We do the research, you get the alpha!

Cryptocurrencies and the Internet

$68,350.00

3.76%$2,058.16

7.36%$1.66

29.63%$1.43

3.13%$628.48

5.07%$0.999963

0.00%$88.52

8.07%$0.285923

0.28%$0.100888

7.27%$1.031

-0.25%$0.297128

10.95%$51.01

3.83%$0.999873

-0.01%$496.04

-1.05%$8.78

0.77%$28.25

1.86%$9.22

7.96%$0.171266

6.02%$345.70

4.11%$0.99972

-0.03%$0.163046

5.84%$0.999834

0.01%$0.00957868

0.91%$0.101388

3.67%$56.66

7.82%$1.00

0.03%$248.59

-0.19%$9.54

10.68%$0.963368

7.85%$0.00000622

2.38%$0.078647

4.34%$0.116329

0.81%$1.28

-2.86%$5,163.76

-0.07%$4.00

14.27%$5,199.87

-0.00%$1.34

-5.61%$0.621718

3.69%$1.00

0.00%$119.35

0.81%$1.12

0.01%$0.996937

-0.07%$181.97

5.55%$0.00000411

0.52%$0.702877

-0.72%$77.77

2.79%$1.00

0.02%$0.069704

4.39%$2.26

1.59%$0.999758

-0.02%$0.167983

1.53%$1.17

17.14%$0.00000164

-0.67%$9.17

7.32%$0.274796

7.37%$2.43

10.49%$0.999303

-0.05%$0.113346

-1.61%$0.411856

5.68%$11.00

0.01%$8.71

2.34%$7.10

3.18%$0.00189947

7.18%$0.060106

4.77%$1.97

-5.64%$0.01767368

9.50%$64.43

0.48%$0.109113

7.40%$0.868679

3.43%$0.03127178

5.95%$1.002

0.21%$0.00969156

3.68%$3.50

1.36%$0.09079

5.79%$1.031

13.90%$1.49

7.15%$1.24

0.29%$0.979651

14.09%$1.00

0.04%$114.41

0.01%$0.743013

-10.07%$1.027

0.00%$1.11

0.19%$0.03443025

3.06%$0.00778394

6.96%$1.84

2.78%$0.080546

0.46%$0.03235167

12.69%$0.099224

4.63%$0.00000646

8.58%$1.096

0.01%$0.161955

8.73%$0.996096

-0.10%$1.00

0.00%$0.289098

7.88%$0.01295942

-0.03%$28.73

3.06%$0.999108

-0.01%$0.264084

7.57%$0.071391

5.13%$1.087

-0.09%$0.999848

0.01%$1.18

0.38%$0.695894

6.98%$0.00721192

8.14%$35.21

4.95%$1.33

7.17%$0.397161

5.72%$0.04561926

-0.75%$167.81

1.16%$0.525794

3.33%$1.001

0.04%$0.167188

6.72%$0.253362

8.54%$0.08507

5.46%$1.056

1.08%$1.47

0.14%$0.03501698

2.01%$0.999814

0.01%$129.70

5.61%$0.369006

7.76%$1.019

-0.13%$0.057812

6.44%$0.00000034

1.89%$0.00000033

0.16%$16.35

1.34%$3.24

1.07%$0.01641291

-0.58%$3.21

1.40%$0.054027

3.48%$1.53

-1.60%$0.346706

11.23%$0.070753

5.19%$0.02757889

4.55%$0.316744

5.37%$0.00003033

5.18%$0.00587752

2.55%$0.998202

0.18%$0.326919

5.81%$0.238637

9.90%$17.43

-1.24%$0.98299

-0.91%$0.051687

4.26%$1.42

-2.37%$0.125039

3.27%$0.075794

5.72%$0.355786

6.72%$1.60

-2.21%$0.00272093

5.00%$6.63

6.64%$0.00247885

-0.35%$0.04450544

4.71%$0.132562

-8.62%$0.02192546

6.45%$0.087803

9.03%$1.38

7.10%$1.001

0.22%$0.10163

13.39%$1.79

6.00%$1.00

0.00%$0.985701

-0.29%$0.217038

8.01%$0.999902

0.03%$1.075

0.01%$0.00218435

2.35%$1.29

4.72%$0.507713

-0.72%$22.79

0.00%$0.00000097

2.02%$0.097901

-1.79%$0.199543

8.17%$0.00003633

2.39%$5,254.96

-6.67%$2.80

5.02%$0.92409

31.95%$0.100105

8.50%$0.196512

-0.69%$0.053557

2.17%$1.00

0.00%$0.080154

-1.02%$0.186755

3.00%$0.00500421

3.94%$0.02005768

-0.78%$0.820423

4.41%$0.122968

1.83%$9.33

5.65%$0.00386127

8.51%$18.55

2.44%$1.00

0.00%$1.92

6.55%$3.96

5.54%$0.055119

5.47%$1.001

0.13%$0.635859

5.53%$2.10

2.23%$2.15

6.12%$0.168086

6.31%$1.81

0.86%$0.02008948

0.59%$0.02275703

-3.15%$3.51

1.96%$48.01

0.02%$0.04254673

5.67%$0.000008

3.84%$1.26

1.06%$0.953679

-4.23%$0.149683

-0.03%$0.995408

-0.53%$0.998551

0.03%$0.174006

5.76%$0.33051

6.93%$0.414306

3.45%$1.011

-0.36%$0.665906

0.58%$0.304447

-0.58%$0.096488

7.39%$4.60

5.13%$0.083143

3.62%$0.133392

4.81%$0.619035

4.06%$0.263513

3.23%$0.0230824

-8.09%$1,096.95

-0.06%$0.130168

2.83%$0.293316

3.00%$0.080318

6.25%$0.073755

-1.82%$0.312717

-2.64%$0.00150649

3.15%$0.367091

-2.23%$0.254644

0.02%$0.00406094

1.97%$0.130498

-0.43%$0.219883

0.36%$0.995389

-0.00%$11.07

-3.85%$1.001

0.00%$2.40

5.80%$0.197467

-0.36%$0.344563

4.53%$1.47

1.61%$0.559699

8.95%$1.75

-8.57%$0.99993

-0.01%$1.064

0.13%$0.999841

-0.00%$11.67

5.28%$0.999971

0.96%

In a new report looking at money trends over the next decade, German finance giant Deutsche Bank has suggested that cryptocurrency adoption could soar as a result of increasing fragility inside today’s fiat financial systems.

In the 84 page report that was written by Deutsche Bank strategist Jim Reid, he gave an overview into the “end of fiat money” and the subsequent rise of digital currencies in its place.

In the forward-looking document, Deutsche Bank warned that “eventually, it is possible that inflation will become more and more embedded in our system and doubts will rise about the sustainability of fiat money.” As a direct consequence of this, the bank said that “demand for alternative currencies will therefore likely be significantly higher by the time 2030 rolls around.”

The bank went on to say that the forces that have held the current fiat system together now “look fragile and could, in fact, unravel in the 2020s.” They added that this “will start to lead to a backlash against fiat money and demand for alternative currencies, such as gold or crypto could soar.”

The firm said that assuming governments back cryptocurrencies, and consumers want them, “adoption rates will drive the timeline for mainstream use.”

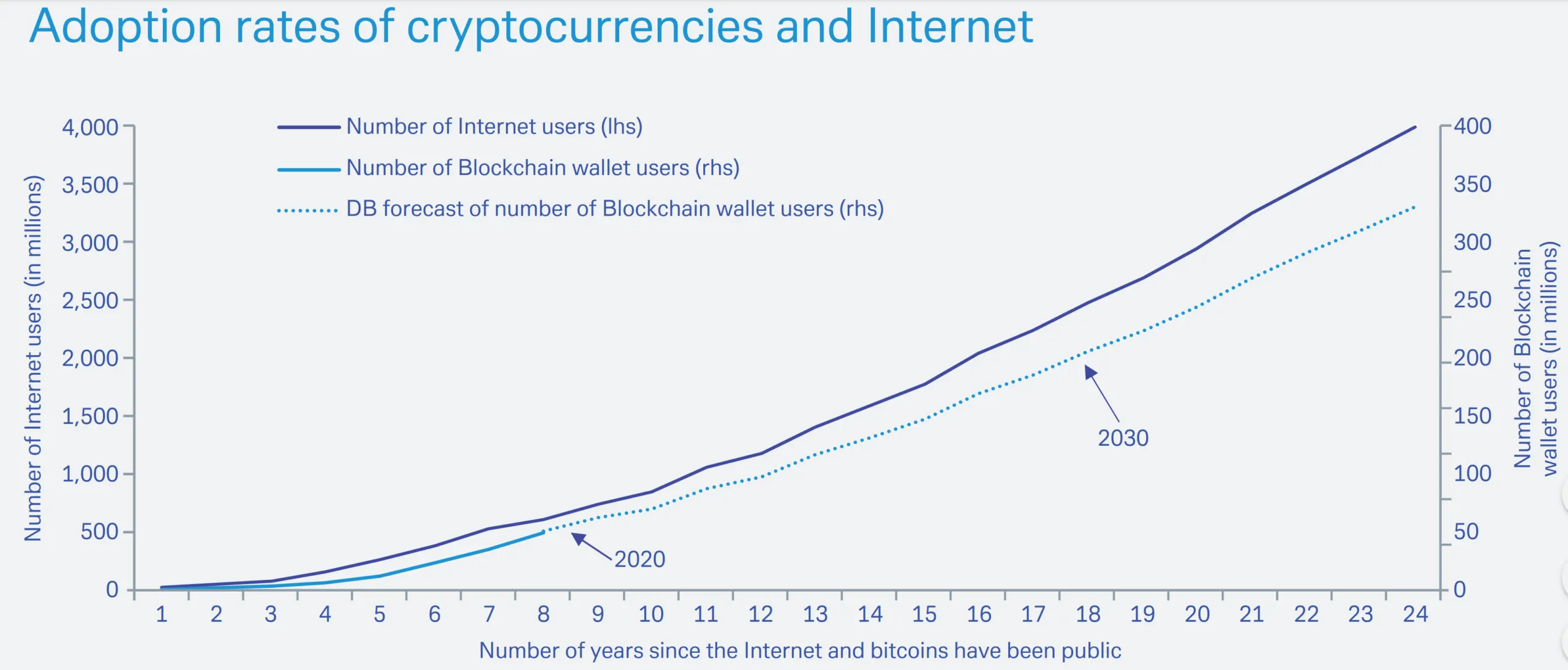

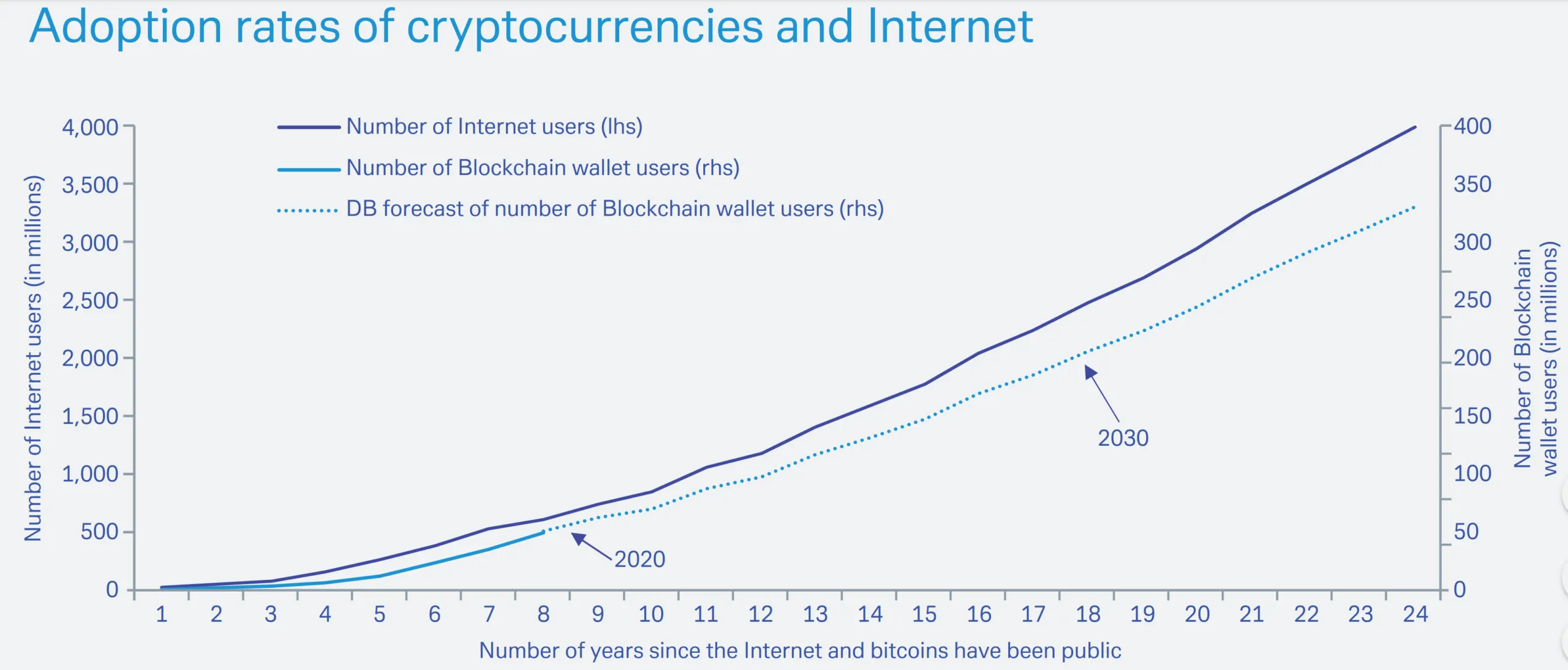

To prove this point the German bank included a chart that laid out the correlation between the growth of both the Internet and blockchain wallet users. In the data that started when both the internet and bitcoin entered the public eye (from 2011 for blockchain wallet users)—a tight correlation can be seen between the two technologies.

In the data, Deutsche Bank estimates that the current amount of blockchain wallet users would rise from around 75 million to 200 million by the year 2030. The bank added that “while critics bemoan cryptocurrencies as constrained by regulatory hurdles, we believe the incentives of governments and card providers are such that digital currencies are inevitable.”

However, the bank headquartered in Frankfurt, Germany was still looking to hedge its bets. It did also mention that as the company looked to the decade ahead, “it would not be surprising if a new and mainstream cryptocurrency were to unexpectedly emerge.”