We do the research, you get the alpha!

Maker sees soaring revenues

$86,346.00

-2.51%$2,975.15

-3.36%$1.90

-3.52%$857.59

-2.66%$1.89

-4.66%$1.00

0.01%$127.79

-1.72%$0.278792

0.20%$2,973.81

-3.38%$0.129728

-3.98%$1.031

1.88%$0.388568

-2.54%$58.03

-2.50%$3,633.40

-3.30%$86,271.00

-2.35%$538.88

-4.00%$3,229.12

-3.28%$0.999527

-0.02%$1.00

0.03%$12.87

-3.75%$3,224.89

-3.26%$9.22

0.19%$2,975.81

-3.23%$408.15

-0.56%$27.55

-5.29%$0.220861

-4.22%$411.92

1.61%$0.999446

-0.03%$86,322.00

-2.44%$77.60

-2.33%$1.47

-6.19%$12.31

-4.97%$0.114334

-4.23%$0.999989

0.00%$1.079

0.15%$0.00000792

-2.37%$1.29

3.93%$1.00

0.02%$1.50

-2.91%$0.133643

-2.09%$0.095946

-1.55%$1.21

-0.02%$5.08

-5.04%$1.76

1.37%$192.26

1.21%$0.999422

0.01%$0.00787732

0.03%$269.13

-4.80%$0.071229

-0.63%$3.49

-1.73%$107.06

-2.18%$4,315.75

0.43%$0.999039

0.04%$1.54

-3.59%$12.33

-4.23%$1.00

0.00%$0.790703

-15.39%$2,977.35

-2.99%$159.64

-1.66%$0.00000407

-3.29%$0.219012

-7.56%$0.199666

-1.78%$3.02

-1.42%$4.55

-1.18%$127.86

-1.71%$1.14

0.01%$0.00000163

-0.26%$4,316.30

-0.07%$0.0025045

-6.43%$0.02832402

-5.31%$0.999848

0.00%$1.11

0.00%$10.33

-2.25%$0.058274

-1.65%$1.11

0.04%$0.539578

-5.15%$0.999317

-0.02%$0.999646

-0.02%$0.417099

-6.20%$0.999891

0.01%$3,423.30

-3.21%$10.20

-1.91%$0.113177

-3.80%$1.56

-4.02%$138.77

-1.81%$857.96

-2.64%$0.04300856

-3.57%$0.1967

-4.66%$75.29

-2.69%$3,155.20

-3.23%$5.32

-1.87%$0.060089

-6.46%$0.115324

-3.56%$86,700.00

-2.35%$2.05

-3.16%$3,165.25

-3.80%$86,399.00

-2.41%$86,682.00

-2.25%$0.01161437

-3.87%$0.050385

6.65%$0.01071825

-5.29%$0.917125

-2.59%$1.26

-4.91%$10.92

0.01%$0.999712

-0.04%$113.64

0.02%$1.00

0.03%$0.999899

-0.02%$0.118693

-5.11%$1.017

0.06%$27.73

-5.30%$1.41

-5.31%$0.00000872

-3.82%$3,219.30

-3.50%$86,266.00

-2.36%$1.11

0.04%$3.63

15.12%$2.02

-5.63%$0.090044

-0.14%$87,099.00

-3.79%$0.999849

0.00%$0.01159911

-4.15%$3,175.71

-3.12%$0.999684

-0.04%$0.01023415

-1.92%$0.999853

0.00%$1.14

1.82%$147.80

-1.56%$2,977.61

-3.20%$0.189578

-2.98%$0.223568

-4.96%$3,130.91

-2.41%$1.70

-5.81%$0.998603

-0.00%$0.29226

-3.53%$5,685.86

-6.56%$0.998237

-0.00%$2,976.04

-3.28%$86,456.00

-2.15%$35,382,014.00

0.00%$40.74

-0.89%$0.353709

-6.43%$4.96

-4.80%$0.461544

-4.13%$0.996007

-0.05%$2,460.42

0.00%$0.549782

-6.98%$0.538937

-6.02%$1.23

0.23%$0.00529565

-1.30%$0.097272

-6.27%$0.519444

-5.41%$0.263531

-5.74%$0.785868

-0.81%$0.725151

-5.96%$2,975.24

-3.24%$0.999905

-0.01%$172.04

-1.67%$3,202.25

-3.31%$0.421556

-6.68%$0.436478

26.93%$0.502859

-7.62%$3,137.01

-3.78%$0.212894

-3.06%$0.071091

-4.25%$0.00004283

-4.69%$0.975611

-0.26%$2.87

24.35%$0.999492

-0.25%$0.03804091

-5.65%$1.11

0.03%$3,259.27

-3.62%$0.02037282

1.08%$0.0000004

9.99%$0.0000004

-1.86%$90,454.00

0.00%$0.03928513

1.37%$0.00408949

-9.63%$0.111748

-1.09%$0.091674

-3.31%$3,312.05

-3.28%$9.85

-6.00%$85,485.00

-4.11%$0.374477

-2.28%$0.071296

-2.98%$18.38

-4.72%$22.16

-0.11%$86,338.00

-2.35%$0.058957

-3.99%$0.226193

-9.36%$1.18

0.20%$0.334621

-3.51%$0.129784

-3.97%$138.76

0.07%$2.02

-4.53%$0.999235

0.04%$0.999789

-0.09%$18.72

-2.52%$0.321481

-4.81%$2,974.26

-3.35%$1.72

-4.50%$1.001

-0.11%$0.082594

-5.80%$1.003

0.32%$0.11919

-5.31%$117.57

-4.65%$0.03052563

-5.05%$0.187531

-1.41%$0.999619

-0.05%$15.17

-5.11%$0.00651838

-4.63%$3,222.51

-3.18%$0.00603924

-2.15%$0.263016

-0.80%$0.085992

-5.19%$1.12

-0.04%$1.44

-1.94%$2,929.78

-3.66%$86,426.00

-2.41%$3,219.72

-3.42%$0.283928

-5.02%$0.993036

-0.01%$27.54

-5.68%$2,975.71

-3.27%$0.275072

-3.46%$907.26

-2.52%$2.63

1.86%$0.01501073

0.53%$24.16

-11.98%$0.133782

-12.85%$1.00

0.00%$27.29

-5.17%$1.089

0.03%$3.72

-5.15%$0.162695

-3.92%$86,553.00

-2.42%$0.95806

-7.02%$0.133145

-4.27%$86,377.00

-2.81%$0.0290293

-2.02%$2,973.37

-3.38%$0.00249312

-2.27%$18.44

-27.25%$0.240865

1.15%$0.00000115

-0.61%$64.30

3.07%$3,635.14

-3.23%$3.59

-4.54%

The supply of DAI stablecoin surged to a 5-month high of 5.35 billion, per Makerburn.com data.

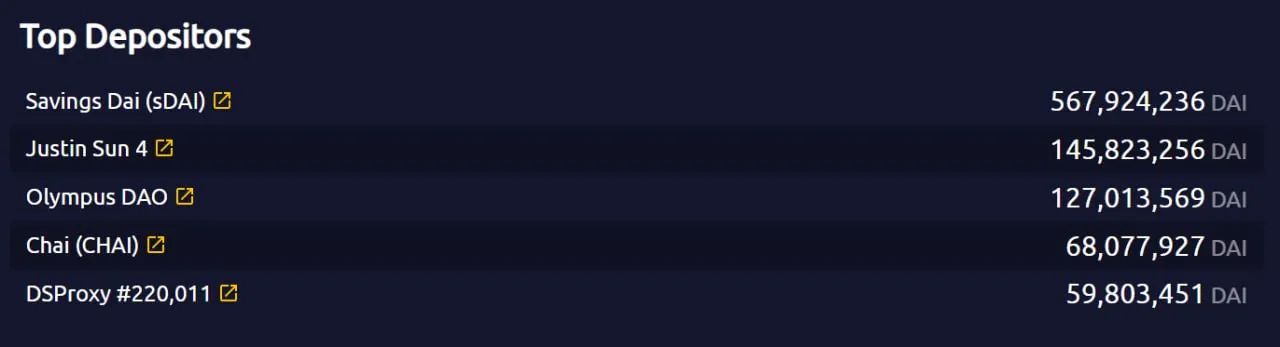

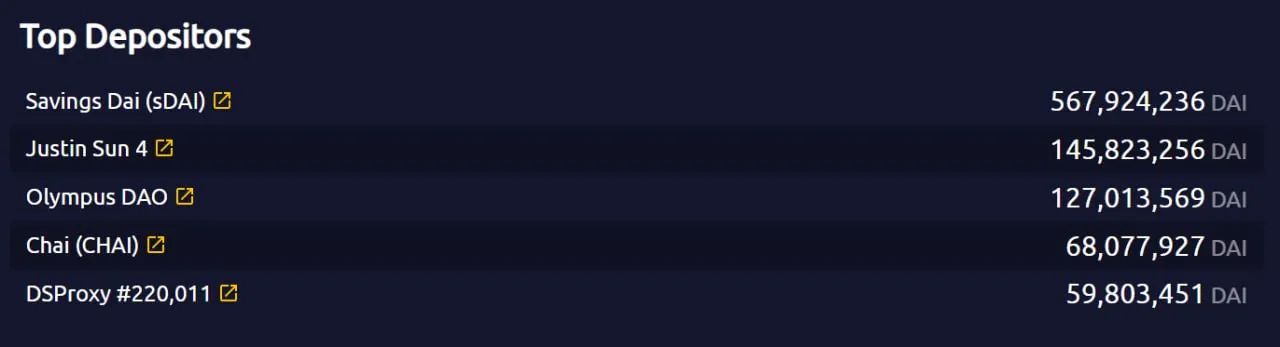

The steep rise comes amid users, including prominent DeFi entities like Justin Sun and OlympusDAO, rushing to scoop up the increased returns in Maker deposits.

Maker is a stablecoin issuing platform on Ethereum and is governed by the MakerDAO community formed of MKR token holders.

Alongside rising supply, the protocol’s annualized revenue also hit a two-year high of 165.4 million as the DAI supply increased, per Makerburn.com data. This means Maker is currently earning roughly $165 million per year in fees.

The deposits in the protocol’s DAI Savings Rate (DSR) jumped nearly four-fold from $340 million to $1.3 billion since last week, per a Dune dashboard by MakerDAO’s asset-liability lead, Sebastien Derivaux.

The rise can likely be attributed to the MakerDAO community voting to temporarily increase the annual yields from 3.19% to 8% on August 6.

Maker’s DSR contracts let DAI holders earn from the protocol’s revenue by depositing DAI into it. The revenue is accrued through yields from collateral deposits and fees paid by Maker users.

Both Tron founder Justin Sun and wallets linked to OlympusDAO have deposited $148.5 million and $124.8 million worth of DAI, respectively, to start soaking up the higher returns.

Moreover, a rise in the short-term U.S. Treasury yield to a five-month high of 4.91% also helped increase the protocol’s revenue.

The surge in yield played a significant role in boosting the protocol's revenue due to its substantial exposure to U.S. government bonds. The bonds make up 57.7% of MakerDao's total revenue, as indicated by Derivaux's dune dashboard.

Derivaux told Decrypt that “revenues should remain elevated as long as short-term rates remain high.” He added that MakerDAO’s revenue should increase when Paxos and Gemini start paying MakerDAO returns on their stablecoin deposits, similar to USDC yields via Coinbase Custody.

“That was a one-year effort to put those assets as yielding, happy to see it come to fruition,” said Derivaux.