We do the research, you get the alpha!

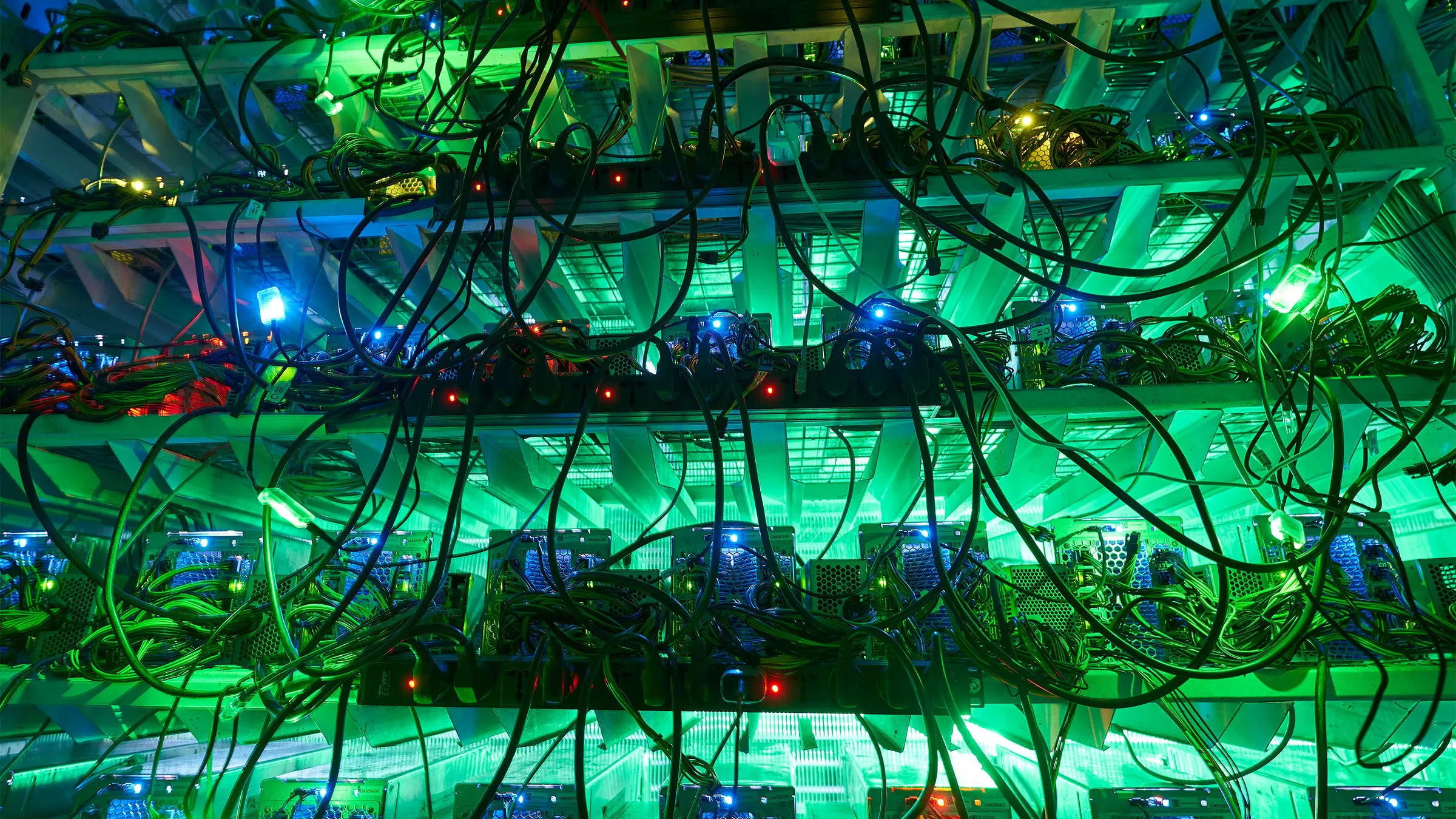

The largest Bitcoin mining companies are steadily claiming greater dominance over Bitcoin’s network security, even though their stock performance this year might not suggest such success.

JP Morgan analysts summed up the current state of the market in their “September ’24 Bitcoin Mining Halftime Report" published Monday, noting that publicly listed U.S. mining companies saw their piece of the network hash rate pie expand for the fifth straight month—to a record 26.7%.

Hash rate measures the pace at which miners are working to mine Bitcoin’s next block, and earn its associated subsidy and fee rewards. When hash rate increases, it generally means that miners are using more electricity and more powerful machinery to mine Bitcoin. As a result, mining is more competitive and the entire Bitcoin network is more secure.

In August, the 14 publicly listed miners tracked by JP Morgan collectively added another 12 exahashes per second (EH/s) to their mining fleets. These gains were led by Canadian miner IREN, which added 5.5 EH/s, and Marathon Digital—the world’s largest corporate miner—with another 3.7 EH/s.

Altogether, the miners have collectively increased their hash rate by over 50% since the year began. Their total combined hash rate is now 175 EH/s, comprising 26.7% of the entire Bitcoin network.

Yet increased hash rate hasn’t necessarily translated to more revenue in recent months. IREN was the only public miner in August to increase its number of BTC mined compared to the previous month.

According to JP Morgan, the monthly bitcoin mined per exahash of operating capacity has drastically declined this year, in no small part due to the Bitcoin halving event in April. The halving cuts the block reward size in half, dropping from 6.25 BTC to 3.125 BTC in the latest quadrennial event.

“This metric has declined over time as the network hash rate (and mining difficulty) has increased, and tends to move lower during the summer months as miners curtail operations,” the analysts added.

Since September began, Bitcoin’s hash rate has climbed to new all-time highs, while Bitcoin’s price has only trended lower—a lethal combination for crushing miner profitability. Most public miners have also seen their stock value plummet, with CleanSpark (CLSK) suffering a 12% drop.

The Valkyrie Bitcoin Miners ETF (WGMI)—a diversified proxy for the mining industry at large—is now down 2% year to date, whereas the price of BTC itself has risen 30%.

“The aggregate market cap of the 14 U.S.-listed bitcoin miners we track declined 3% since the end of August, and currently trade just shy of 2x their proportional share of the four-year block reward, the lowest level since May ‘24,” JP Morgan wrote.

Edited by Andrew Hayward