In brief:

We do the research, you get the alpha!

$68,174.00

5.07%$2,063.20

9.46%$1.59

25.28%$1.45

6.40%$626.72

5.65%$0.9999

0.01%$87.65

7.51%$0.286832

0.22%$0.10004

8.49%$1.031

-0.24%$50.96

5.16%$0.294278

11.26%$501.94

2.00%$0.999891

0.01%$8.81

0.76%$28.15

4.73%$9.28

10.46%$0.173575

8.20%$348.41

4.76%$0.998918

0.04%$0.162833

7.40%$0.999668

0.03%$0.00950699

2.02%$0.10214

6.18%$56.49

7.95%$0.999769

-0.03%$250.34

6.37%$9.36

10.15%$0.952804

9.45%$0.00000616

3.79%$0.078057

4.11%$0.113528

-0.65%$1.28

-0.57%$5,166.61

-0.17%$4.00

15.60%$5,201.86

-0.13%$1.34

-6.98%$0.608756

2.19%$1.00

0.00%$1.12

-0.00%$183.69

7.18%$0.997615

0.01%$115.18

-1.15%$0.711019

2.20%$0.00000405

3.00%$77.89

4.28%$1.00

0.04%$0.070117

4.98%$0.169771

3.44%$2.25

1.48%$0.999649

-0.01%$0.00000163

-1.09%$1.14

15.05%$9.00

7.70%$0.99909

-0.04%$0.27077

7.55%$2.39

10.75%$0.11212

-0.40%$11.00

0.01%$0.40718

5.17%$8.66

2.56%$7.11

3.57%$0.00182366

6.47%$0.060169

5.75%$1.94

-4.15%$63.71

-0.19%$0.01681006

-2.91%$0.110096

9.73%$0.850312

2.43%$0.03143105

7.31%$1.001

0.17%$0.00974719

4.38%$3.49

3.41%$0.090129

6.52%$1.24

0.13%$1.005

11.81%$1.00

0.03%$114.41

0.01%$1.45

6.15%$0.960712

13.98%$0.745786

-4.02%$1.027

0.00%$1.11

0.19%$0.03493922

5.50%$1.86

6.10%$0.00771428

7.46%$0.080322

0.22%$0.03387869

19.34%$0.10024

8.47%$1.096

0.01%$0.996001

0.24%$0.158935

8.23%$0.0000063

7.89%$1.00

0.04%$0.287219

7.15%$29.70

6.51%$0.01283137

0.00%$0.999427

0.06%$0.261153

7.49%$0.070643

5.50%$1.087

-0.13%$0.999855

-0.00%$1.18

0.13%$0.694886

6.18%$0.00712239

8.38%$35.25

6.90%$1.32

7.31%$0.392607

5.65%$0.04659159

1.12%$167.01

-0.10%$0.520243

1.54%$1.00

0.01%$1.50

4.84%$0.164881

7.17%$0.085363

7.40%$0.250946

7.50%$1.038

2.13%$0.03437285

2.93%$0.99974

0.00%$0.375269

15.20%$130.13

6.32%$1.019

-0.08%$0.00000034

2.75%$0.056945

4.99%$0.00000033

0.42%$16.28

1.98%$3.21

2.73%$1.56

5.56%$3.21

1.33%$0.01626985

-1.27%$0.052756

1.65%$0.342414

11.29%$0.070062

5.60%$0.3229

11.36%$0.00594882

4.25%$0.02724067

4.41%$0.999602

0.31%$0.00002982

5.56%$0.393023

7.58%$17.51

0.89%$0.3209

6.27%$0.234897

7.19%$0.982721

-0.66%$0.077134

3.25%$1.41

1.07%$0.050842

2.87%$0.123117

3.58%$1.60

-0.35%$0.00269267

5.56%$0.134645

-3.68%$6.45

6.26%$0.00246426

-0.63%$0.02230967

10.06%$0.04430487

6.09%$0.999998

0.30%$0.08586

7.73%$1.33

4.91%$1.79

6.09%$0.098594

13.27%$1.00

0.00%$0.985564

-0.29%$1.029

39.12%$0.999703

0.01%$1.075

0.01%$1.30

4.33%$0.212355

8.63%$0.00215584

3.54%$0.50007

-1.13%$22.79

0.00%$0.00000098

2.11%$5,284.97

-1.45%$2.80

6.45%$0.096923

-1.95%$0.00003606

2.21%$0.195982

7.68%$0.05408

4.49%$0.862119

11.51%$9.82

5.73%$0.197018

1.14%$0.098388

9.03%$1.00

0.00%$0.188688

6.46%$0.079

-0.37%$0.0200872

0.68%$0.00492803

3.27%$4.13

11.80%$1.00

0.00%$18.55

2.78%$0.00376433

7.74%$1.89

5.01%$0.11593

-2.77%$0.054997

7.45%$1.00

0.07%$0.17021

10.69%$2.14

7.02%$0.621972

3.92%$1.81

0.77%$3.55

5.26%$0.02287185

-6.08%$0.01998478

-1.03%$2.03

-0.90%$48.00

0.01%$0.04188687

6.34%$0.994742

-0.09%$0.0000079

4.47%$1.26

0.36%$0.338306

7.96%$0.999498

0.04%$0.148066

0.26%$0.998672

0.05%$0.415411

5.44%$0.169924

4.42%$1.012

-0.20%$0.304295

0.25%$0.647187

-0.24%$0.631437

5.13%$0.134569

7.25%$0.095451

6.50%$4.54

4.38%$0.082039

1.45%$0.131992

5.93%$0.263144

3.96%$1,096.53

-0.11%$0.07387

-1.35%$0.079319

7.88%$11.58

3.92%$0.313355

-1.66%$0.285896

0.81%$0.00148942

3.32%$0.363496

-0.61%$0.252532

1.66%$0.131188

-0.04%$0.220252

2.21%$0.0040209

2.06%$0.02128955

-12.02%$1.001

0.00%$0.200388

4.64%$2.35

2.54%$1.47

2.05%$0.338169

2.01%$12.00

6.07%$0.999774

0.02%$1.73

-8.31%$0.04516575

4.95%$0.995649

0.06%$1.063

0.17%$0.999771

0.02%$1.08

0.07%

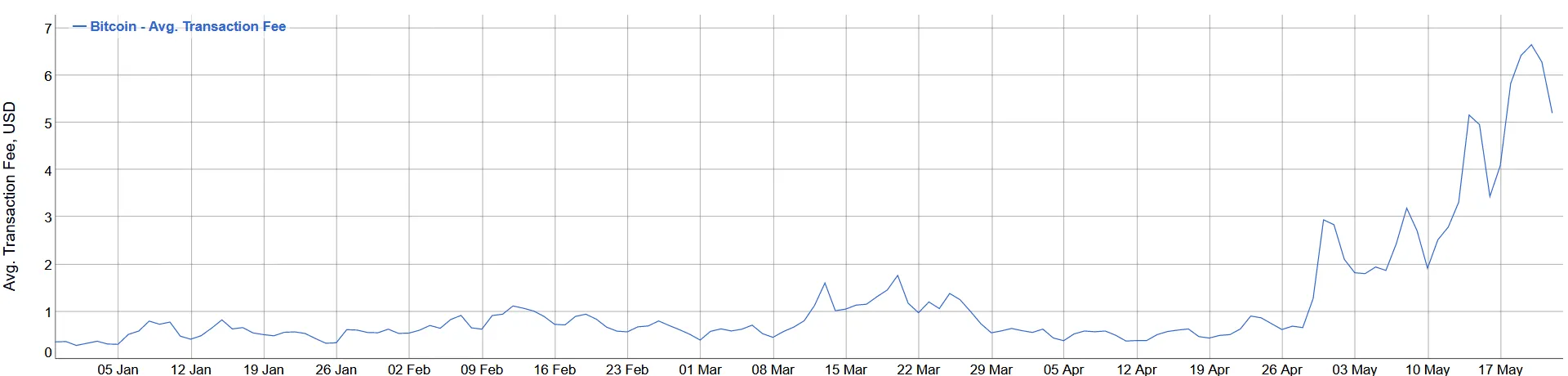

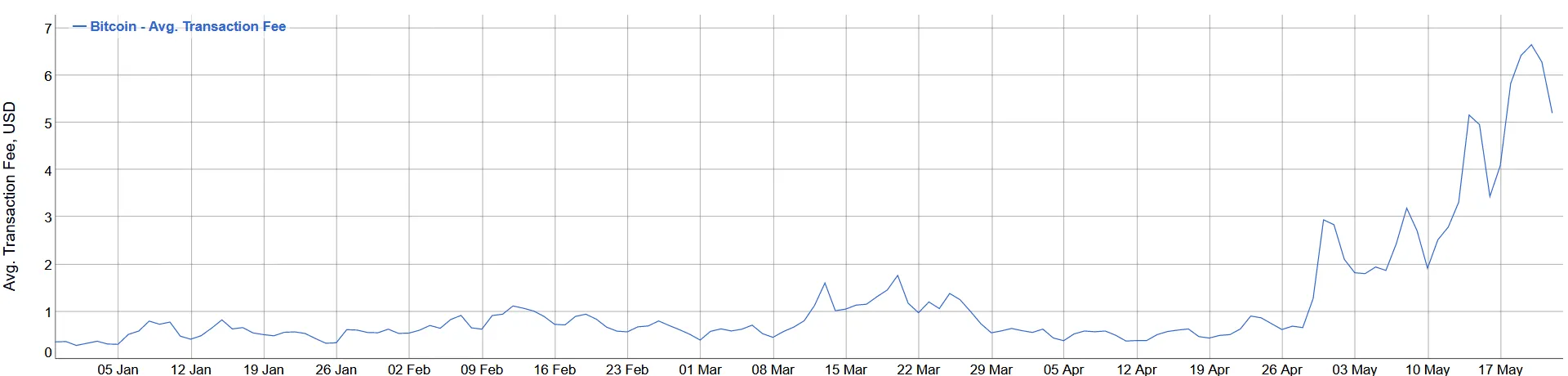

The average cost of sending transactions on the Bitcoin network has increased by 2,213% since the turn of the year.

That’s according to data from Bitinfocharts, which shows that average Bitcoin transaction fees climbed as high as $6.64 on May 20. That’s the highest average cost of a Bitoin transaction since July 2018—almost two years ago.

At the turn of the year, average fees were as low as $0.28—marking a 2,213% spike since January 1.

The sudden spike in the average cost of a Bitcoin transaction appeared to be due to the increased activity on the network ahead of the halving of Bitcoin’s block reward.

But the block reward reduction—from 12.5 BTC per block to 6.25 BTC—passed on May 12, and fees have only continued to soar. In fact, since the halving took place, average transaction fees have surged by over 144%.

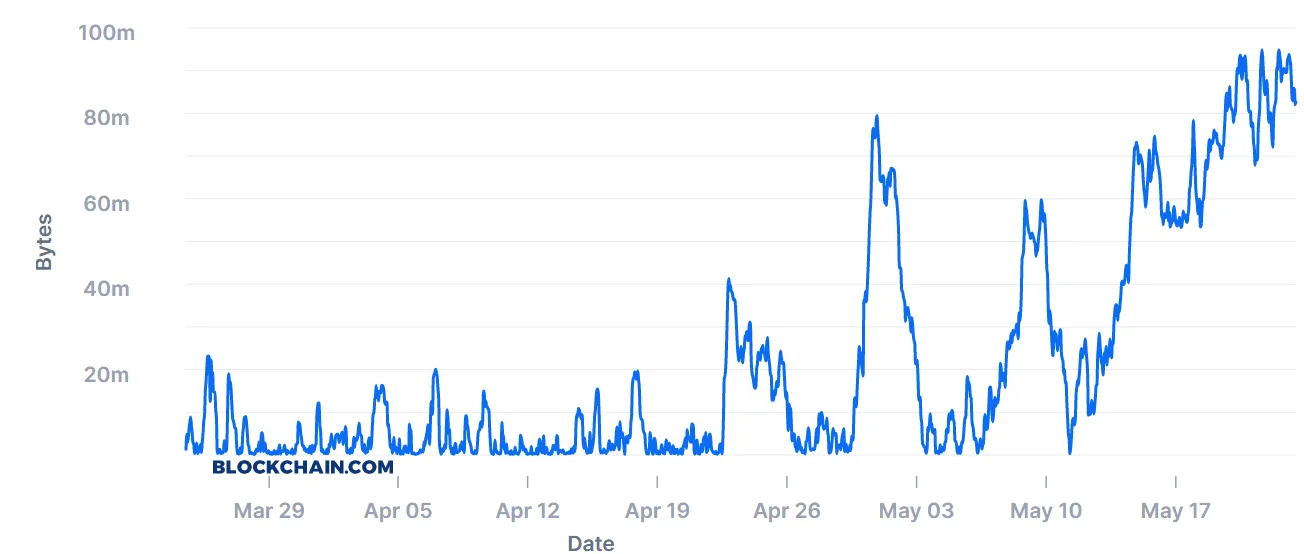

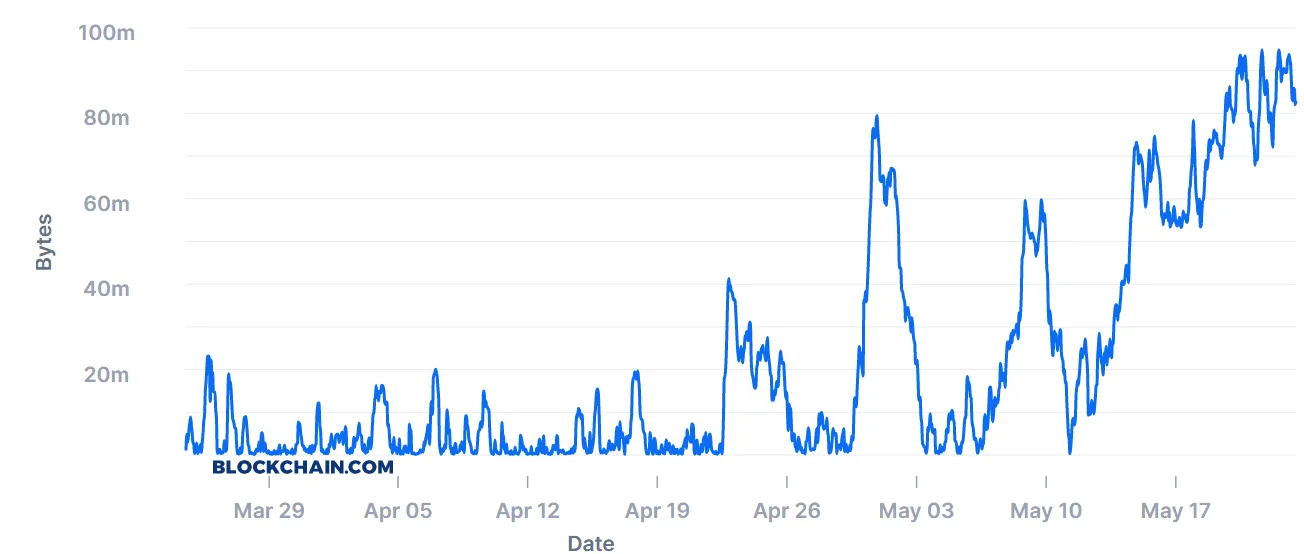

Fees typically rise whenever the Bitcoin blockchain comes under heavy usage. That notion is backed up by data from Blockchain.com, which displays a heavily backlogged mempool of pending Bitcoin transactions.

On May 20, the mempool showed 94MB of Bitcoin transactions waiting to be processed. The mempool hasn’t been this clogged since January 2018—during the height of Bitcoin’s biggest bull run to date.

For reference, Bitcoin’s blocks process 1MB worth of transactions at a time. When the network comes under heavy usage, people are forced to pay higher transaction fees for the privilege of having their transactions included in the next block.

Users are still free to set lower transaction fees within their wallets. However, they run the risk of being ignored by Bitcoin’s miners, who naturally seek out higher-paying fees.

Bitcoin users are even free to set their fees to zero. This was a common occurrence in the early days of Bitcoin, but today, miners are more likely to ignore such transactions or reject them entirely.