In brief

We do the research, you get the alpha!

$69,017.00

7.80%$2,100.02

13.36%$1.74

40.18%$1.48

9.42%$635.25

8.70%$0.999921

0.00%$90.37

15.36%$0.28609

1.03%$0.105247

14.62%$1.034

0.54%$0.311591

20.04%$51.70

7.66%$512.64

5.92%$1.00

0.00%$8.76

3.59%$28.79

5.98%$9.52

16.15%$0.168271

5.18%$340.93

4.52%$1.00

0.08%$0.16864

12.51%$0.999663

-0.01%$0.00967757

3.52%$0.105817

10.60%$58.45

14.06%$257.43

5.26%$9.73

17.14%$1.00

-0.08%$1.013

17.73%$0.00000648

9.59%$0.079955

7.83%$0.118337

7.24%$1.31

0.61%$5,150.37

0.30%$4.13

23.91%$5,182.03

0.25%$1.34

-5.59%$0.632953

7.33%$1.00

0.00%$122.73

8.15%$0.00000437

11.36%$188.59

12.17%$0.72119

3.56%$0.997724

0.02%$79.16

7.27%$0.07116

9.21%$1.00

0.01%$1.25

28.47%$0.171629

5.86%$1.12

0.00%$2.25

2.58%$1.00

0.05%$0.00000165

0.70%$9.55

14.33%$0.290232

17.49%$2.53

19.38%$0.999479

-0.03%$0.117516

3.76%$0.423357

12.71%$9.02

8.78%$11.00

0.01%$0.00193068

11.77%$7.26

6.58%$0.061452

7.89%$2.01

0.72%$0.01762662

10.23%$66.68

8.14%$0.113828

16.12%$0.895149

9.04%$0.03219601

10.09%$0.094551

12.62%$3.61

7.65%$0.00987287

8.27%$0.999525

-0.01%$1.098

24.50%$1.049

27.63%$1.54

13.48%$1.24

0.29%$1.00

0.02%$114.40

0.01%$0.746939

-8.04%$1.027

0.00%$1.11

0.35%$0.03496664

4.71%$0.00807281

13.47%$1.85

11.35%$0.081045

1.13%$0.105715

14.40%$0.00000678

17.70%$0.03177893

10.79%$1.096

0.01%$0.998278

0.03%$0.165968

15.01%$1.00

0.04%$0.01296166

3.38%$0.274283

15.12%$29.01

4.25%$0.274918

6.95%$0.998803

-0.05%$0.073093

11.17%$0.00765009

19.70%$1.088

0.18%$0.716069

19.14%$1.18

0.32%$0.999879

-0.01%$35.82

10.00%$1.35

12.80%$0.40644

10.50%$0.541928

8.04%$166.93

0.61%$0.174819

14.28%$0.0446252

-3.02%$0.262081

17.43%$1.001

0.05%$1.096

7.60%$0.086115

10.52%$1.49

4.17%$0.0357596

7.16%$133.13

10.62%$0.999743

-0.00%$0.375857

16.82%$1.019

-0.12%$0.00000034

4.73%$3.36

7.46%$16.71

8.25%$0.00000033

0.68%$0.056451

6.36%$0.363752

22.10%$0.056059

11.27%$1.58

6.74%$0.01653666

0.57%$0.337126

17.10%$0.072813

10.97%$3.20

1.56%$0.02879683

12.47%$0.00003184

14.22%$0.00605413

8.81%$0.994822

0.01%$0.341162

14.59%$0.132708

12.93%$0.053615

11.38%$0.994775

0.28%$17.43

2.08%$0.236136

13.37%$0.077793

12.54%$0.00281082

11.39%$1.43

-3.05%$6.89

14.98%$1.60

-2.43%$0.111502

27.59%$0.04617913

10.81%$0.136138

-6.17%$0.093139

18.93%$0.0024942

0.25%$0.02209049

9.76%$0.328459

1.43%$1.40

12.98%$0.998119

-0.03%$0.226569

15.86%$1.79

5.62%$0.0022417

4.82%$0.999999

-0.00%$0.524828

5.59%$1.32

11.69%$0.98597

-0.26%$0.999811

-0.01%$1.075

0.01%$22.79

0.00%$0.205494

12.83%$0.00003739

7.00%$0.099097

0.42%$2.87

10.67%$0.00000096

0.65%$0.103174

15.80%$0.938033

40.25%$5,214.59

-4.56%$0.200365

5.00%$0.054322

5.13%$0.00411245

17.07%$0.193587

13.77%$0.00515159

8.61%$0.02058312

7.30%$0.126747

9.11%$1.00

0.00%$4.26

16.66%$0.080231

0.60%$0.813191

5.17%$19.10

7.60%$1.99

14.78%$1.00

0.00%$9.04

-4.47%$0.659244

12.95%$0.17537

18.15%$0.055634

10.67%$2.21

13.01%$0.999136

0.00%$2.11

1.43%$0.02330876

1.30%$0.04432358

12.80%$1.82

1.45%$0.00000815

8.87%$48.01

0.01%$0.01976193

-1.23%$3.43

2.30%$1.26

0.81%$0.156328

7.32%$0.180954

14.76%$0.341964

12.49%$0.9474

-4.77%$0.425142

9.75%$0.99443

-0.60%$0.999202

0.07%$1.013

-0.02%$0.307746

0.76%$0.662749

4.56%$4.77

11.78%$0.098531

13.40%$0.084865

9.51%$0.269732

7.95%$0.626388

6.11%$0.133866

7.60%$0.083018

14.41%$0.301447

8.15%$0.02334687

-7.94%$0.132261

6.71%$1,096.63

-0.09%$0.377678

3.84%$0.00152738

5.02%$0.259997

5.74%$0.00415097

6.10%$0.31323

-0.81%$0.072855

-2.20%$0.225616

4.35%$1.91

3.30%$11.28

-2.08%$0.131689

1.07%$0.995486

-0.03%$2.47

10.20%$0.204831

9.31%$1.001

0.00%$0.342842

4.13%$1.48

3.70%$11.95

2.30%$1.00

0.00%$1.062

-0.01%$0.113836

11.70%$0.999829

-0.00%$0.989576

-3.69%

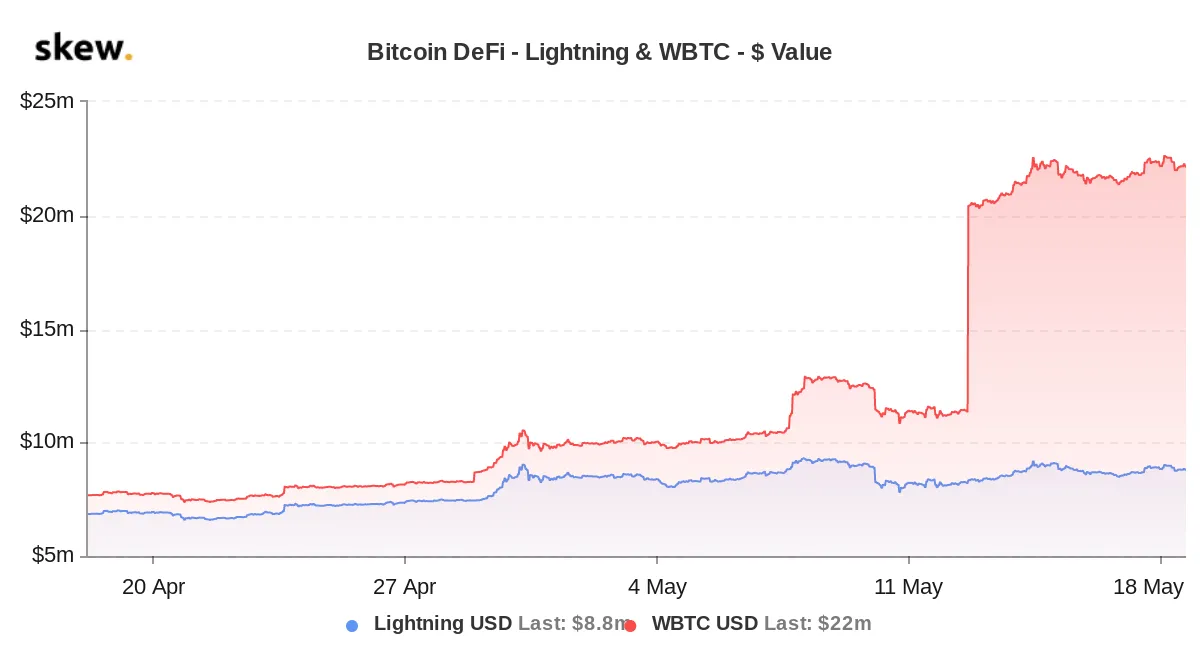

Wrapped Bitcoin (WBTC) has found new life thanks to its new use case as collateral on the Maker platform.

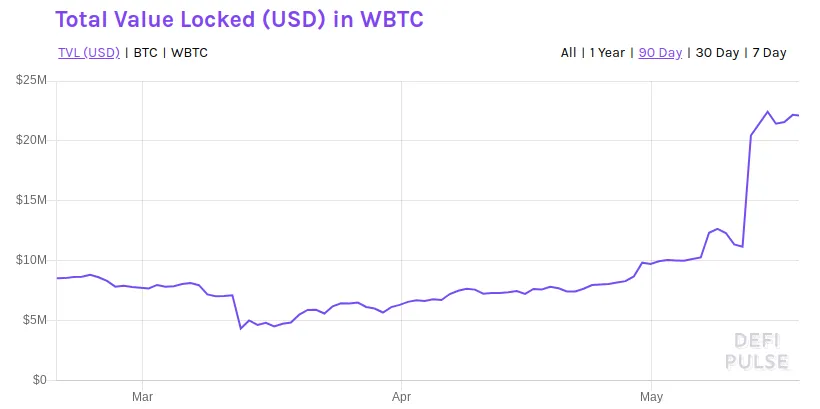

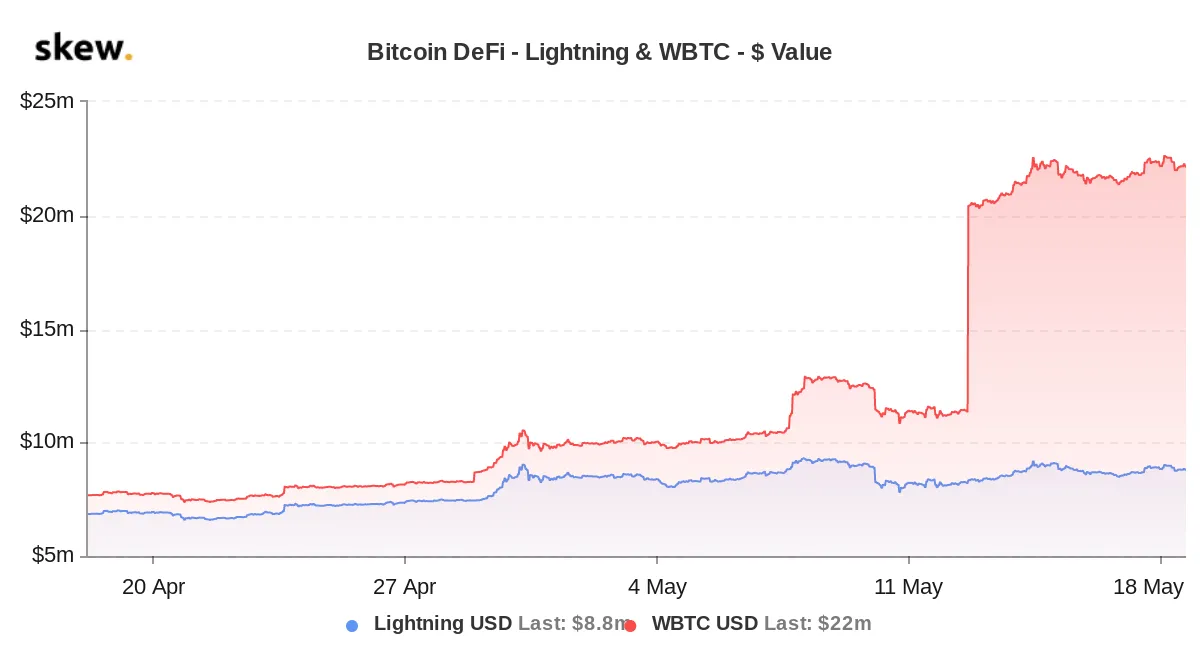

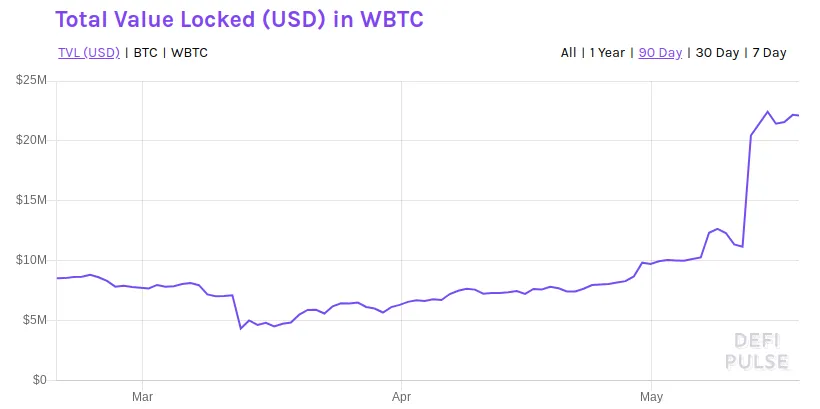

The number of Wrapped Bitcoin has more than doubled since the cross-chain currency was added as a collateral option on the Maker protocol. Total Bitcoin locked rose from about 1,000 to nearly 2,300 since the Maker proposal was passed, with more Bitcoin locked in under two weeks than all that were locked since the WBTC launched in January 2019. The total value locked reached an all-time high of $22.45 million on May 14.

The inflows show there’s been a massive renewal of interest in WBTC, and in unlocking the growing liquidity trapped on the Bitcoin chain.

The Maker protocol uses smart contracts to issue and manage loans of dollar-pegged DAI tokens backed with cryptocurrency as collateral. Maker has gradually added cryptocurrencies to be used as collateral for loans, including the most recent decentralized governance vote to add WBTC earlier in May.

WBTC represents one of a number of different approaches to transferring Bitcoins onto the Ethereum blockchain. The WBTC platform, which requires trusted third parties to facilitate the transfer between blockchains, is a collaborative project between Maker, Compound, Kyber and other major DeFi players.

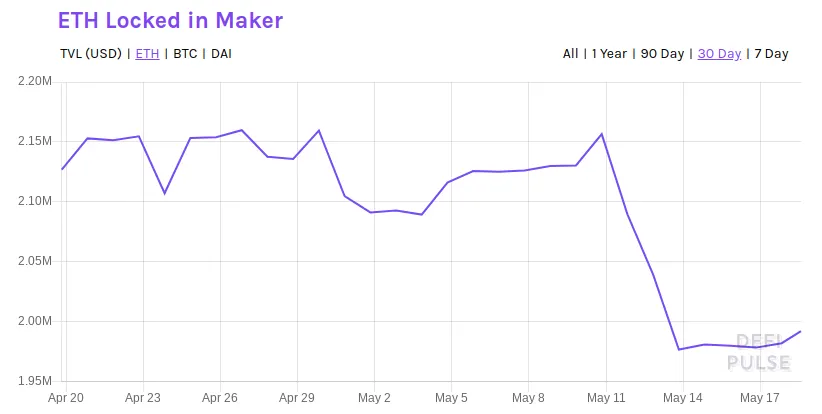

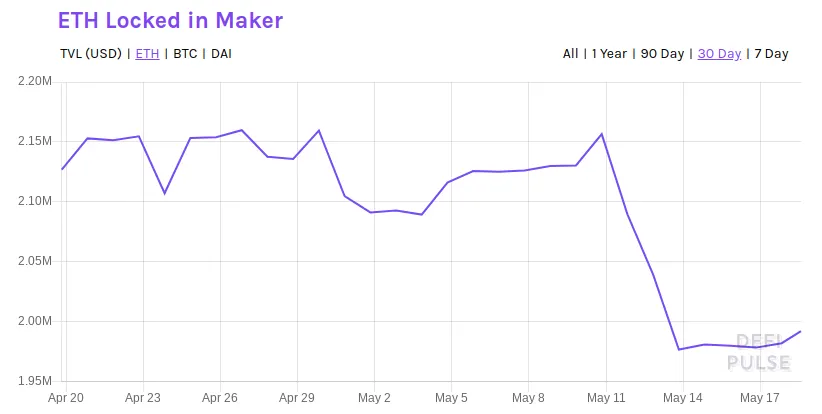

Notably, the amount of ETH locked in Maker loans fell by 8% between May 10 and May 13, indicating some existing loan holders may have been eager to add WBTC as a way to diversify their collateral accounts. More diverse collateral holdings are important because they spread out the risk of a drop in value of any one asset.

The new Bitcoin moving to Ethereum has not seen the same spike on the competing Lightning network. This could be a signal that users are not seeking faster transactions so much as greater liquidity and a more robust financial ecosystem.

In just a few short weeks, WBTC has shown all it needed was a viable use case to attract more attention than had ever been seen before. This could be interpreted as a metaphor for DeFi itself, which may be just one one killer app away from bringing users flooding into one of crypto’s fastest growing sectors.