In brief

We do the research, you get the alpha!

Ethereum’s DeFi boom

$76,323.00

-3.16%$2,277.98

-2.20%$1.52

-1.36%$761.72

-2.54%$1.60

-1.02%$0.999612

-0.01%$97.76

-6.45%$0.287022

1.24%$0.108406

0.70%$1.035

0.17%$52.72

2.04%$0.299474

0.05%$529.77

-0.09%$0.999567

0.02%$8.86

2.83%$33.42

-9.86%$388.90

3.17%$9.65

-0.87%$0.177396

-8.12%$0.998485

0.00%$0.177092

-0.63%$0.999834

0.01%$60.70

0.83%$280.16

-3.37%$1.085

0.15%$10.10

-0.30%$1.13

-1.70%$0.00000679

-1.44%$0.091668

-0.34%$0.136648

3.84%$5,066.11

3.28%$0.999664

0.01%$1.40

1.83%$0.083158

-0.08%$0.00914785

-0.58%$1.50

0.58%$3.92

0.31%$0.716309

-2.35%$5,095.67

3.20%$3.03

-1.51%$0.994709

0.04%$127.64

-0.48%$195.40

-0.81%$86.19

-2.69%$0.00000423

-0.08%$1.00

0.00%$1.11

-0.01%$0.00000175

0.71%$0.999578

-0.00%$1.19

-0.87%$9.74

-0.21%$1.00

0.04%$2.73

1.30%$0.062346

-0.30%$0.00240347

-4.31%$0.16082

1.10%$0.573881

-2.77%$0.284804

0.38%$0.998264

-0.07%$9.29

-1.40%$0.110738

-2.76%$0.414651

1.74%$6.03

-0.87%$8.06

-2.36%$0.140552

0.88%$0.01955551

-8.97%$2.09

4.42%$0.998694

-0.04%$67.63

-0.97%$4.23

-0.82%$1.28

0.13%$0.107767

1.66%$0.99947

0.05%$0.03302202

-0.60%$10.98

0.03%$0.00989221

-1.13%$0.04959909

2.28%$1.57

-0.90%$1.088

-0.06%$0.809426

0.88%$0.134109

-1.83%$0.00863317

1.06%$1.024

0.00%$1.31

1.91%$0.03651402

-2.25%$1.10

-0.09%$114.18

0.01%$1.24

0.07%$0.082964

2.64%$0.00000718

-0.27%$0.193078

-1.42%$0.999186

0.00%$0.996885

0.04%$0.086924

-4.70%$1.093

0.00%$0.302267

-0.68%$42.26

-4.47%$1.59

-0.11%$0.999546

0.02%$0.48182

-1.37%$0.998015

-0.03%$0.02741023

-3.79%$0.01257843

-2.84%$1.37

-1.41%$0.00756434

-1.78%$1.086

-0.13%$76,389.00

-2.78%$0.045046

1.52%$0.997413

-0.05%$0.221841

-3.75%$0.098811

-2.95%$0.649374

0.57%$1.18

0.08%$0.185489

0.47%$0.285069

-0.88%$0.998786

-0.15%$0.998993

-0.05%$163.41

3.49%$1.13

-0.00%$1.54

-11.95%$0.109703

-2.34%$1.83

-0.57%$3.67

-0.43%$0.315938

2.06%$0.04115252

-3.12%$0.061849

2.09%$0.01869703

-1.03%$0.51276

2.42%$0.419654

0.58%$20.46

7.99%$0.380485

-4.65%$0.00000035

-1.34%$0.00003536

-0.87%$0.00000034

-2.72%$89.75

4.34%$0.376035

0.02%$0.076264

2.13%$0.02995507

-1.34%$15.42

-0.92%$116.40

-0.49%$0.00614636

0.63%$0.999574

-0.01%$0.997101

-0.07%$0.056125

-1.48%$0.050993

-1.18%$0.313639

2.20%$0.056243

0.36%$0.695581

3.38%$1.00

2.67%$0.00292038

-6.38%$0.993619

0.57%$0.00275134

-0.78%$2.18

-1.83%$17.32

-2.83%$0.099869

-0.81%$1.58

-0.07%$0.147834

1.42%$13.44

-7.63%$6.86

-0.54%$1.56

2.19%$0.252688

-1.46%$0.02358937

-0.74%$0.03390511

-4.23%$2.47

-0.56%$20.81

-1.97%$3.26

-0.13%$0.998649

-0.11%$0.00477705

-0.12%$0.222033

0.01%$0.221922

0.33%$1.36

-2.55%$0.999995

0.00%$0.987442

0.00%$0.113303

-0.65%$5,749.70

-0.31%$0.999535

-0.03%$0.216304

-1.87%$1.014

-0.00%$0.00000101

-0.93%$0.096213

-5.65%$0.00003791

2.95%$0.00556213

-2.24%$1.073

0.01%$22.45

0.00%$2.62

-1.02%$0.205237

-7.90%$0.110279

-1.25%$0.00202957

-8.88%$0.01830909

1.67%$0.05161

-1.72%$20.11

-0.02%$2.42

5.37%$0.053487

4.38%$1.00

0.00%$0.123216

-2.02%$2.01

6.62%$0.681951

-3.10%$0.077756

-1.15%$0.05864

-3.40%$2,271.00

-2.01%$2.29

-0.40%$0.00000899

-0.82%$0.177656

0.19%$0.176417

-3.31%$1.013

0.04%$0.00000198

0.00%$1.90

-1.15%$0.999951

0.03%$0.912634

-6.10%$0.996949

-0.10%$2.56

0.28%$1.28

-0.02%$47.94

-0.02%$0.718742

3.17%$0.460313

-2.10%$1.00

0.00%$0.113121

-1.35%$0.994203

0.05%$0.35214

-4.04%$2,778.71

-2.57%$0.184886

-1.39%$0.33404

2.63%$0.094422

0.01%$1.23

0.58%$0.094705

-3.10%$0.254627

0.69%$0.999044

-0.09%$0.00485417

0.86%$0.295591

2.82%$5.02

4.53%$0.526999

-1.93%$0.173365

6.39%$0.141387

10.91%$0.079753

-3.73%$0.289608

3.77%$1.08

0.02%$9.15

0.20%$0.338897

-0.81%$0.00163012

-1.43%$0.637159

2.30%$1,095.22

0.07%$0.148429

1.27%$76,043.00

-2.28%$78,935.00

-2.48%$0.00260029

-0.12%$0.997644

-0.06%$0.03416608

-6.16%$2.66

1.15%

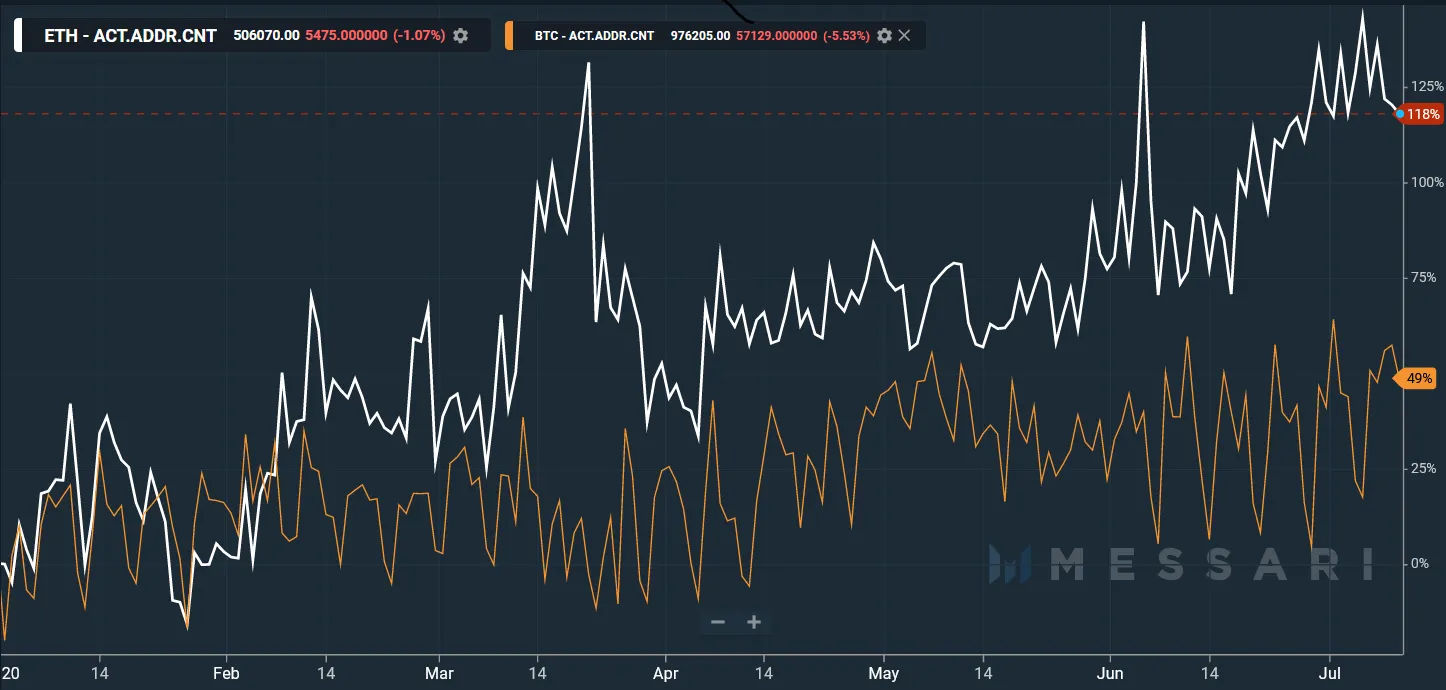

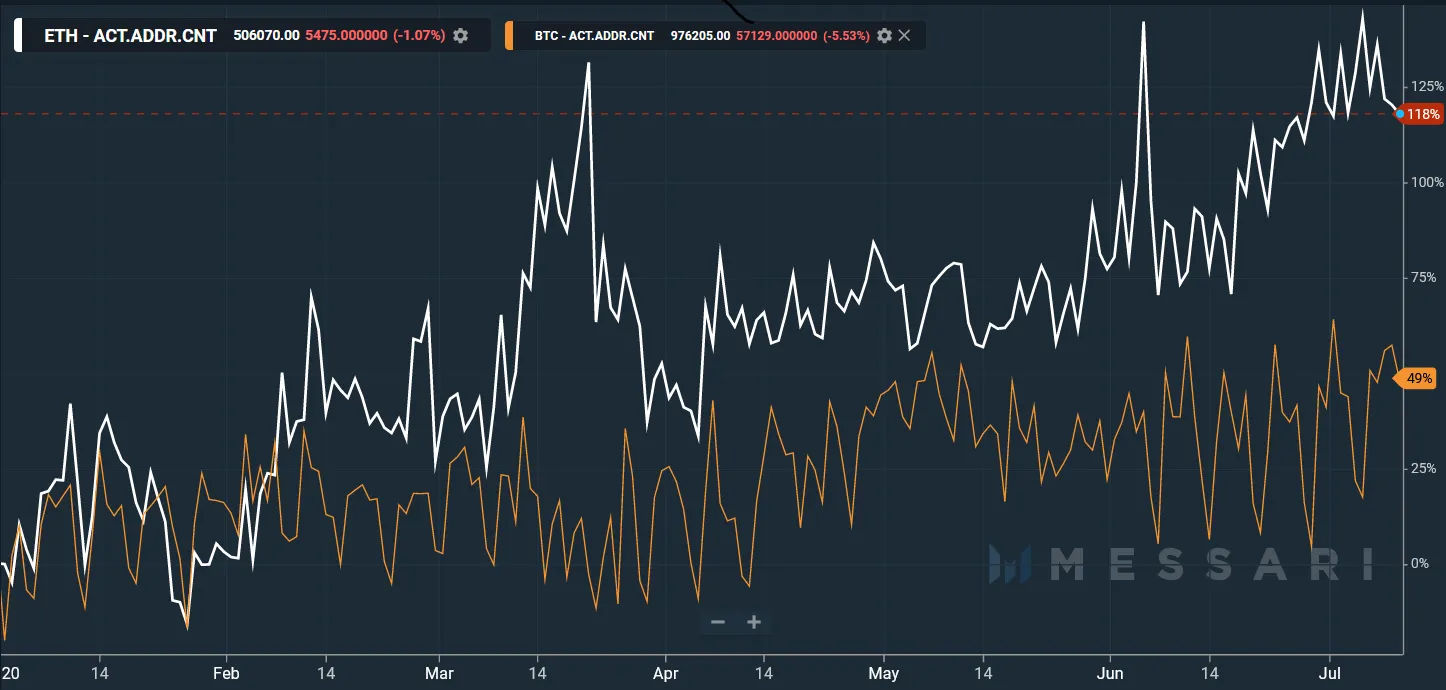

The number of active Ethereum addresses has more than doubled since the start of 2020. Ethereum's active address count is growing at nearly twice the rate of Bitcoin’s.

Data from the blockchain analytics website Messari shows that Ethereum’s active address count has increased by 118% since the turn of the year. Bitcoin’s active address count, by comparison, increased by 49%.

Why are more people turning to Ethereum than Bitcoin? One obvious answer—Ethereum is home to the top decentralized finance (DeFi) applications.

The rise of DeFi apps on Ethereum drove the blockchain’s total number of unique addresses to over 100 million by early June. A July report from Dapp.com estimated that DeFi applications accounted for over 97% of all Dapp volume on Ethereum.

The 100 million figure accounts for every unique address used in a transaction on Ethereum—both senders and recipients. This, obviously, doesn’t account for users who use multiple addresses, and so doesn’t entirely reflect the growth of Ethereum’s user base.

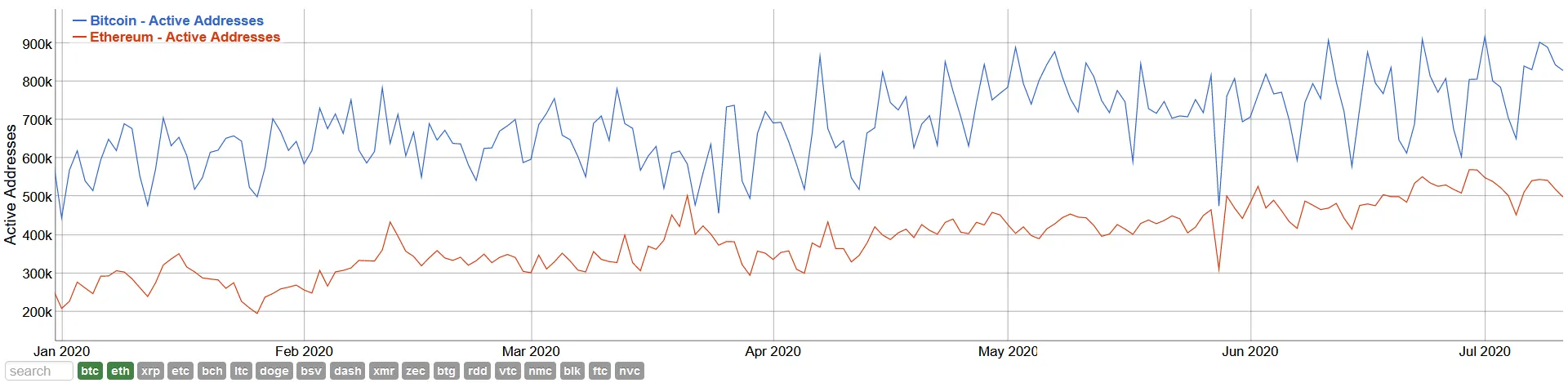

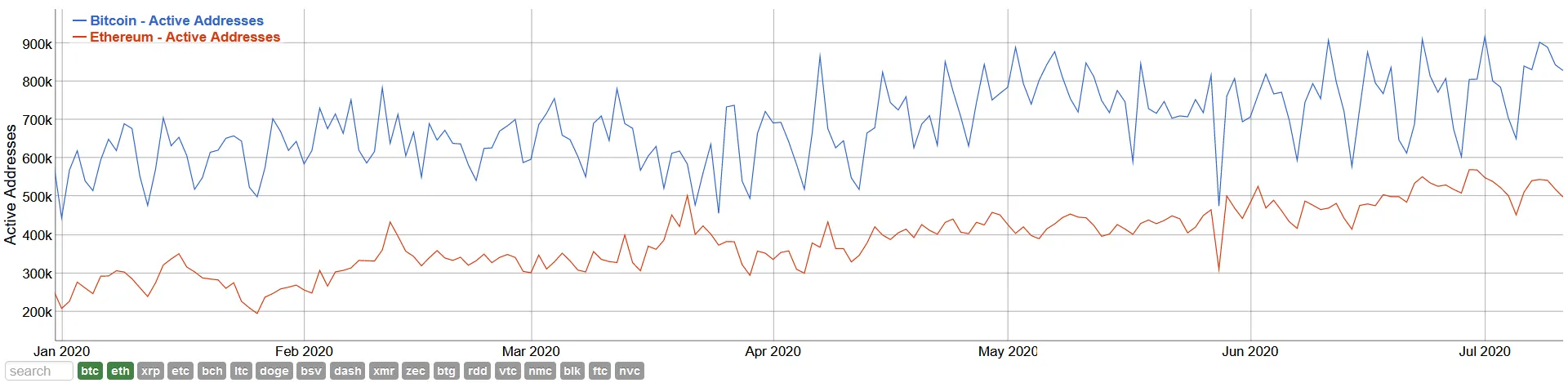

However, data from Bitinfocharts tracks transactions that go either from or to unique Ethereum addresses. Seen below, unique active Ethereum addresses rose 160% since January 1, climbing from 208,392, to 542,458 at time of writing.

Meanwhile, Bitcoin’s unique active address count rose 42% in the same time, climbing from 585,047 on January 1 to 832,751 by July 10. This aligns closely with the data from Messari, and lends credence to the notion that Ethereum is currently experiencing a groundswell of renewed interest and activity.

But while the rise of DeFi has undoubtedly contributed to the rise in unique Ethereum addresses, another Ethereum-based Dapp could also be playing a major role.

As reported by Decrypt on July 5, Forsage, the most popular Dapp on activity by user count, was responsible for guzzling almost 13% of Ethereum’s gas. Gas is the “fuel” that runs Ethereum, and is used as a measurement of the price of performing computations on the network.

That means Forsage—which the Philippines SEC has denounced as an unregistered security—is hogging 13% of the entire Ethereum blockchain. The presence of a Russian Ponzi scheme known as MMM Global has also contributed to the hoarding of Ethereum’s computational power in recent times. These operations usually see funds transferred from address to address, adding to Ethereum’s total unique address count.

Today, Forsage accounts for 12.5% of Ethereum’s gas usage, according to Dune Analytics, while ETH Gas Station places the figure at 15.8%.

Either way, the presence of what Ethereum researcher and developer Philippe Castonguay told Decrypt were “inevitable and unstoppable” Ponzi schemes should also be considered when accounting for Ethereum’s increased usage.