We do the research, you get the alpha!

The funding rates for Bitcoin and Ethereum, the leading cryptocurrencies by market cap, remain negative for derivative traders, suggesting a potential short-term bull signal.

The Federal Reserve’s recent interest rate hikes and plans for future tightening of policy have placed increased pressure on markets across the globe. This past Friday, Federal Reserve Chairman Jerome Powell reiterated his intent to counter inflation with higher interest rates in the near future. Markets reacted sharply to inflation news in May and have continued to slowly make new lows amid a summer of economic turmoil.

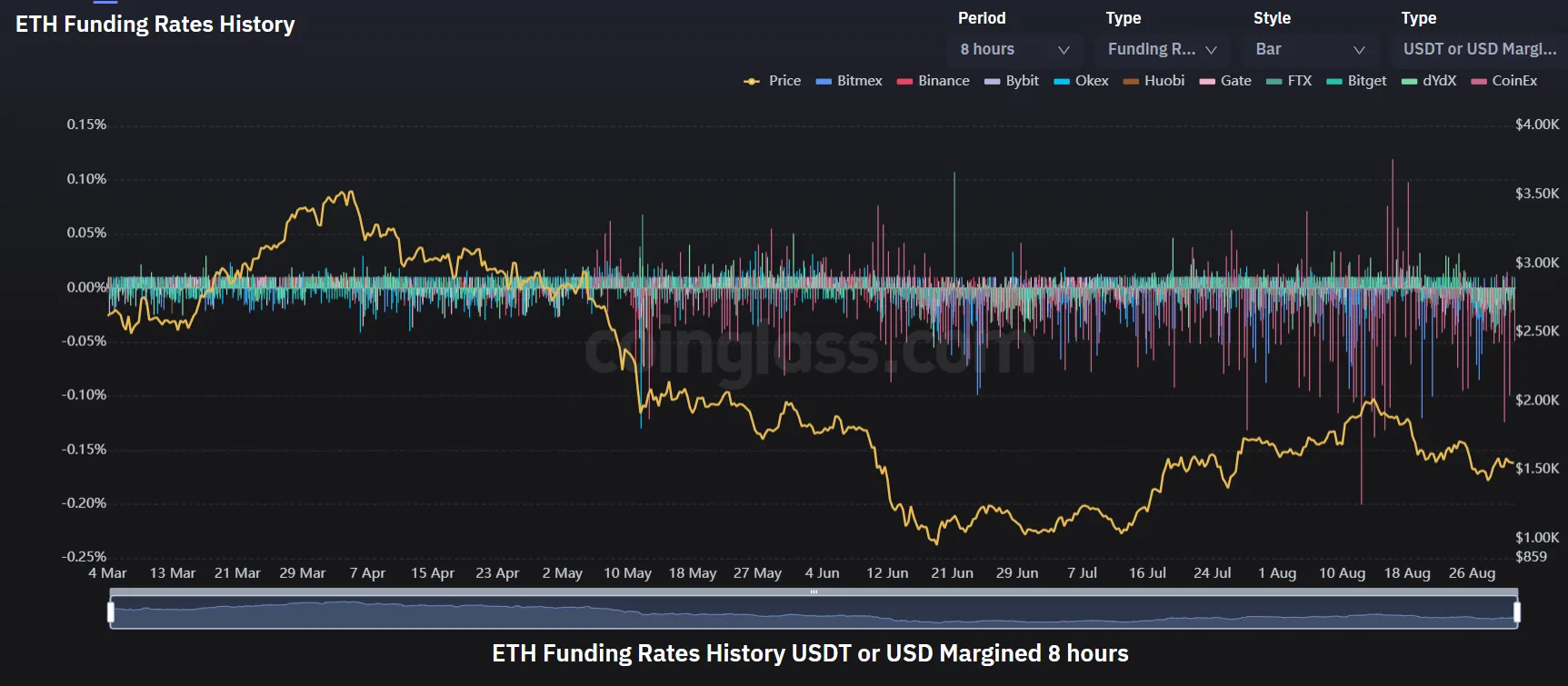

The macroeconomic picture has bled into prices for derivatives, which are contracts whose value is dependent on an underlying asset or group of assets. Derivative prices have kept funding rates generally below zero since May.

Funding rates are periodic payments between traders to make the perpetual futures contract price close to the index price, or the underlying crypto constituting the futures contract. A perpetual futures contract is an agreement to buy or sell an asset at a predetermined price without an expiration date on the contract.

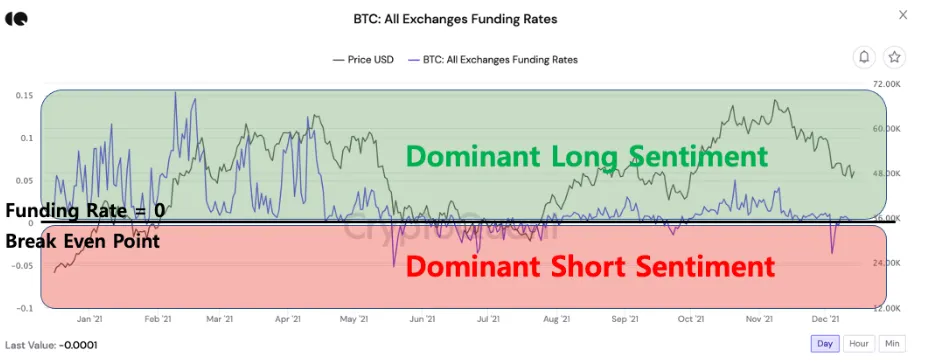

While this may seem technical, funding rates are designed to show the overall sentiment of the traders and how they view future market conditions. When funding rates remain negative, it indicates how traders are short, or expect the market to go down. When funding rates are positive, it implies how traders are long, or expect the market to go up in the long run.

The sample chart above from crypto analytics firm CryptoQuant shows how funding rates under zero indicate that most traders expect lower Bitcoin levels to come, while funding rates above zero would show that traders expect higher future prices. Negative funding rates suggest that many market traders are bearish; however, this brings opportunity for potential buyers of futures contracts.

Changes in parts of a funding rate can affect market sentiment and opportunity. Interest rates and premiums make up a funding rate. While the interest rate is often fixed, the premium can be determined by the difference between the perpetual futures price and the index price.

“A negative funding rate indicates that perpetual prices are below the mark price, which means that short positions pay for longs,” according to Binance, a leading derivatives trading exchange. In other words, funding rates incentivize traders to buy perpetual futures contracts when the price is lower than the index price of an asset.

In the current market scenario, the wealth of shorts (sellers) in the perpetuals market has created an interest for longs (buyers) as the prices of Bitcoin and Ethereum in the futures market are lower than their index prices. Although there are many shorts in the market, the growing premium has placed a demand for longs. This demand could eventually create a short-term bull scenario as traders look to capture value in the perpetual futures market.

As markets continue to struggle with the ongoing inflation and interest rate threats, shorts will likely dominate traders’ sentiments. This will force premiums to be in favor of buyers to push the funding rates back closer to zero. Traders can only hope market participants are willing to take advantage of the ongoing negative funding rates enough to create a short-term rally in the market. If not, the futures market will likely see a continuation of the funding rate’s trend.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.