We do the research, you get the alpha!

At one point early Wednesday, Bitcoin analysts were saying that a worrying amount of BTC had been transferred onto exchanges, and the asset faced a steep sell wall on its way to a six-digit milestone.

But that didn't last very long.

Last last night during U.S. trading hours, Bitcoin climbed as high as $103,679 according to CoinGecko data.

And even now, as the Bitcoin price hovers at $103,511—having climbed nearly 8% compared to this time yesterday—it's within striking distance of another new all-time high mark.

So what have traders made of this? Judging by the order books, there won't be a hasty retreat below $100,000 any time soon, BRN analyst Valentin Fournier told Decrypt.

"The order book reveals robust support at the $100K level, with over 4,600 BTC in buy orders," he said. "On the sell side, there are approximately 3,400 BTC in orders below the $110K level, suggesting a weaker resistance compared to the barrier that had to be overcome to break past $100K.”

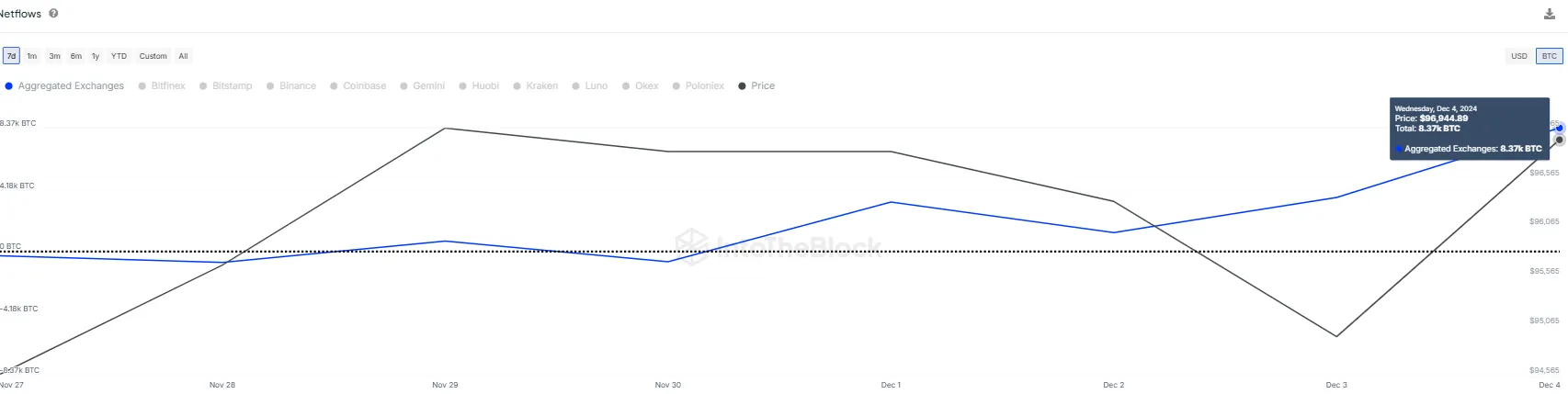

IntotheBlock Marketing Director Vincent Maliepaard told Decrypt the firm noted a "significant net inflow" of more than 8,000 BTC—worth roughly $860 million at current prices—onto exchanges yesterday.

But it's not known how many other investors will use this new high-water mark to take profits. "As for today, we update this data daily and take the net flow of the full day," he said. "So we won't have this data until early tomorrow."

Taken in aggregate—buying, swapping, and selling—traders have already generated more volume today than they did yesterday. On Wednesday, roughly $87 billion worth of Bitcoin had changed hands That's a far cry from the $98 billion that's already been traded so far on Thursday, according to CoinGecko data.

The busiest day for Bitcoin traders this year was November 13, after Bitcoin climbed past $93,000 for the first time ever and analysts became certain that the so-called Trump trade would carry BTC all the way to $100,000 before the end of the year. Over $152 billion worth of Bitcoin traded hands on that date.

Edited by Andrew Hayward