We do the research, you get the alpha!

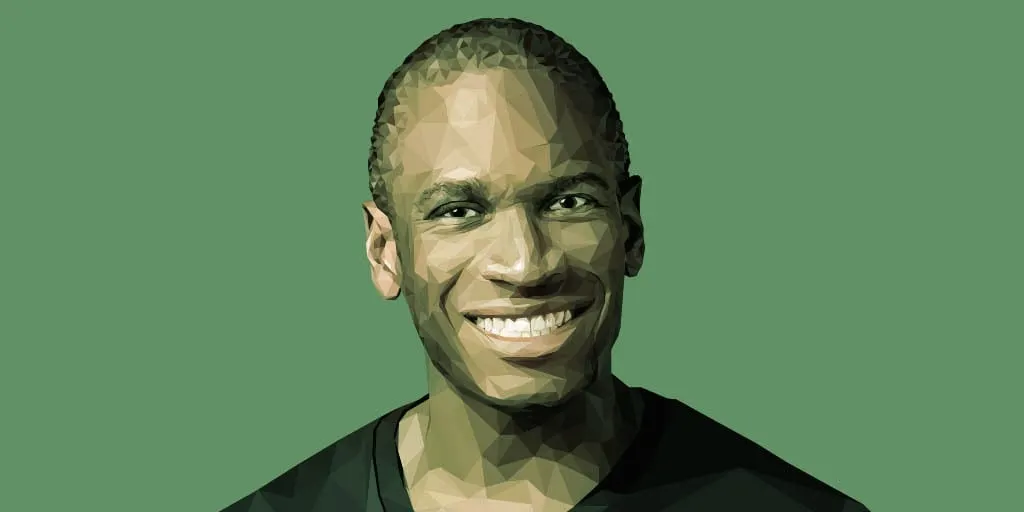

Decentralization may be core to crypto’s DNA, but the same cannot be said about people’s preferences when engaging with digital assets, said Arthur Hayes.

The distribution of decision-making and control is an essential component of Satoshi Nakamoto’s vision for Bitcoin in 2008, well before the dawn of the digital assets industry. But Hayes, the former CEO of cryptocurrency exchange BitMEX, suggested this central tenet isn’t important to the masses.

“At the end of the day, the average person doesn't actually care about decentralization or centralization,” he said on the latest episode of Decrypt’s gm podcast. “If you want to actually become your own financial institution and take control of the destiny of your finances, that's there for you to do at this point, [but] it's harder to use.”

Digital assets are decentralized in the sense that they do not require financial institutions for someone to maintain ownership of their funds or conduct transactions. Yet millions of people opt to rely on centralized institutions that offer frictionless crypto-related products and services, Hayes claimed, making the technology more palatable for the masses.

“[A] good price, good product, good user experience,” he said, “That's all the majority of you will care about and will care about in the future.”

There are plenty of centralized entities in the digital assets industry today, including major exchanges like Binance or Coinbase. But as crypto crashed last year, scrutiny of centralized actors like FTX intensified, fueled by the company’s apparent mismanagement at the hands of former CEO Sam Bankman-Fried.

A common catchphrase invoked in crypto is, “Not your keys, not your crypto.” The adage is popular among those who adhere strongly to the fundamental ideals of the technology.

Yet, from Hayes’ point of view, centralized players provide a crucial middle-ground—allowing people to participate in owning crypto without requiring them to navigate the complexity of financial sovereignty entirely on their own.

“Most people don't want anything to do with running their finances,” He said. “They want to have meaningful work, save some money, [and] provide for their family.”

Non-custodial wallets and decentralized exchanges are notable examples of how crypto doesn’t require financial intermediaries to serve as an asset. But Hayes suggested that there’s a lack of demand for decentralized crypto products because the impact it has on the bottom line when it comes to investing is somewhat negligible to most people.

Hayes pointed to inflation as something that provokes greater engagement in crypto than the concept of decentralization, which he said can “create speculators out of everyone.”

Further, the notion that wages for the average worker are not keeping up with increases in the cost of living stokes more involvement in financial markets, whether that’s trading crypto, gold, stocks, or any other asset, Hayes posited.

He added that whether or not a decentralized crypto product is eventually widely adopted by the masses will likely be determined by factors outside of crypto, such as inflation or the recent banking crisis in the U.S., based on how much those events could disrupt their lives.

Hayes noted the fear among depositors in Silicon Valley Bank that they would not be made whole when the bank failed last month as one recent example. It was the second-largest failure of a bank in U.S. history.

Even then, it might not ever get to the point where the average person manages their own crypto or trades on a decentralized exchange, he said. But that “might still be okay,” because not everyone has a “desire to run their own finances,” regardless of crypto’s future learning curve.

Hayes said he believes the balance between centralization and decentralization could change over time as decentralized crypto products become more robust.

“Hopefully, there [are] more people working on solutions that make that easier to use so that competition is a little bit more fair,” he said.