We do the research, you get the alpha!

Thorswap blocks sanctioned countries

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$69,060.00

7.03%$2,068.63

11.33%$1.63

30.54%$1.46

7.59%$631.71

7.21%$1.00

0.00%$89.39

13.52%$0.285834

0.96%$0.104029

12.84%$1.035

0.53%$0.308635

18.40%$51.55

6.66%$514.91

6.50%$1.00

0.00%$8.74

3.26%$28.66

4.94%$9.42

14.16%$339.81

5.34%$0.164233

1.69%$0.998948

-0.04%$0.167422

10.81%$1.00

0.04%$0.00962447

2.02%$0.105435

9.80%$58.01

12.62%$257.66

4.73%$9.68

15.69%$0.999818

-0.09%$1.012

16.37%$0.00000645

8.70%$0.079641

6.65%$1.33

0.60%$0.117271

6.27%$5,165.35

0.24%$4.08

22.11%$5,197.63

0.21%$1.35

-4.95%$0.626806

6.09%$1.00

0.00%$122.95

7.29%$0.00000435

10.38%$186.13

9.69%$0.718039

2.59%$0.997806

0.03%$78.73

6.46%$1.00

0.01%$0.070694

8.35%$1.23

26.01%$1.12

0.00%$0.17121

4.72%$2.25

2.53%$1.00

0.01%$0.00000165

0.54%$9.47

12.62%$0.286276

14.60%$2.49

16.96%$0.999309

-0.06%$0.117507

3.94%$0.423301

12.24%$8.94

7.71%$11.00

0.01%$7.20

6.40%$0.00192106

9.10%$2.07

3.78%$0.061522

7.96%$66.24

6.72%$0.112113

13.31%$0.01667445

2.16%$0.88716

7.76%$0.03201635

9.18%$1.099

32.81%$0.094436

11.86%$3.60

6.08%$1.004

0.44%$0.00979151

6.54%$1.095

23.54%$1.52

11.43%$1.24

0.20%$0.757302

-10.33%$1.001

0.05%$114.40

0.01%$1.027

0.00%$1.11

0.40%$0.00804377

12.39%$0.03460709

3.56%$1.83

13.12%$0.08096

1.03%$0.104716

12.64%$0.00000661

13.54%$0.0318678

11.06%$1.096

0.01%$1.001

0.33%$0.163596

12.59%$1.00

0.04%$0.01296093

3.37%$28.95

3.62%$0.273088

14.08%$0.276892

5.17%$0.999568

0.01%$0.072873

10.06%$1.087

-0.18%$0.714928

17.47%$0.00745321

15.63%$1.18

0.39%$1.00

0.00%$35.65

8.47%$1.34

11.45%$0.403198

9.29%$167.47

0.92%$0.533432

2.32%$0.04441643

-3.57%$0.172439

12.17%$0.26263

17.13%$1.00

0.01%$1.10

7.45%$1.49

3.60%$0.085259

9.26%$0.03564582

5.24%$132.84

9.78%$0.999832

-0.00%$0.372317

13.30%$1.02

-0.13%$3.35

5.77%$0.00000034

3.90%$16.76

9.05%$0.056623

7.02%$0.00000033

0.54%$0.367377

21.97%$0.056202

10.51%$1.58

5.26%$0.01651606

0.48%$3.20

1.68%$0.072332

9.72%$0.332406

13.10%$0.02858989

10.22%$0.00003141

11.75%$0.00602009

8.02%$0.999432

0.19%$0.336087

12.03%$0.053377

10.50%$0.996133

0.40%$0.129455

9.90%$17.45

2.38%$0.231604

12.64%$0.077049

11.16%$0.00278937

10.25%$1.41

-3.56%$6.84

14.05%$1.60

-2.34%$0.139029

1.99%$0.04623396

10.45%$0.00249423

0.31%$0.092152

16.77%$0.107906

22.12%$0.02221719

9.71%$1.39

12.54%$0.320177

-3.14%$1.004

0.58%$0.222462

12.44%$1.77

4.93%$1.00

0.00%$0.00222982

6.10%$0.986105

-0.25%$0.522975

4.50%$1.00

0.01%$1.30

10.16%$1.075

0.01%$22.79

0.00%$0.205565

11.79%$0.099911

-0.28%$0.0000374

6.82%$2.87

10.56%$0.00000096

0.49%$0.102487

13.84%$5,239.08

-2.54%$0.941793

51.29%$0.197908

2.65%$0.194787

16.53%$0.053935

4.17%$0.02074858

7.91%$0.00513171

7.01%$1.00

0.00%$0.00399835

12.87%$0.125965

8.46%$0.080143

0.70%$4.25

16.20%$18.99

7.04%$1.98

14.42%$1.00

0.00%$0.651906

10.79%$0.77794

0.62%$0.05573

9.55%$0.173837

15.79%$2.19

11.82%$1.003

0.38%$2.13

2.06%$8.73

-9.00%$0.0232614

1.40%$0.04409937

11.38%$1.81

1.06%$0.01995816

-0.53%$48.01

0.02%$0.0000081

8.06%$3.41

-1.74%$1.26

1.12%$0.156444

7.36%$0.181216

14.19%$0.339368

9.90%$0.947317

-4.78%$1.002

-0.03%$0.998826

0.03%$0.424416

9.16%$1.013

-0.01%$0.663315

4.52%$0.306187

0.08%$4.75

10.97%$0.098492

12.38%$0.084401

8.39%$0.625955

5.09%$0.134406

7.90%$0.268639

6.88%$0.083289

13.84%$0.02327865

-7.20%$0.299607

6.31%$0.131412

4.65%$1,097.76

0.01%$0.074705

0.27%$0.376768

3.45%$0.315353

-0.29%$0.0015117

3.40%$11.58

-2.47%$0.225091

3.25%$1.92

2.72%$0.00407855

4.44%$0.13132

0.61%$0.250115

1.37%$0.205128

7.90%$0.99541

-0.01%$2.44

8.30%$1.001

0.00%$0.343396

4.33%$7.64

-11.86%$12.15

4.25%$1.46

2.27%$1.067

0.39%$1.001

0.05%$1.001

-2.93%$0.999937

-0.01%

RUNE, the native token of THORChain, saw a staggering 8% overnight rise as the project resumed trading on its leading exchange THORSwap.

THORSwap suspended trading last Friday after illicit funds linked to the FTX exploit in November 2022 were allegedly passed through the exchange.

Services such as lending, borrowing, and staking actions remained operational.

THORSwap uses the assets deposited on THORChain, a layer-1 blockchain optimized for interoperability between various blockchains, as liquidity to facilitate cross-chain swaps.

The exchange resumed trading yesterday with an update to its “terms of service,” adding “some extra guardrails” to prevent the flow of illicit funds and have legal compliance.

Still, RUNE had been in a downtrend since THORSwap’s trading suspension, dropping 27% over the week from $2.03 to lows of $1.48 right before the positive reversal took place yesterday.

The governance token of THORSwap, THOR, also rose by 11.5% following the announcement.

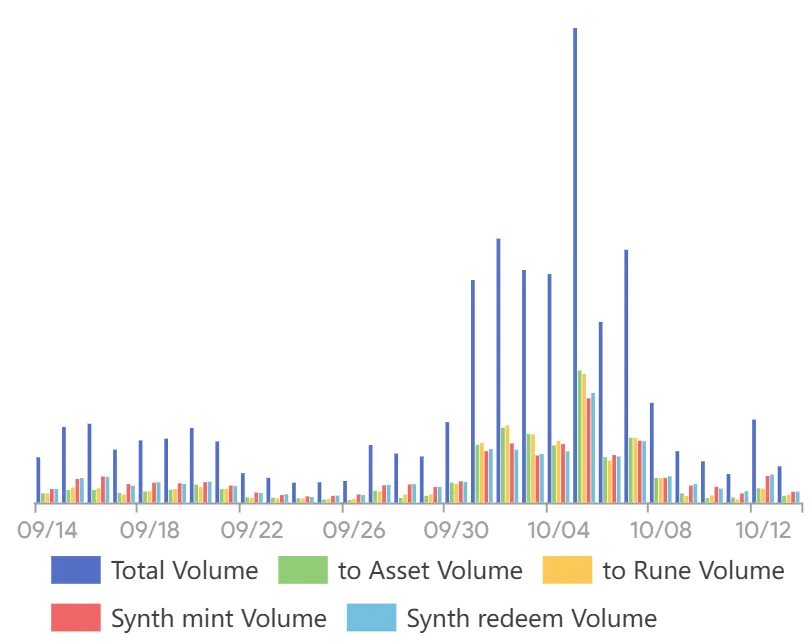

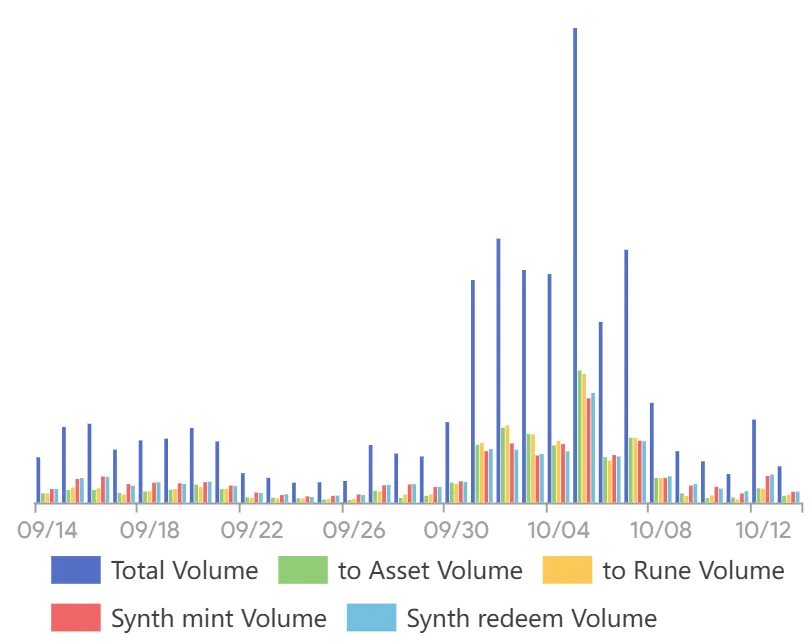

The trading volumes via THORChain jumped to $62 million on Thursday after falling below $30 million over the last couple of days, per data from THORChain Explorer.

In addition to blockchain illicit funds, the THORSwap team also updated its terms of service to block users from countries sanctioned by the U.S.

The protocol’s team announced that it has “partnered with an industry leader” to add the guardrails.

Uniswap, a decentralized exchange on Ethereum, uses a similar guardrail to identify financial crime. The leading DEX partnered with sleuthing firm TRM Labs in April 2022 to analyze and block transactions that are likely linked to illicit activity.

A THORSwap spokesperson told Decrypt "This brings THORSwap in parity with other leading industry DEX interfaces such as Uniswap, 1inch, Pancakeswap and more."

Some users were quick to raise concerns about the new rules, saying it contradicts the principle of decentralization.

Matt Ahlborg, a crypto researcher, replied to THORSwap saying that blanket bans are unethical because they adversely affect “hundreds of millions of innocent people.”

To which, a THORChain supporter replied that there are other applications that users from sanctioned countries can use instead of THORSwap, as it's built by “an American team” and “have to legally comply.”

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.