Decentralized finance (DeFi) is transforming how assets are traded, staked, and utilized, but its full potential depends on the infrastructure supporting complex, scalable, and interoperable applications.

Flare is meeting this challenge by combining advanced data capabilities with opportunities for users and developers. From liquid staking, which unlocks the value of staked assets for use as collateral, to cross-chain connectivity and perpetual trading , Flare is laying the foundation for a connected and impactful DeFi future.

DeFi on Flare

Flare’s approach is to create a decentralized, data-driven foundation with enshrined oracle solutions and trustless asset bridging, while enabling participants to unlock earning opportunities and explore innovative DeFi applications. These include:

- Decentralized data feeds: The Flare Time Series Oracle (FTSO) ensures fast and accurate price pair data for DeFi protocols, such as decentralized exchanges (DEX) Enosys and SparkDEX and automated trading strategies on Raindex.

- Trustless asset bridging: The FAssets system enables non-smart contract tokens like Bitcoin (BTC), XRP, and Dogecoin (DOGE) in DeFi. By bringing smart contract capacities to these assets, FAssets attract new liquidity while maintaining trust-minimized security.

- Liquid staking: Flare’s flrETH token introduces Ethereum liquid staking directly on Flare. It provides Ethereum (ETH) holders with liquidity for DeFi activities like collateralized lending or automated trading, while earning ETH staking yield.

- Stablecoin: USDX, a 1:1 USD-backed stablecoin by Hex Trust, has launched on Flare as a vital DeFi primitive. It can be used in various DeFi applications and staked in Clearpool's T-Pool for real-world yield. Staking USDX returns cUSDX, usable as collateral in Flare's FAsset system, enabling non-smart contract assets in DeFi.

What is flrETH, and how does it work?

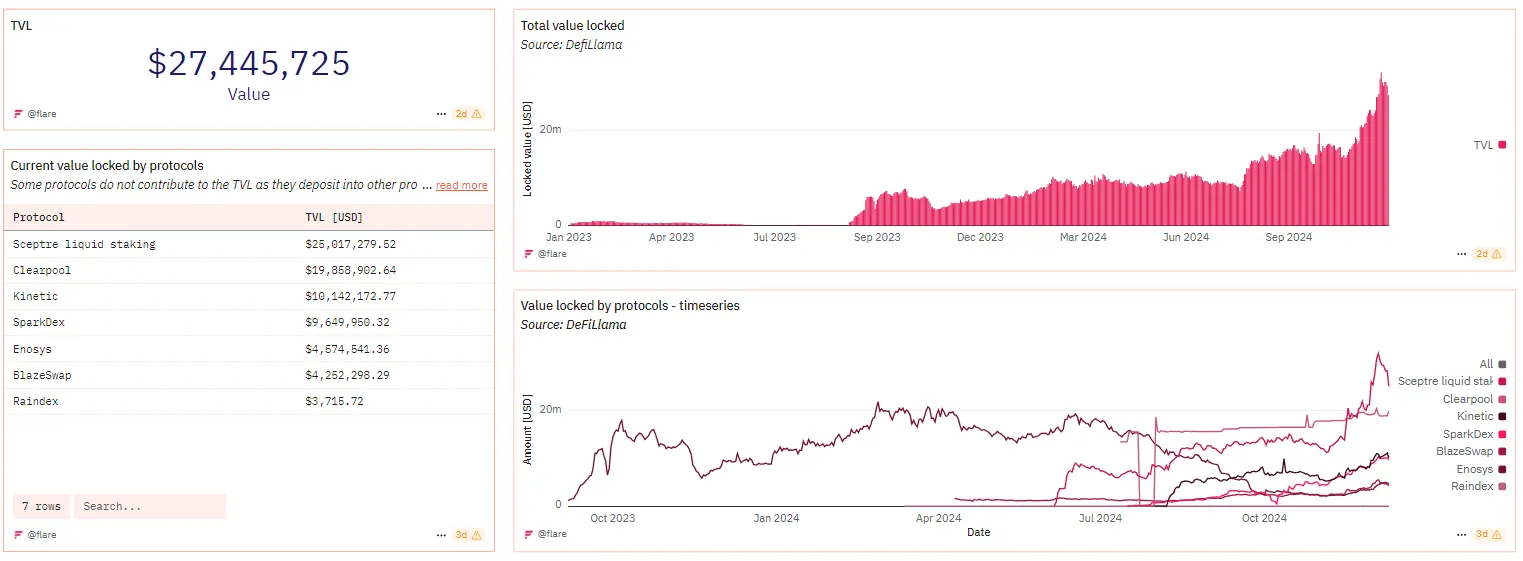

Liquid staking is one of the fastest-growing sectors in DeFi, with the total value locked (TVL) in DeFi protocols rising by over 130% in the past year.

DeFi opportunities on @FlareNetworks 🌞

1️⃣ Looking for yield on FLR?

Swap for sFLR on a DEX and hold.

Swap for sFLR and supply to Kinetic to earn additional yield.

Swap for sFLR and LP into an sFLR/wFLR pool to earn rFLR.

2️⃣ Looking for USD yields?

Get USDX and wrap it… pic.twitter.com/8D4Qpd4Qx3

— Flare ☀️ (@FlareNetworks) October 20, 2024

Developed by Ethereum experts Dinero, flrETH is backed by Dinero’s dual-to:ken staking solution. Users can stake ETH while simultaneously tapping into DeFi activities such as liquidity pools, collateralized lending, or automated trading on Flare.

The flrETH token also has potential future uses, such as integration into FAssets collateral pools.

Key DeFi projects on Flare

Flare’s DeFi ecosystem is powered by the network’s advanced infrastructure and oracles, and includes:

- 🛡️ Sceptre: Flare’s first liquid staking protocol allows users to maximize FLR rewards while participating in DeFi. sFLR tokens, representing liquid-staked FLR, can be used in lending protocols and liquidity pools.

- 🔗 SparkDEX: A pioneering DEX with concentrated liquidity pools, where liquidity providers allocate funds to specific price ranges to maximize efficiency and returns. It supports trading pairs including stablecoins, sFLR and wFLR—wrapped FLR, a ERC-20 version of FLR for use in DeFi. It has also launched a perp DEX, SparkDEX Eternal, which is fully backed by the Flare Time Series Oracle.

- ⏱️ Kinetic: A borrow-and-lend protocol allowing users to leverage assets (including FAssets when live) with innovative financial tools, such as dynamic loan-to-value ratio adjustments They rely on real-time FTSO price feeds for accurate and efficient operations.

How is Flare scaling its DeFi ecosystem?

Flare offers multiple layers of engagement for FLR tokenholders, who can stake their tokens to validators to help secure the network, and delegate their wrapped FLR to data providers.

Flare's rFLR DeFi Emissions Program plays a key role in scaling liquidity on protocols like SparkDEX and Kinetic by distributing monthly FLR token rewards.

The rFLR program also complements the upcoming launch of FAssets on mainnet by incentivizing the integration of non-smart contract tokens like Bitcoin, helping Flare attract cross-chain liquidity and user participation.

The future of DeFi on Flare

Flare is building out its ecosystem of DeFi decentralized applications (dapps) with strategic collaborations and advancements like offchain verifiable compute, accelerated by the hackathon it is co-hosting with Google Cloud in March 2025.

With advances like offchain compute and Fassets to boost liquidity and innovation, Flare is aiming to bridge global finance with cutting-edge blockchain innovation through commitments to security, scalability, and interoperability.

Sponsored post by Flare

Learn More about partnering with Decrypt.