We do the research, you get the alpha!

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$86,044.00

-2.83%$2,943.72

-4.62%$1.88

-3.67%$852.29

-3.32%$1.89

-5.07%$0.999998

-0.00%$125.84

-3.24%$0.278335

0.40%$2,942.76

-4.61%$0.128669

-4.07%$1.031

1.88%$0.383549

-3.32%$57.79

-2.98%$3,596.27

-4.64%$85,880.00

-2.83%$532.39

-4.67%$3,194.97

-4.57%$0.999957

0.02%$0.999742

-0.04%$12.73

-4.60%$3,190.26

-4.52%$9.23

0.49%$2,943.58

-4.57%$405.32

-1.50%$27.53

-5.47%$0.219172

-4.49%$408.91

0.81%$0.999516

-0.01%$86,028.00

-2.90%$76.90

-1.88%$1.46

-7.00%$12.34

-4.45%$0.999669

-0.06%$0.112192

-4.97%$1.08

-0.45%$0.00000787

-2.56%$1.29

-0.07%$0.999858

-0.00%$1.48

-4.78%$0.132839

-3.78%$0.095074

-2.12%$1.21

-0.06%$5.02

-5.66%$1.77

1.10%$185.82

-1.87%$0.999304

-0.02%$0.00779114

-3.15%$0.07105

-0.23%$266.68

-5.69%$3.48

-2.27%$4,300.48

-0.20%$105.87

-3.65%$0.99873

-0.07%$1.54

-3.11%$12.28

-3.68%$0.817834

-12.58%$1.00

0.00%$2,941.65

-4.65%$157.03

-3.18%$0.00000402

-3.44%$0.218895

-6.14%$0.198827

-1.57%$3.03

-3.06%$4.51

-2.09%$1.14

0.03%$125.85

-3.32%$0.00000164

0.17%$4,314.22

-0.28%$0.02817752

-6.86%$0.00248606

-6.45%$0.99973

0.01%$1.11

0.00%$1.11

0.03%$10.20

-3.72%$0.999283

-0.03%$0.999573

-0.03%$0.534233

-4.85%$0.056945

-4.51%$0.411706

-7.46%$0.999644

-0.02%$3,386.59

-4.58%$10.10

-2.80%$0.111706

-4.63%$1.57

-2.67%$852.11

-3.25%$0.04268007

-3.99%$136.83

-3.28%$0.194976

-4.50%$74.53

-3.55%$3,120.34

-4.67%$5.29

-2.12%$0.062193

-7.00%$0.114413

-3.52%$85,767.00

-3.36%$2.05

-2.91%$3,147.22

-4.64%$86,235.00

-2.77%$85,949.00

-2.90%$0.01145776

-6.77%$0.04973407

5.81%$0.910909

-4.70%$0.01054813

-6.16%$1.25

-4.36%$10.92

0.01%$0.999855

-0.01%$113.64

0.02%$0.999749

-0.02%$0.118467

-4.56%$1.017

0.06%$0.999844

-0.03%$27.73

-5.31%$1.39

-6.04%$0.00000862

-4.74%$85,841.00

-2.85%$3,181.05

-4.80%$1.11

0.07%$3.60

10.33%$2.04

-5.58%$0.09026

0.64%$86,324.00

-4.65%$0.9998

0.01%$0.999584

-0.03%$3,143.47

-4.45%$0.01145866

-6.78%$0.01007622

-3.99%$0.999863

0.00%$145.38

-3.20%$1.12

-0.19%$2,945.27

-4.46%$0.187377

-4.65%$0.223061

-4.21%$1.71

-5.59%$3,081.06

-4.32%$5,725.33

-4.92%$0.9985

-0.02%$0.288971

-4.01%$0.997726

0.05%$2,943.25

-4.64%$86,439.00

-2.19%$35,382,014.00

0.00%$40.65

-1.56%$0.353799

-5.51%$0.996486

-0.01%$0.461091

-3.85%$2,460.42

0.00%$4.92

-4.77%$0.54471

-6.59%$0.537488

-7.11%$0.00530151

-1.40%$1.23

0.17%$0.515158

-7.36%$0.263054

-5.82%$0.718953

-6.70%$2,944.34

-4.55%$0.097546

-4.72%$0.767722

-2.38%$0.999626

-0.01%$0.425979

-5.10%$169.19

-3.34%$3,167.79

-4.69%$3.14

69.51%$0.509427

-7.07%$0.21116

-4.32%$3,102.57

-5.36%$0.07153

-3.62%$0.982085

1.32%$0.00004232

-4.83%$1.006

0.28%$0.407212

15.42%$0.03798963

-5.24%$1.11

0.01%$3,231.96

-4.77%$0.0000004

-1.96%$0.02032157

0.96%$90,454.00

0.00%$0.00407752

-12.28%$0.03908019

0.84%$0.090905

-3.83%$0.109168

-4.19%$3,274.77

-4.64%$85,824.00

-3.35%$9.78

-6.51%$0.00000037

3.53%$0.369889

-2.90%$0.070632

-3.09%$18.19

-5.97%$22.09

-0.05%$85,903.00

-2.72%$0.227099

-10.20%$0.058818

-3.90%$1.17

0.07%$0.331787

-4.50%$138.56

0.25%$0.128673

-4.11%$2.01

-4.51%$0.999058

0.03%$1.00

0.05%$0.319223

-4.92%$1.71

-4.77%$1.00

0.05%$18.47

-6.21%$0.999327

-0.07%$0.082526

-6.03%$0.03053585

-5.39%$0.118565

-6.02%$116.31

-6.16%$15.24

-4.44%$2,943.85

-4.46%$0.99938

-0.08%$0.00650421

-5.30%$0.185832

-2.27%$3,184.37

-4.73%$0.086166

-5.71%$0.260545

-1.90%$0.00597536

-3.53%$1.12

0.02%$1.44

-2.38%$2,905.66

-4.79%$86,058.00

-2.72%$22.73

-12.59%$27.54

-5.48%$0.992856

-0.05%$3,184.91

-4.58%$0.281474

-5.18%$0.275045

-3.47%$2,944.60

-4.44%$901.58

-3.43%$2.64

1.86%$0.01486719

2.09%$0.135005

-11.04%$27.54

-4.29%$1.00

0.00%$1.089

0.03%$3.72

-5.28%$0.162527

-3.66%$24.30

-7.63%$86,181.00

-2.87%$0.955127

-7.81%$0.132608

-4.55%$85,953.00

-2.77%$0.02912186

-1.06%$2,940.54

-4.58%$0.00251698

-3.50%$0.00000115

-0.82%$0.239627

1.25%$63.95

0.43%$1.001

0.13%$1.16

-0.00%

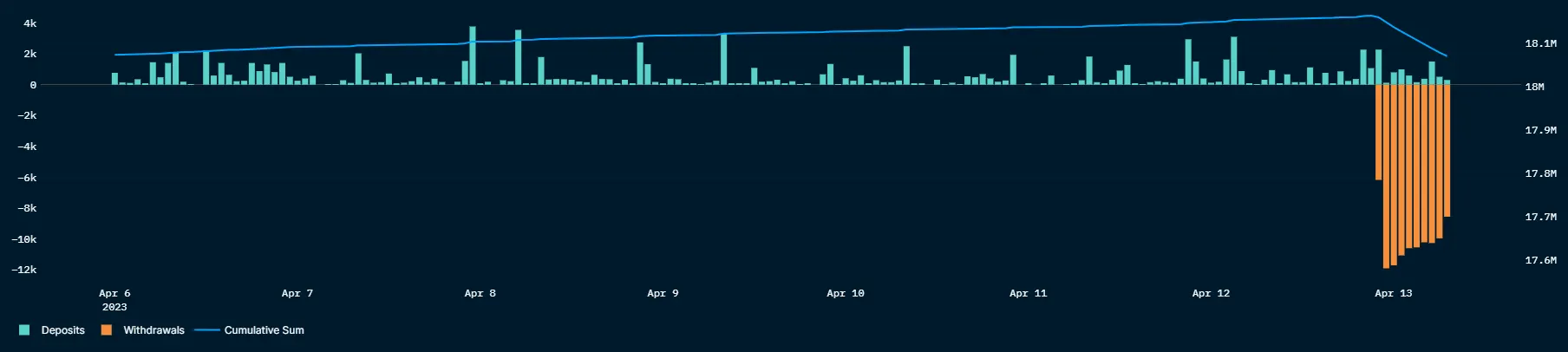

Following the network's latest Shanghai upgrade, Ethereum is soaring.

The second-largest cryptocurrency by market capitalization is currently up almost 6% over the past 24 hours, with ETH trading hands at around $1,980, per CoinGecko.

Liquidation data from Coinglass also suggest that bearish traders were proven wrong too, with Ethereum leading the pack at more than $44 million trades liquidated over the past 24 hours.

Of that sum, roughly 77% of those positions were short.

The successful execution of the Shanghai upgrade finally allowed Ethereum stakers to withdraw their holdings since staking first kicked off in December 2020.

This was the network's biggest upgrade since last September's merge event, when Ethereum moved from a proof-of-work consensus algorithm to a proof-of-stake one.

As a proof-of-stake network, Ethereum taps validators instead of miners to secure the network. To become a validator, users must first deposit (or stake) 32 Ethereum, roughly $63,000 at press time, to the network and maintain a node at all times to earn rewards.

Should that node fail, validators can have that 32 ETH sum slashed as a penalty.

Prior to Shanghai, however, these validators weren't allowed to withdraw from the network nor collect any accumulated awards. This led to widespread speculation that the ability to finally withdraw funds would incite a bearish impulse on the network.

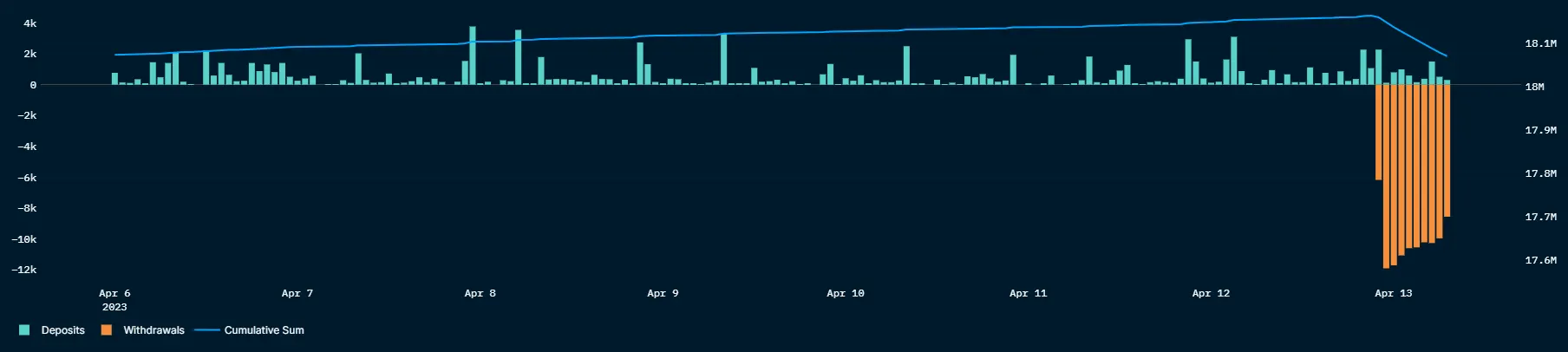

Indeed, as data pulled from Nansen indicates, many validators have indeed made their exit, taking with them their staked Ethereum and rewards as they leave. Over the past 24 hours, there has been a net exit of more than 84,500 ETH.

But based on current price performance, it doesn't appear that the newly-unlocked Ethereum is being sold on the open market. At least not yet.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.