We do the research, you get the alpha!

Entrepreneur and former BitMEX CEO Arthur Hayes fears Bitcoin will suffer a "vicious sell-off" around the time Donald Trump takes office.

In a characteristically lengthy blog post (which followed a 300-word introduction about yoga) the trader warned that crypto investors have unrealistically high expectations for what the president can achieve.

While Trump has promised to make America "the crypto capital of the world" and establish a strategic Bitcoin reserve, Hayes says his administration will only have 12 months to enact ambitious policies.

"There are no politically acceptable solutions available to Trump to quickly bring about such change," he wrote on Substack.

Hayes anticipates that much of the president-elect's next term will be subsumed by the 2026 midterm elections—with the Republicans losing governing power at the hands of an impatient electorate, he said.

"It is almost impossible for Trump to appease his base sufficiently to prevent the Democrats from retaking both legislative bodies in 2026. The people are impatient because they are desperate," he writes.

When this realization sets in among the markets, he says a "harrowing dump" lies in store for Bitcoin and other so-called "Trump trades."

"Investors are setting themselves up for severe buyer’s remorse," Hayes writes.

Hayes is especially skeptical about Trump's vow to transform 200,000 BTC seized from criminals into a taxpayer-owned stockpile, and goes on to predict that such a reserve won't end up being established.

"However, it doesn’t matter if a US BSR happens because just the threat of it creates buying pressure," he writes.

Elsewhere in his essay, Hayes predicts that "another pillar to the crypto bull market" could emerge if Mainland Chinese investors are eventually allowed to gain exposure to Bitcoin ETFs in Hong Kong.

And he claims those in power across the EU will "secretly buy crypto hand over fist" while everyday consumers "suffer under state-sanctioned inflation," adding: "That's just the way the croissant flakes."

While Hayes believes Bitcoin's best days do lie ahead, he warns the path to $1 million will be scarred by nasty corrections along the way. "Trump Truth tells me the best way to maximize returns is to own Bitcoin and crypto,” he writes. “And therefore, I will be buying dips and rips. Yahtzee!!!"

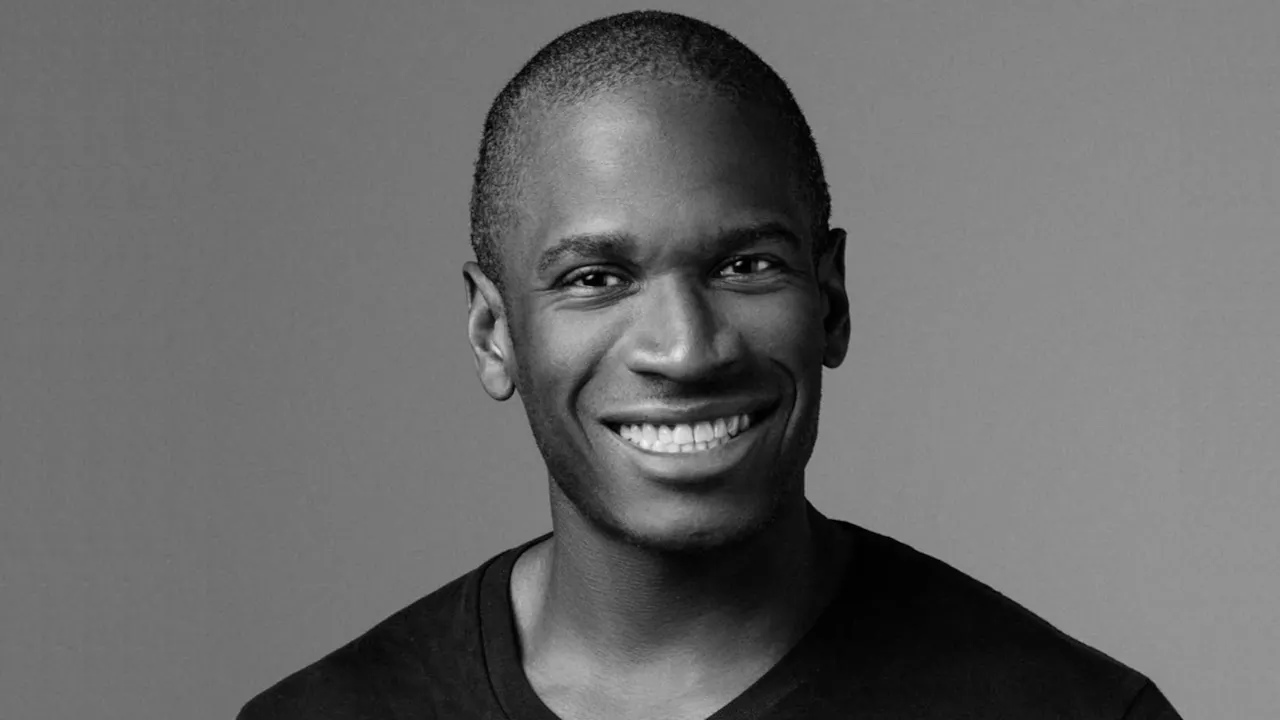

The 39-year-old is renowned for his bold opinions and predictions, but isn't afraid to mark his own homework.

Back in September, Hayes admitted that he'd only had a 25% success rate in his market predictions over a 12-month period—describing that score as "pretty shit to the common man." Nonetheless, Hayes asserted that he's remained profitable by leveraging longer-term macroeconomic trends.

Edited by Stacy Elliott.