We do the research, you get the alpha!

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$69,060.00

7.03%$2,068.63

11.33%$1.63

30.54%$1.46

7.59%$631.71

7.21%$1.00

0.00%$89.39

13.52%$0.285834

0.96%$0.104029

12.84%$1.035

0.53%$0.308635

18.40%$51.55

6.66%$514.91

6.50%$1.00

0.00%$8.74

3.26%$28.66

4.94%$9.42

14.16%$339.81

5.34%$0.164233

1.69%$0.998948

-0.04%$0.167422

10.81%$1.00

0.04%$0.00962447

2.02%$0.105435

9.80%$58.01

12.62%$257.66

4.73%$9.68

15.69%$0.999818

-0.09%$1.012

16.37%$0.00000645

8.70%$0.079641

6.65%$1.33

0.60%$0.117271

6.27%$5,165.35

0.24%$4.08

22.11%$5,197.63

0.21%$1.35

-4.95%$0.626806

6.09%$1.00

0.00%$122.95

7.29%$0.00000435

10.38%$186.13

9.69%$0.718039

2.59%$0.997806

0.03%$78.73

6.46%$1.00

0.01%$0.070694

8.35%$1.23

26.01%$1.12

0.00%$0.17121

4.72%$2.25

2.53%$1.00

0.01%$0.00000165

0.54%$9.47

12.62%$0.286276

14.60%$2.49

16.96%$0.999309

-0.06%$0.117507

3.94%$0.423301

12.24%$8.94

7.71%$11.00

0.01%$7.20

6.40%$0.00192106

9.10%$2.07

3.78%$0.061522

7.96%$66.24

6.72%$0.112113

13.31%$0.01667445

2.16%$0.88716

7.76%$0.03201635

9.18%$1.099

32.81%$0.094436

11.86%$3.60

6.08%$1.004

0.44%$0.00979151

6.54%$1.095

23.54%$1.52

11.43%$1.24

0.20%$0.757302

-10.33%$1.001

0.05%$114.40

0.01%$1.027

0.00%$1.11

0.40%$0.00804377

12.39%$0.03460709

3.56%$1.83

13.12%$0.08096

1.03%$0.104716

12.64%$0.00000661

13.54%$0.0318678

11.06%$1.096

0.01%$1.001

0.33%$0.163596

12.59%$1.00

0.04%$0.01296093

3.37%$28.95

3.62%$0.273088

14.08%$0.276892

5.17%$0.999568

0.01%$0.072873

10.06%$1.087

-0.18%$0.714928

17.47%$0.00745321

15.63%$1.18

0.39%$1.00

0.00%$35.65

8.47%$1.34

11.45%$0.403198

9.29%$167.47

0.92%$0.533432

2.32%$0.04441643

-3.57%$0.172439

12.17%$0.26263

17.13%$1.00

0.01%$1.10

7.45%$1.49

3.60%$0.085259

9.26%$0.03564582

5.24%$132.84

9.78%$0.999832

-0.00%$0.372317

13.30%$1.02

-0.13%$3.35

5.77%$0.00000034

3.90%$16.76

9.05%$0.056623

7.02%$0.00000033

0.54%$0.367377

21.97%$0.056202

10.51%$1.58

5.26%$0.01651606

0.48%$3.20

1.68%$0.072332

9.72%$0.332406

13.10%$0.02858989

10.22%$0.00003141

11.75%$0.00602009

8.02%$0.999432

0.19%$0.336087

12.03%$0.053377

10.50%$0.996133

0.40%$0.129455

9.90%$17.45

2.38%$0.231604

12.64%$0.077049

11.16%$0.00278937

10.25%$1.41

-3.56%$6.84

14.05%$1.60

-2.34%$0.139029

1.99%$0.04623396

10.45%$0.00249423

0.31%$0.092152

16.77%$0.107906

22.12%$0.02221719

9.71%$1.39

12.54%$0.320177

-3.14%$1.004

0.58%$0.222462

12.44%$1.77

4.93%$1.00

0.00%$0.00222982

6.10%$0.986105

-0.25%$0.522975

4.50%$1.00

0.01%$1.30

10.16%$1.075

0.01%$22.79

0.00%$0.205565

11.79%$0.099911

-0.28%$0.0000374

6.82%$2.87

10.56%$0.00000096

0.49%$0.102487

13.84%$5,239.08

-2.54%$0.941793

51.29%$0.197908

2.65%$0.194787

16.53%$0.053935

4.17%$0.02074858

7.91%$0.00513171

7.01%$1.00

0.00%$0.00399835

12.87%$0.125965

8.46%$0.080143

0.70%$4.25

16.20%$18.99

7.04%$1.98

14.42%$1.00

0.00%$0.651906

10.79%$0.77794

0.62%$0.05573

9.55%$0.173837

15.79%$2.19

11.82%$1.003

0.38%$2.13

2.06%$8.73

-9.00%$0.0232614

1.40%$0.04409937

11.38%$1.81

1.06%$0.01995816

-0.53%$48.01

0.02%$0.0000081

8.06%$3.41

-1.74%$1.26

1.12%$0.156444

7.36%$0.181216

14.19%$0.339368

9.90%$0.947317

-4.78%$1.002

-0.03%$0.998826

0.03%$0.424416

9.16%$1.013

-0.01%$0.663315

4.52%$0.306187

0.08%$4.75

10.97%$0.098492

12.38%$0.084401

8.39%$0.625955

5.09%$0.134406

7.90%$0.268639

6.88%$0.083289

13.84%$0.02327865

-7.20%$0.299607

6.31%$0.131412

4.65%$1,097.76

0.01%$0.074705

0.27%$0.376768

3.45%$0.315353

-0.29%$0.0015117

3.40%$11.58

-2.47%$0.225091

3.25%$1.92

2.72%$0.00407855

4.44%$0.13132

0.61%$0.250115

1.37%$0.205128

7.90%$0.99541

-0.01%$2.44

8.30%$1.001

0.00%$0.343396

4.33%$7.64

-11.86%$12.15

4.25%$1.46

2.27%$1.067

0.39%$1.001

0.05%$1.001

-2.93%$0.999937

-0.01%

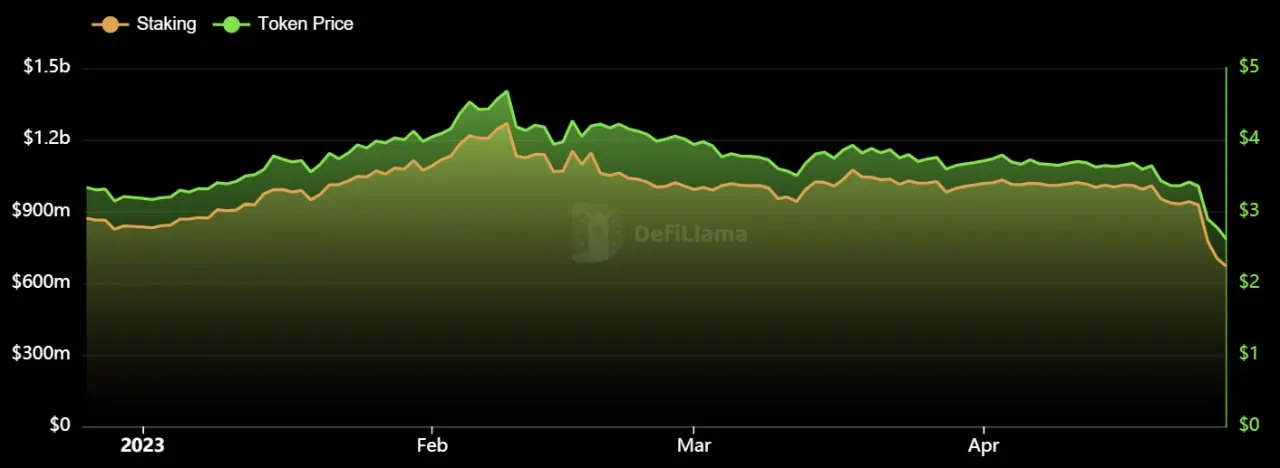

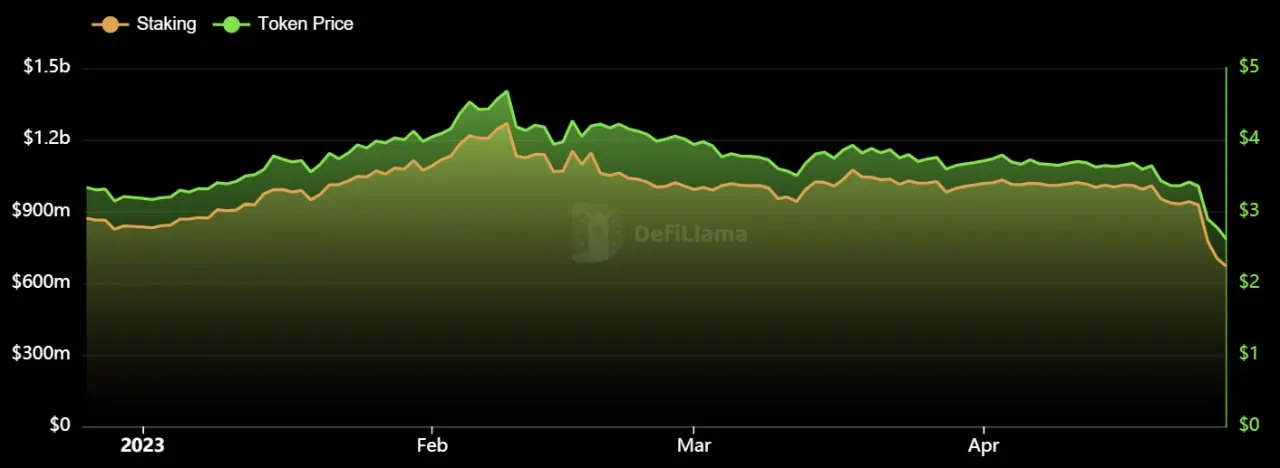

PancakeSwap’s native token has been flattened this past week.

CAKE token has plummeted roughly 24.4% over the past seven days, per CoinGecko, as a proposed change to the project’s tokenomics looms large.

PancakeSwap is a decentralized exchange (DEX) built on the BNB Chain. The project recently forked Uniswap V3’s code and launched its version on Ethereum and Aptos.

The core team introduced the proposal to reduce the token’s inflation rate to 3-5% from the current rates above 20%.

In plain English, the proposal, if passed, would lower the amount of tokens the project’s stakers can earn.

“Current inflation rates are unsustainable for CAKE over the long term, and reductions are required for the long-term health of PancakeSwap,” reads the proposal.

The vote on the proposal began on April 26 and ends tomorrow. Currently, the community has voted in favor of an “aggressive reduction” of staking rewards, which would cut the amount of tokens emitted by more than half.

While the reduced inflation rate will improve tokenomics by slowing dilution of its supply, the immediate decline in staking rewards has already caused an exodus in stakers.

The token’s price has dropped almost simultaneously with the amount of CAKE unstaked.

Since the team first proposed the tokenomics change on April 19, the staking amount has reduced from 1.007 billion CAKE to 677.851 million CAKE on April 27.

While CAKE suffered declines amid the tokenomics proposal, the rest of the cryptocurrency market experienced significant volatility due to macroeconomic events and on-chain analytics errors.

At the time of writing, Bitcoin is trading roughly at par with its price a week ago, while Ethereum is down 2.6% during the same period.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.