In brief

We do the research, you get the alpha!

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$86,044.00

-2.83%$2,943.72

-4.62%$1.88

-3.67%$852.29

-3.32%$1.89

-5.07%$0.999998

-0.00%$125.84

-3.24%$0.278335

0.40%$2,942.76

-4.61%$0.128669

-4.07%$1.031

1.88%$0.383549

-3.32%$57.79

-2.98%$3,596.27

-4.64%$85,880.00

-2.83%$532.39

-4.67%$3,194.97

-4.57%$0.999957

0.02%$0.999742

-0.04%$12.73

-4.60%$3,190.26

-4.52%$9.23

0.49%$2,943.58

-4.57%$405.32

-1.50%$27.53

-5.47%$0.219172

-4.49%$408.91

0.81%$0.999516

-0.01%$86,028.00

-2.90%$76.90

-1.88%$1.46

-7.00%$12.34

-4.45%$0.999669

-0.06%$0.112192

-4.97%$1.08

-0.45%$0.00000787

-2.56%$1.29

-0.07%$0.999858

-0.00%$1.48

-4.78%$0.132839

-3.78%$0.095074

-2.12%$1.21

-0.06%$5.02

-5.66%$1.77

1.10%$185.82

-1.87%$0.999304

-0.02%$0.00779114

-3.15%$0.07105

-0.23%$266.68

-5.69%$3.48

-2.27%$4,300.48

-0.20%$105.87

-3.65%$0.99873

-0.07%$1.54

-3.11%$12.28

-3.68%$0.817834

-12.58%$1.00

0.00%$2,941.65

-4.65%$157.03

-3.18%$0.00000402

-3.44%$0.218895

-6.14%$0.198827

-1.57%$3.03

-3.06%$4.51

-2.09%$1.14

0.03%$125.85

-3.32%$0.00000164

0.17%$4,314.22

-0.28%$0.02817752

-6.86%$0.00248606

-6.45%$0.99973

0.01%$1.11

0.00%$1.11

0.03%$10.20

-3.72%$0.999283

-0.03%$0.999573

-0.03%$0.534233

-4.85%$0.056945

-4.51%$0.411706

-7.46%$0.999644

-0.02%$3,386.59

-4.58%$10.10

-2.80%$0.111706

-4.63%$1.57

-2.67%$852.11

-3.25%$0.04268007

-3.99%$136.83

-3.28%$0.194976

-4.50%$74.53

-3.55%$3,120.34

-4.67%$5.29

-2.12%$0.062193

-7.00%$0.114413

-3.52%$85,767.00

-3.36%$2.05

-2.91%$3,147.22

-4.64%$86,235.00

-2.77%$85,949.00

-2.90%$0.01145776

-6.77%$0.04973407

5.81%$0.910909

-4.70%$0.01054813

-6.16%$1.25

-4.36%$10.92

0.01%$0.999855

-0.01%$113.64

0.02%$0.999749

-0.02%$0.118467

-4.56%$1.017

0.06%$0.999844

-0.03%$27.73

-5.31%$1.39

-6.04%$0.00000862

-4.74%$85,841.00

-2.85%$3,181.05

-4.80%$1.11

0.07%$3.60

10.33%$2.04

-5.58%$0.09026

0.64%$86,324.00

-4.65%$0.9998

0.01%$0.999584

-0.03%$3,143.47

-4.45%$0.01145866

-6.78%$0.01007622

-3.99%$0.999863

0.00%$145.38

-3.20%$1.12

-0.19%$2,945.27

-4.46%$0.187377

-4.65%$0.223061

-4.21%$1.71

-5.59%$3,081.06

-4.32%$5,725.33

-4.92%$0.9985

-0.02%$0.288971

-4.01%$0.997726

0.05%$2,943.25

-4.64%$86,439.00

-2.19%$35,382,014.00

0.00%$40.65

-1.56%$0.353799

-5.51%$0.996486

-0.01%$0.461091

-3.85%$2,460.42

0.00%$4.92

-4.77%$0.54471

-6.59%$0.537488

-7.11%$0.00530151

-1.40%$1.23

0.17%$0.515158

-7.36%$0.263054

-5.82%$0.718953

-6.70%$2,944.34

-4.55%$0.097546

-4.72%$0.767722

-2.38%$0.999626

-0.01%$0.425979

-5.10%$169.19

-3.34%$3,167.79

-4.69%$3.14

69.51%$0.509427

-7.07%$0.21116

-4.32%$3,102.57

-5.36%$0.07153

-3.62%$0.982085

1.32%$0.00004232

-4.83%$1.006

0.28%$0.407212

15.42%$0.03798963

-5.24%$1.11

0.01%$3,231.96

-4.77%$0.0000004

-1.96%$0.02032157

0.96%$90,454.00

0.00%$0.00407752

-12.28%$0.03908019

0.84%$0.090905

-3.83%$0.109168

-4.19%$3,274.77

-4.64%$85,824.00

-3.35%$9.78

-6.51%$0.00000037

3.53%$0.369889

-2.90%$0.070632

-3.09%$18.19

-5.97%$22.09

-0.05%$85,903.00

-2.72%$0.227099

-10.20%$0.058818

-3.90%$1.17

0.07%$0.331787

-4.50%$138.56

0.25%$0.128673

-4.11%$2.01

-4.51%$0.999058

0.03%$1.00

0.05%$0.319223

-4.92%$1.71

-4.77%$1.00

0.05%$18.47

-6.21%$0.999327

-0.07%$0.082526

-6.03%$0.03053585

-5.39%$0.118565

-6.02%$116.31

-6.16%$15.24

-4.44%$2,943.85

-4.46%$0.99938

-0.08%$0.00650421

-5.30%$0.185832

-2.27%$3,184.37

-4.73%$0.086166

-5.71%$0.260545

-1.90%$0.00597536

-3.53%$1.12

0.02%$1.44

-2.38%$2,905.66

-4.79%$86,058.00

-2.72%$22.73

-12.59%$27.54

-5.48%$0.992856

-0.05%$3,184.91

-4.58%$0.281474

-5.18%$0.275045

-3.47%$2,944.60

-4.44%$901.58

-3.43%$2.64

1.86%$0.01486719

2.09%$0.135005

-11.04%$27.54

-4.29%$1.00

0.00%$1.089

0.03%$3.72

-5.28%$0.162527

-3.66%$24.30

-7.63%$86,181.00

-2.87%$0.955127

-7.81%$0.132608

-4.55%$85,953.00

-2.77%$0.02912186

-1.06%$2,940.54

-4.58%$0.00251698

-3.50%$0.00000115

-0.82%$0.239627

1.25%$63.95

0.43%$1.001

0.13%$1.16

-0.00%

DeFi protocols are growing more intertwined by the day.

Protocol tokens from token swap platforms Kyber Network and 0x will be accepted as collateral assets on Maker’s crypto-backed loan platform following a successful Executive Vote concluded Sunday. It’s a recognition of the growing value of DeFi protocol tokens, and a testament to the versatility of the Maker platform, where just about any asset can be considered for inclusion to provide loan collateral.

The addition of Kyber’s KNC and 0x’s ZRX comes after four days of voting on the measure, and also coincides with Kyber’s announcement of the release date for the Katalyst protocol upgrade, now scheduled for July 7, 2020.

Notably, both tokens have been added to the platform with a higher liquidation ratio (the minimum value collateral assets must make up of the total loan) than other collateral options such as Wrapped Bitcoin (WBTC) or Circle’s stablecoin USDC. The difference accounts for the relatively greater risk of drawing loans against the less established and unpegged digital assets, who’s value are likely to be more volatile.

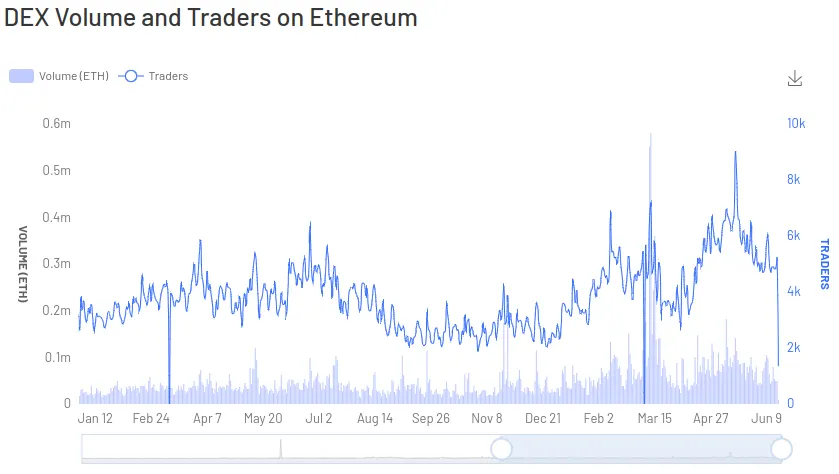

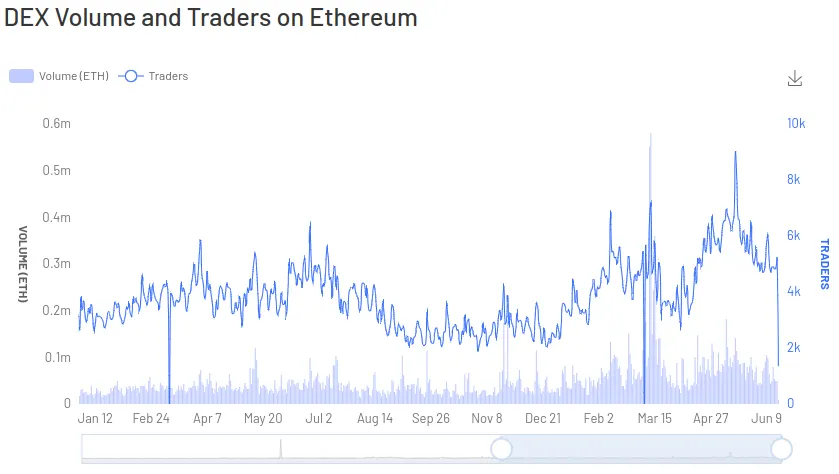

Decentralized exchange (DEX) tokens such as Kyber’s KNC have made headlines recently, offering impressive year-to-date returns compared to more well known assets like BTC or ETH. Both trading volume and the number of active traders on decentralized exchanges has been on an upward trajectory since 2019, with the greatest spike in activity occurring during the March 2020 crypto crash.

Kyber’s Katalyst upgrade is likely to bring the protocol into the spotlight and potentially increase demand for KNC tokens, as has been the case with other recent upgrades and governance token issuances from Compound and Balancer.

Katalyst will allow holders to stake KNC tokens while making it easier and more rewarding to be a liquidity provider for the network. Kyber also recently gained investment from Silicon Valley-based VC ParaFi, which purchased an undisclosed number of KNC tokens.

The addition of KNC and ZRX tokens to the Maker platform captures the essence of a number of converging DeFi trends—the slowly growing popularity of decentralized exchanges, a rapidly expanding list of recent or upcoming DeFi protocol upgrades, and ramp up of the long-awaited community control of the future of some of the most popular DeFi products through governance tokens.

It all adds up to an industry that still has some maturing to do, but could have the potential to transform finance for users around the globe.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.