We do the research, you get the alpha!

Bitcoin' (BTC) hash rate hit a new all-time high over the weekend, meaning that it becomes increasingly difficult for any individual or group to control more than 50% of the network’s total computational power.

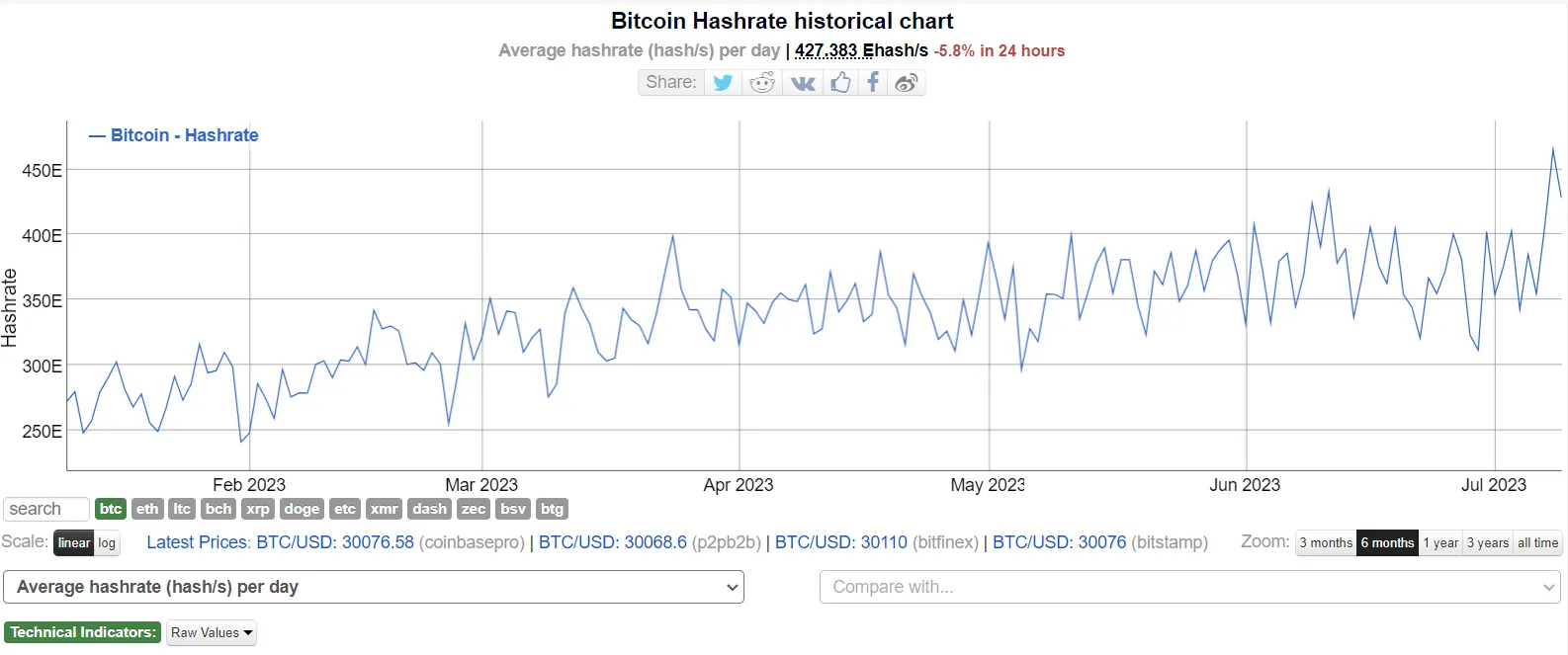

According to data from Bitinfocharts, Bitcoin’s hash rate spiked to 465 EH/s on Saturday from 406 EH/s on the previous day.

Despite the value dropping almost 6% to 428 EH/s on Sunday, the world’s leading blockchain network’s hash rate is still at its highest levels.

In the world of Proof-of-Work (PoW) cryptocurrencies such as Bitcoin, the hash rate stands as a critical metric, unveiling the health and security of the network. It serves as a measure of the estimated computational power committed to supporting the Bitcoin ecosystem, encompassing crucial activities like mining, key generation, and block validation. By analyzing the hash rate, one can gain insights into the network's resilience against hostile takeovers, particularly the dreaded 51% attack, where an entity gains control over the majority of the network's computing power.

A higher hash rate directly correlates with a more robust and secure network, creating formidable barriers for anyone attempting to compromise its integrity.

As the hash rate escalates, the level of difficulty for potential attacks increases exponentially, making the network increasingly impervious to malicious actors.

While bringing more security to the network, an elevated hash rate, however, comes with certain trade-offs for miners. These include increased competition and the need to allocate additional resources for more powerful mining hardware and cooling systems, which may also result in higher energy consumption.

To compensate for the growing expanses, miners can sell the coins they produce, although dropping prices means they need to sell more Bitcoin for the same face value.

At the time of writing, the leading cryptocurrency was changing hands at $30,164, down 0.4% over the last day, according to CoinGecko.

Why is Bitcoin's hash rate surging?

One potential reason for the latest Bitcoin hash rate surge is that Texas-based miners “are back at full (or near full) capacity,” according to a Hash Rate Index report.

Pointing to recent heatwaves in Texas, the report says that the scorching temperatures still turned out to be “too weak to cause substantial problems” to the state’s electricity grid, meaning that miners could resume their operations as normal.

"The hash rate continues to rise as miners are replacing older hardware with newer and more efficient machines in anticipation of the upcoming halving. This means hash rate is still rising without the requirement for new locations and more power," Henrike Christin Müller, Investor Relations Manager at Northern Data told Decrypt. "Moreover, the YTD increase in the BTC price also drives further hash rate expansion by miners globally."

This development is also likely to result in the growth in Bitcoin mining difficulty, added the report, forecasting an anticipated adjustment that is due later this week above 7.5%.

Mining difficulty is the value representing the computational power required to mine a single Bitcoin. It’s adjusted roughly every two weeks, getting more difficult as more miners enter the network and easier when they leave.

“There are thousands of other miners around the world who are expanding capacity when/if they can, so the growth isn't only coming from Texas,” said the report's authors. “Wherever it's coming from, the end result is the same: the next difficulty adjustment is going to be a f** whopper.”

After three consecutive positive adjustments, Bitcoin mining difficulty fell 3.26% on June 29, according to BTC.com.