Even some experienced and seasoned crypto investors can struggle with the details and nuances of filing crypto-related tax returns.

First, you have to determine if crypto is income or an investment. You then have to calculate fair market value (FMV), determine your cost basis (and choose a cost basis method), and determine if transactions are taxable events or not. If it’s a taxable event, you then have to determine if a profitable sale will incur short-term or long-term capital gains.

Beyond all this, there is still uncertainty as to how many novel DeFi processes such as wrapping are treated from the IRS’ perspective. For these reasons, many choose to get assistance in order to correctly and accurately file, save time, and reduce the stress associated with the annual April filing deadline. In this article we'll explore some of the options available.

Crypto tax software and tools

While some simply use familiar spreadsheet software (think Google Sheets or Excel) and log their transactions manually, this can be a frustrating, time-consuming, and error-prone endeavor—especially if you aren’t a spreadsheet wizard.

As soon as your transactions span several wallets, exchanges and blockchains, this method can become almost impossible. For these reasons, you should consider trying some bespoke tax-accounting software that is designed for those who invest in crypto, receive it as income, or both.

Most crypto tax software companies offer a selection of paid software packages that vary based on what you need. While you can find some of these tools for free, some of the best tools and accounting packages are paid services.

Crypto Tax Calculator is the global tax partner for Coinbase and offers both free and paid plans for all levels of crypto trading activity. While some tax software tools only offer support for basic transactions, Crypto Tax Calculator can handle the most complex crypto transactions you can throw at it, from cross-chain bridging, liquidity pools, lending, borrowing and leverage trading. The platform also offers full support for all NFT types across different chains, and can handle NFT trades, mints and royalties for creators.

Crypto Tax Calculator provides pre-filled IRS Form 8949 and Form 1040, as well as a direct integration with TurboTax to make filing your taxes incredibly easy. There is also the ability to give your accountant direct access to your accountant, allowing them to review your transactions before you file.

CryptoTaxCalculator provides pre-filled IRS Form 8949 and Form 1040

Using reputable crypto tax software is an excellent, cost-effective option for those who plan to file on their own. Some also use the software to create records that they can share with their account or tax advisor.

Using CryptoTaxCalculator for your taxes

Put an end to your tax nightmare in three steps with Crypto Tax Calculator. Generate tax-optimized reports, harvest losses and maximize your savings. Here's how.

1. Import your data automatically using direct integrations.desktop

1. Import your data automatically using direct integrations.desktop 2. Review smart tips to maximize your tax savings.desktop

2. Review smart tips to maximize your tax savings.desktop 3. Generate your tax reports.desktop

3. Generate your tax reports.desktop

You can use DECRYPT2024 for 20% off all plans with Crypto Tax Calculator.

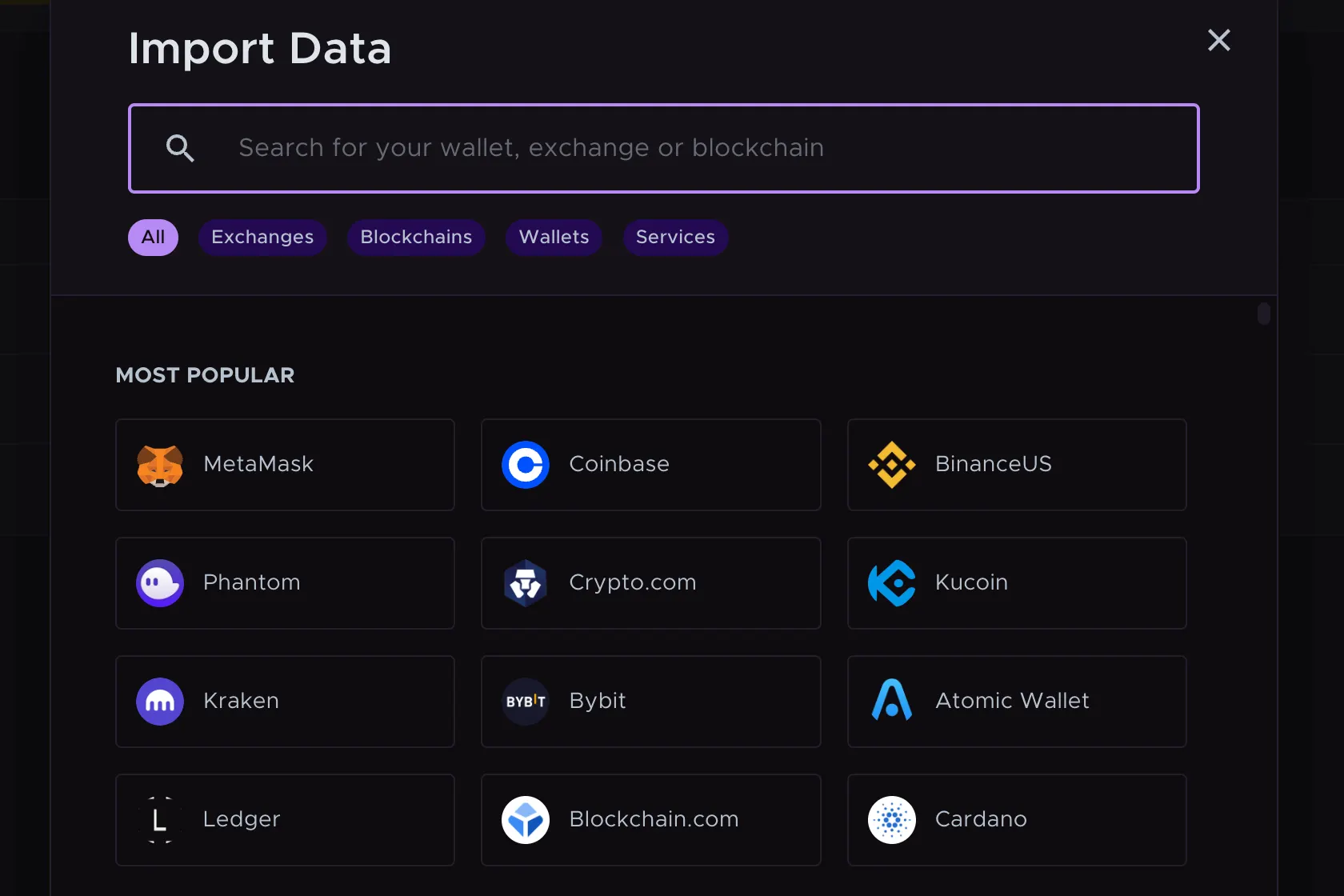

Import your data automatically using direct integrations

Crypto Tax Calculator has direct integrations with over 100 blockchains, as well as 600+ wallets and exchanges, making importing your transaction data fast and easy. Any on-chain DeFi and NFT activity will be automatically pulled into the platform too.

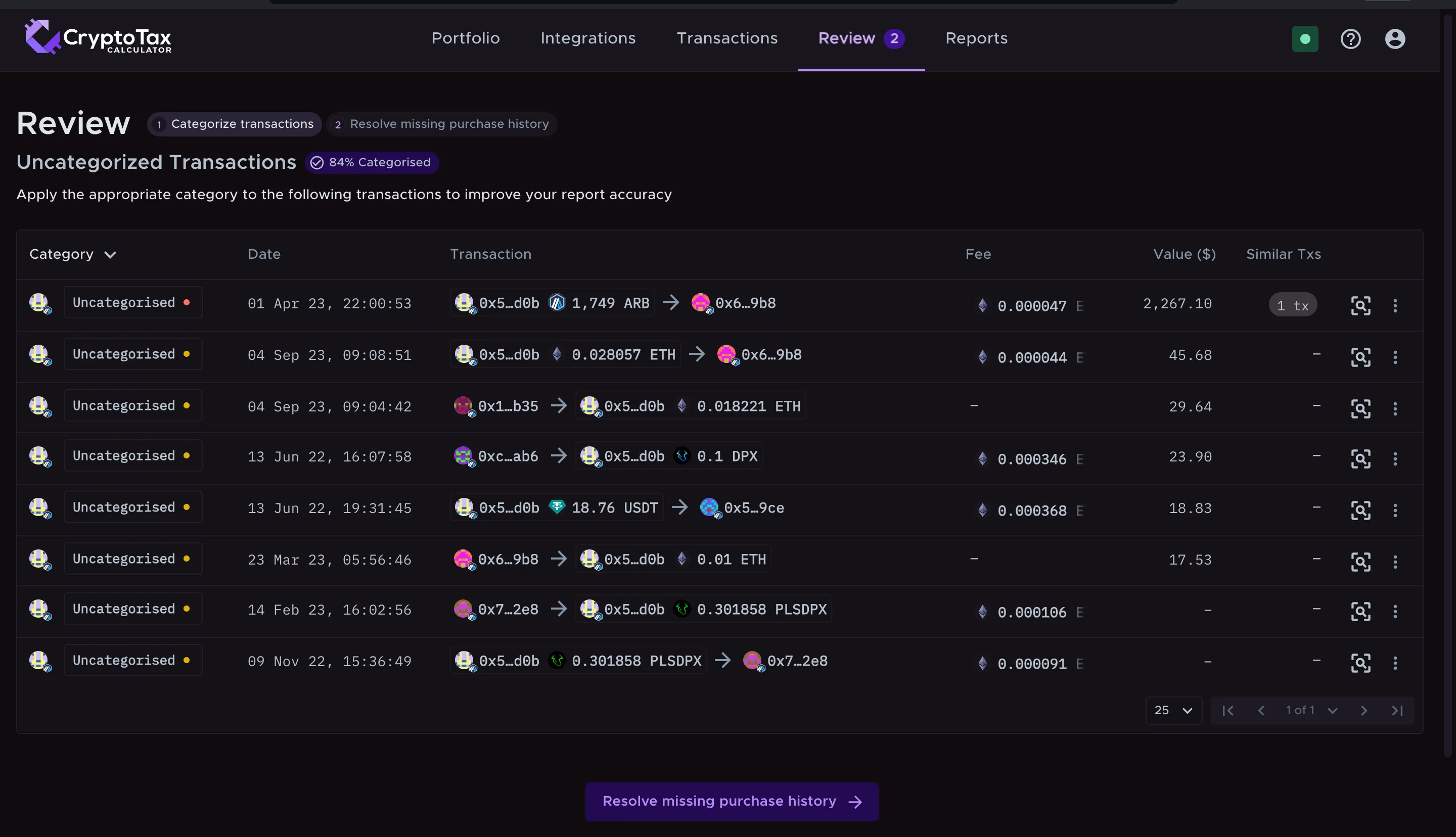

Review smart tips to maximize your tax savings

The platform automatically provides smart tips that are specific to your unique transaction set, allowing you to optimize your transactions for tax and potentially reduce your tax bill. This step also ensures your transaction history is complete so you could pass an audit down the track.

Generate your tax reports

Crypto Tax Calculator provides pre-filled IRS Form 8949 and Form 1040, as well as a direct integration with TurboTax to make filing your taxes incredibly easy. There is also the ability to give your accountant direct access to your account, allowing them to review your transactions before you file.

Crypto services and CPAs

When it comes to filing crypto taxes, hiring a professional is a great option for those that don’t want to go it alone. While you could solicit legal advice from a lawyer or a tax advisor, many would recommend a certified public accountant (CPA). While a CPA is a great option, you should check to make sure they are comfortable handling crypto accounting nuances as some CPAs don’t accept clients with crypto (although this issue seems to be diminishing over time).

In general, getting professional crypto tax help should be more strongly considered if: you have numerous transactions (100s or 1000s), your crypto will be taxed as both income and capital assets, you need help with itemizing costs (such as crypto mining expenses), or you don’t feel confident in being able to accurately file on your own.

Others simply hire a professional because they really dislike the process of filing taxes — or the thought of having to pay them. If you’re worried about filing mistakes and the financial or legal issues that could subsequently follow them, you may come to the conclusion that many already have: paying for a crypto native CPA—or bespoke crypto tax software—is money well spent, and time well saved.

Cheat Sheet

- Many get assistance with their crypto taxes via specialized software or through an advisor or accountant.

- Crypto tax software services are an alternative to standard spreadsheet software that may come with easier transaction entry, advanced features, and live customer support.

- Some seek out the services of a crypto-knowledgeable CPA to help them file their annual tax returns. Those with more complicated crypto tax scenarios should strongly consider seeking professional assistance.

- You can use DECRYPT2024 for 20% off all plans with Crypto Tax Calculator.

Disclaimer

This crypto tax series is merely for informational purposes and should not be considered legal or tax advice. Please solicit the services of a crypto knowledgeable certified public accountant, tax professional, or lawyer should you need further guidance.

Sponsored post by Crypto Tax Calculator

Learn More about partnering with Decrypt.