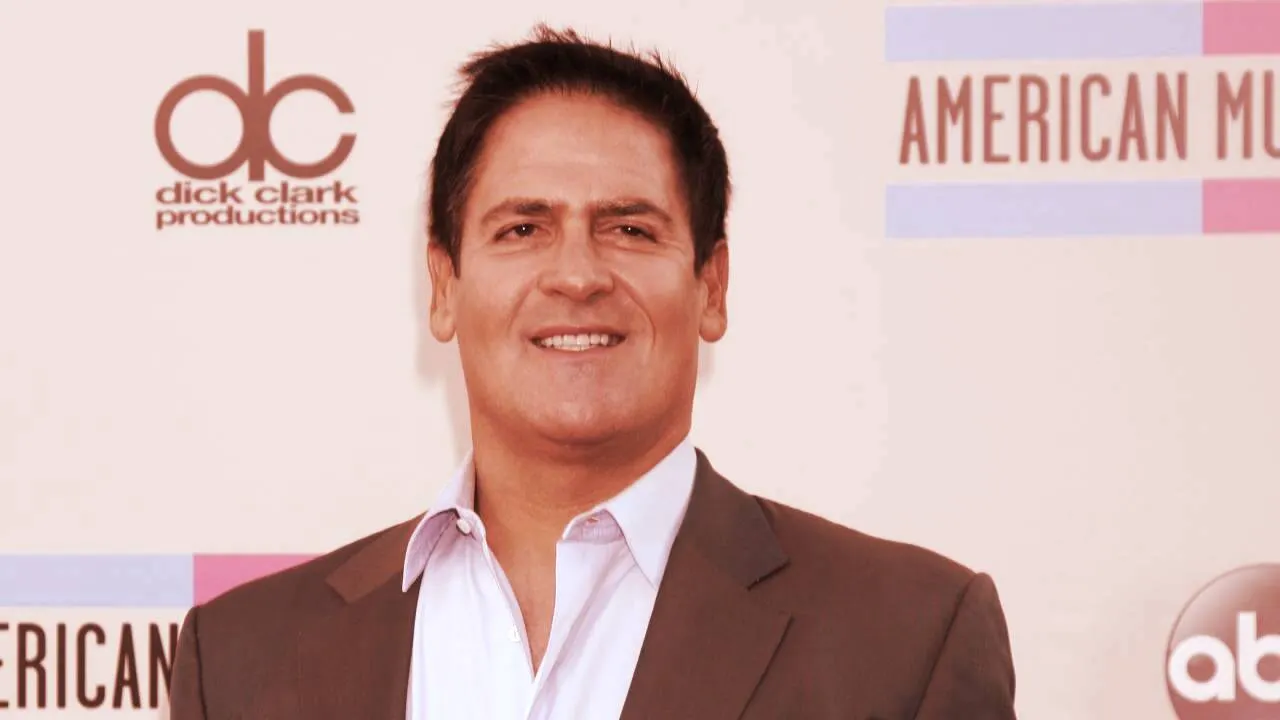

Mark Cuban, billionaire entrepreneur and star of ABC's “Shark Tank,” joined the Altcoin Daily Podcast for a wide-ranging, hour-long conversation about crypto.

Cuban mused on the differences between decentralized application platform Cardano and Dogecoin, and which has the most potential.

"You know, my thoughts on Cardano are the same as they are on Polygon and Ethereum," Cuban said. "There's got to be a there, there."

Cuban says he looks at the number of transactions on a blockchain, calling it a bellwether of success. "I guess the people in Africa are not using [Cardano] as much as they expected, because you don't see the transactions, you don't see the fees," he said.

The Dallas Mavericks owner turned crypto champion says that while Cardano has had smart contracts for some time, he doesn't see where Cardano has had much impact.

Cuban says that the next great application that everyone uses could be built on Cardano. "The door is open for that to happen, but it hasn't happened yet," he said.

The podcast host asked Cuban what advice he would give to Cardano co-founder Charles Hoskinson if he came on “Shark Tank.”

"I say, ‘Where are your revenues?’" Cuban said, adding that just because it's crypto doesn't mean revenues are an afterthought.

"There's this distortion in crypto called market cap," he continued. "You have a small float, you get the price up enough, and you have a total number available from the treasury at a billion. You make it a $10 token, and now you have a $10 billion total market cap."

Cuban said the issue with distorted market caps is not solely an issue with Cardano, noting Dogecoin's $9.3 billion market cap and Shiba Inu's $6.7 billion market cap, according to CoinMarketCap.

"I still think DOGE has got more applications potentially available to it than Cardano," Cuban said, adding that he believes the opportunity for Cardano is greater—at least until Dogecoin also becomes a platform for applications.

"It's still a business,” he said. “No matter what you do, what you say, how you position it, or what your market cap is, there has to be some there, there."