We do the research, you get the alpha!

Fundamentals remains unchanged

$69,060.00

7.03%$2,068.63

11.33%$1.63

30.54%$1.46

7.59%$631.71

7.21%$1.00

0.00%$89.39

13.52%$0.285834

0.96%$0.104029

12.84%$1.035

0.53%$0.308635

18.40%$51.55

6.66%$514.91

6.50%$1.00

0.00%$8.74

3.26%$28.66

4.94%$9.42

14.16%$339.81

5.34%$0.164233

1.69%$0.998948

-0.04%$0.167422

10.81%$1.00

0.04%$0.00962447

2.02%$0.105435

9.80%$58.01

12.62%$257.66

4.73%$9.68

15.69%$0.999818

-0.09%$1.012

16.37%$0.00000645

8.70%$0.079641

6.65%$1.33

0.60%$0.117271

6.27%$5,165.35

0.24%$4.08

22.11%$5,197.63

0.21%$1.35

-4.95%$0.626806

6.09%$1.00

0.00%$122.95

7.29%$0.00000435

10.38%$186.13

9.69%$0.718039

2.59%$0.997806

0.03%$78.73

6.46%$1.00

0.01%$0.070694

8.35%$1.23

26.01%$1.12

0.00%$0.17121

4.72%$2.25

2.53%$1.00

0.01%$0.00000165

0.54%$9.47

12.62%$0.286276

14.60%$2.49

16.96%$0.999309

-0.06%$0.117507

3.94%$0.423301

12.24%$8.94

7.71%$11.00

0.01%$7.20

6.40%$0.00192106

9.10%$2.07

3.78%$0.061522

7.96%$66.24

6.72%$0.112113

13.31%$0.01667445

2.16%$0.88716

7.76%$0.03201635

9.18%$1.099

32.81%$0.094436

11.86%$3.60

6.08%$1.004

0.44%$0.00979151

6.54%$1.095

23.54%$1.52

11.43%$1.24

0.20%$0.757302

-10.33%$1.001

0.05%$114.40

0.01%$1.027

0.00%$1.11

0.40%$0.00804377

12.39%$0.03460709

3.56%$1.83

13.12%$0.08096

1.03%$0.104716

12.64%$0.00000661

13.54%$0.0318678

11.06%$1.096

0.01%$1.001

0.33%$0.163596

12.59%$1.00

0.04%$0.01296093

3.37%$28.95

3.62%$0.273088

14.08%$0.276892

5.17%$0.999568

0.01%$0.072873

10.06%$1.087

-0.18%$0.714928

17.47%$0.00745321

15.63%$1.18

0.39%$1.00

0.00%$35.65

8.47%$1.34

11.45%$0.403198

9.29%$167.47

0.92%$0.533432

2.32%$0.04441643

-3.57%$0.172439

12.17%$0.26263

17.13%$1.00

0.01%$1.10

7.45%$1.49

3.60%$0.085259

9.26%$0.03564582

5.24%$132.84

9.78%$0.999832

-0.00%$0.372317

13.30%$1.02

-0.13%$3.35

5.77%$0.00000034

3.90%$16.76

9.05%$0.056623

7.02%$0.00000033

0.54%$0.367377

21.97%$0.056202

10.51%$1.58

5.26%$0.01651606

0.48%$3.20

1.68%$0.072332

9.72%$0.332406

13.10%$0.02858989

10.22%$0.00003141

11.75%$0.00602009

8.02%$0.999432

0.19%$0.336087

12.03%$0.053377

10.50%$0.996133

0.40%$0.129455

9.90%$17.45

2.38%$0.231604

12.64%$0.077049

11.16%$0.00278937

10.25%$1.41

-3.56%$6.84

14.05%$1.60

-2.34%$0.139029

1.99%$0.04623396

10.45%$0.00249423

0.31%$0.092152

16.77%$0.107906

22.12%$0.02221719

9.71%$1.39

12.54%$0.320177

-3.14%$1.004

0.58%$0.222462

12.44%$1.77

4.93%$1.00

0.00%$0.00222982

6.10%$0.986105

-0.25%$0.522975

4.50%$1.00

0.01%$1.30

10.16%$1.075

0.01%$22.79

0.00%$0.205565

11.79%$0.099911

-0.28%$0.0000374

6.82%$2.87

10.56%$0.00000096

0.49%$0.102487

13.84%$5,239.08

-2.54%$0.941793

51.29%$0.197908

2.65%$0.194787

16.53%$0.053935

4.17%$0.02074858

7.91%$0.00513171

7.01%$1.00

0.00%$0.00399835

12.87%$0.125965

8.46%$0.080143

0.70%$4.25

16.20%$18.99

7.04%$1.98

14.42%$1.00

0.00%$0.651906

10.79%$0.77794

0.62%$0.05573

9.55%$0.173837

15.79%$2.19

11.82%$1.003

0.38%$2.13

2.06%$8.73

-9.00%$0.0232614

1.40%$0.04409937

11.38%$1.81

1.06%$0.01995816

-0.53%$48.01

0.02%$0.0000081

8.06%$3.41

-1.74%$1.26

1.12%$0.156444

7.36%$0.181216

14.19%$0.339368

9.90%$0.947317

-4.78%$1.002

-0.03%$0.998826

0.03%$0.424416

9.16%$1.013

-0.01%$0.663315

4.52%$0.306187

0.08%$4.75

10.97%$0.098492

12.38%$0.084401

8.39%$0.625955

5.09%$0.134406

7.90%$0.268639

6.88%$0.083289

13.84%$0.02327865

-7.20%$0.299607

6.31%$0.131412

4.65%$1,097.76

0.01%$0.074705

0.27%$0.376768

3.45%$0.315353

-0.29%$0.0015117

3.40%$11.58

-2.47%$0.225091

3.25%$1.92

2.72%$0.00407855

4.44%$0.13132

0.61%$0.250115

1.37%$0.205128

7.90%$0.99541

-0.01%$2.44

8.30%$1.001

0.00%$0.343396

4.33%$7.64

-11.86%$12.15

4.25%$1.46

2.27%$1.067

0.39%$1.001

0.05%$1.001

-2.93%$0.999937

-0.01%

Monday’s carnage in the crypto market on Monday caused the market cap of Arbitrum to slip below that of rival project Optimism.

Arbitrum’s governance token ARB dropped to a new all-time low of $0.745, according to data from CoinGecko, while Optimism’s OP token gained 6.8% in the past 24 hours to trade at $1.33. Currently, ARB has recovered some of its losses and is trading at $0.782, at par with yesterday’s price.

The flipping of the two projects’ market caps occurred due to considerable liquidations of ARB long orders. CoinGlass data shows $2.2 million longs were liquidated on Sept. 11, levels not seen since August’s flash crash.

The bullish hype prior to the liquidations can be attributed to PlutusDAO’s introduction of an ARB staking proposal on Sept. 9.

Notably, the total market caps of Arbitrum and Optimism layer-2s are separated by just $66.9 million, with both holding around $1 billion.

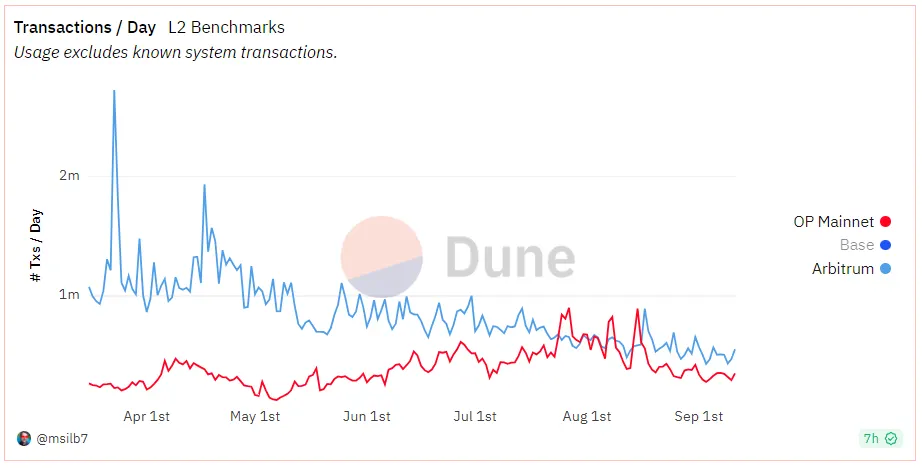

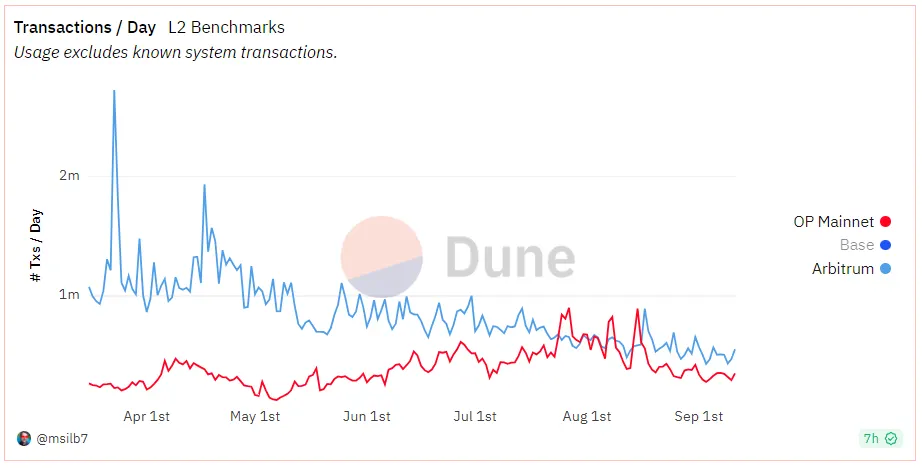

The number of transactions and daily addresses interacting on Arbirum and Optimism has remained consistent since the start of September, with Aribtrum total transacting continuing to lead Optimism, according to a Dune dashboard by pseudonymous data analyst @mslib7.

It suggests that the price surge was primarily due to the futures liquations.

Optimism’s transactions briefly outpaced Arbitrium during the hype around the launch of global ID project Worldcoin, which is built atop Optimism's infrastructure. However, they slipped back below Arbitrum's transactions as the hype around Worldcoin faded.

According to data from DeFiLlama, the total value locked (TVL) in DeFi applications on the two protocols has been on a downward trend. However, there haven't been significant moves to outperform each other.

Arbitrum’s TVL of $1.67 billion stands at more than 2.5 times that of Optimism's TVL at $0.63 million.