We do the research, you get the alpha!

Stablecoin issuer Maker Protocol’s annualized revenue surged to a new all-time high of $203 million yesterday, according to Makerburn.com data.

The previous peak was $172.3 million in May 2021.

Maker is a stablecoin issuing platform on Ethereum, governed by the MakerDAO community formed of MKR token holders. The supply of the protocol’s stablecoin, DAI, reached a new yearly high of $5.6 billion, per Makerburn.com data.

Maker makes money through fees paid by users for borrowing DAI, and fees earned in case of a liquidation of a borrowing position.

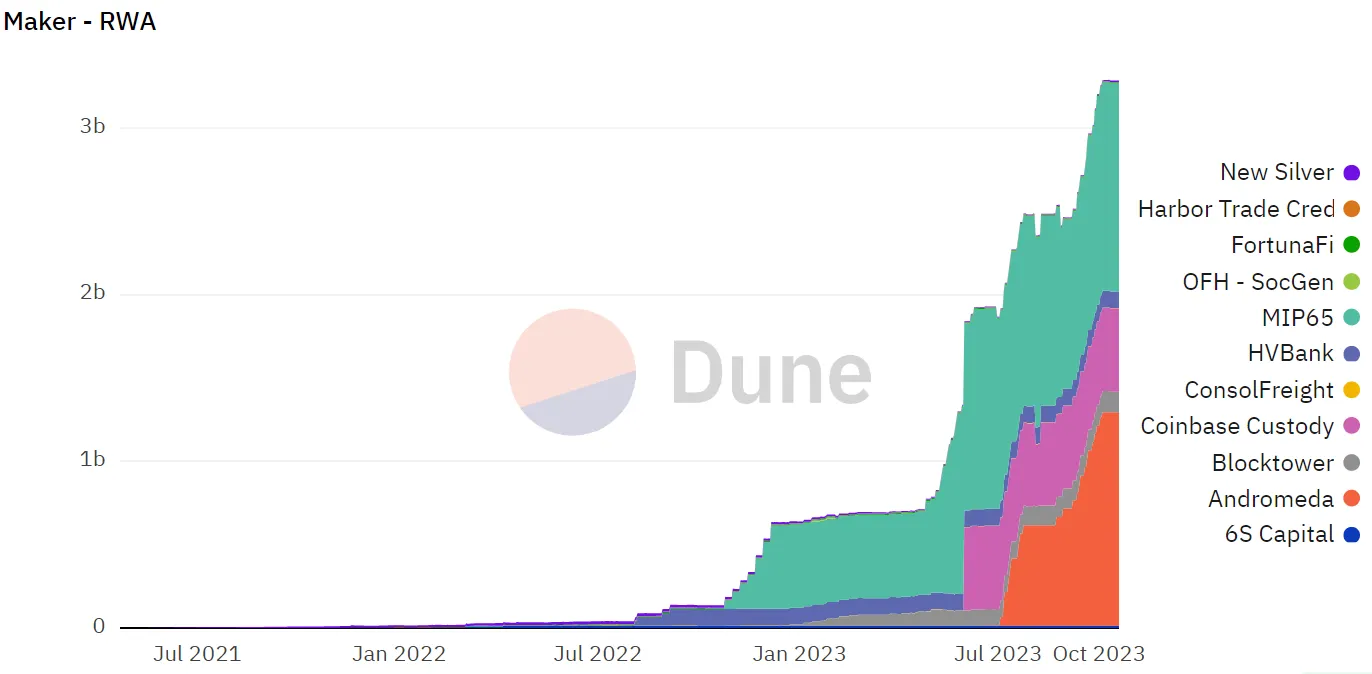

The surge in revenue came amid increased deposits of tokenized real-world assets (RWAs) for minting DAI and higher yields for DAI holders (which, in turn, attracts even more collateral).

Tokenized RWAs are crypto tokens backed by physical or real-world financial assets such as stocks, government bonds, real estate, or art.

MakerDAO’s RWA deposits have soared past $3 billion, making up 42.7% of the protocol's total deposits of $7.54 billion, per DeFiLlama data.

Sébastien Derivaux, MakerDAO’s former real-world finance lead and co-founder of Steakhouse Financial, told Decrypt that MakerDAO is, "reaping the benefits of years of work on RWA," adding that, "revenues will increase if T-bills yields increase."

Treasury bills are currently raking in 5% for holders as the Federal Reserve ratchets up interest rates to tackle inflation in the U.S.

Of the RWA deposits, two vaults in Monetalis Clydesdale and BlockTower Andromeda, which purchases short-dated United States Treasury notes, collectively make up more than three-quarters of the RWA deposits within the Maker Protocol, per a Dune dashboard by data analyst Steakhouse.

The rise in U.S. treasury yields this year amid increased benchmark interest rates by the U.S. Federal Reserve have played a significant role in increasing the protocol’s revenue.

Yield opportunities for DAI holders

Increased yields for DAI holders through its DAI Savings Rate (DSR) mechanism via the Spark Protocol have also contributed to high demand for DAI.

DSR generates yields for DAI holders from the protocol fees paid by users who deposit assets into Maker to mint new DAI.

The DAI deposited into Spark Protocol is represented as sDAI, and accounts for 31.3% of DAI’s total supply at $1.7 billion.

sDAI supply has increased more than fivefold from around $340 million since August, when the Maker community voted to increase sDAI yields. Its holders currently earn an annual rate of 5% from DSR deposits.

DSR deposits saw another boost last week, with the launch of sDAI on Gnosis Chain.

On October 9, Spark Protocol deployed on Gnosis Chain, with its supply increasing from $20 million to nearly $50 million since then, per DeFiLlama data. These holders deposit sDAI into DeFi protocols on the Gnosis Chain for enhanced yields.

Edited by Stephen Graves