In brief

We do the research, you get the alpha!

Bitcoin volatility a concern

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$68,180.00

6.22%$2,057.57

10.97%$1.62

30.21%$1.44

6.51%$629.58

7.84%$0.999899

-0.01%$88.60

11.87%$0.285887

0.68%$0.100377

10.04%$1.031

-0.25%$0.295468

14.03%$50.96

5.95%$0.999908

-0.01%$493.91

0.48%$8.76

1.93%$28.40

3.94%$9.24

12.33%$347.80

6.99%$0.168288

4.33%$0.999419

0.02%$0.16288

8.55%$0.999448

-0.04%$0.00958487

3.24%$0.101311

6.29%$56.63

10.32%$0.9999

-0.01%$9.53

14.64%$245.60

1.21%$0.965579

11.91%$0.00000621

4.88%$0.078575

5.84%$0.116

3.53%$1.27

-0.99%$5,161.54

0.46%$4.02

20.07%$5,196.94

0.49%$1.32

-6.53%$0.6218

4.95%$1.00

0.00%$119.53

4.55%$1.12

-0.00%$0.997335

-0.04%$0.00000413

4.17%$180.17

8.03%$0.704431

1.39%$77.32

4.52%$1.00

0.02%$0.069044

4.34%$2.26

2.79%$0.999813

-0.00%$0.167532

3.23%$0.00000165

0.03%$1.16

19.95%$9.15

10.28%$0.274797

11.45%$2.41

14.07%$0.999485

-0.03%$0.113029

0.87%$0.411283

9.06%$11.00

0.01%$8.71

4.02%$7.12

4.78%$0.00190014

11.36%$0.059806

5.35%$0.01762879

9.60%$1.95

-2.92%$64.64

4.09%$0.108411

10.83%$0.870222

6.45%$1.002

0.19%$0.03097616

5.98%$0.0097333

6.40%$3.51

4.35%$0.090754

8.42%$1.03

16.74%$1.48

9.78%$1.24

0.32%$0.978958

18.16%$1.00

0.04%$114.41

0.01%$0.736605

-8.27%$1.027

0.00%$1.12

1.10%$0.03434044

2.81%$0.00777029

9.13%$1.84

7.10%$0.080792

0.78%$0.098969

7.15%$0.03164735

9.07%$1.096

0.01%$0.00000644

12.34%$0.161769

11.58%$1.00

0.36%$1.00

0.01%$0.283464

8.95%$0.01296529

3.41%$28.81

1.51%$0.999623

0.02%$0.264084

11.47%$0.071431

7.96%$1.087

-0.02%$0.999828

-0.02%$1.18

0.36%$0.00723944

12.30%$0.693097

14.65%$34.87

7.50%$1.33

10.53%$0.396355

7.80%$0.04519594

-1.73%$166.26

0.40%$0.519789

4.78%$1.00

0.04%$0.166711

9.09%$0.252687

11.94%$0.085356

9.42%$1.058

3.03%$1.48

2.66%$0.03509885

4.77%$0.999741

-0.01%$130.01

8.68%$0.367743

9.60%$1.019

-0.13%$0.00000034

4.19%$0.057427

8.03%$0.00000033

0.63%$16.44

5.49%$3.23

3.47%$0.01645764

-0.01%$3.21

1.43%$0.053928

7.23%$1.51

0.09%$0.345563

14.95%$0.070564

7.40%$0.02762835

7.43%$0.314769

10.21%$0.00003023

8.15%$0.999669

0.42%$0.00586503

5.54%$0.326169

8.47%$0.995606

0.37%$0.236549

11.46%$17.35

1.53%$0.051503

6.80%$1.41

-2.05%$0.075515

8.53%$0.12353

4.56%$0.35774

10.36%$1.60

-1.86%$0.00272753

8.31%$6.59

9.71%$0.00248694

0.02%$0.04429219

6.25%$0.132261

-8.86%$0.02166586

7.33%$0.087349

11.74%$1.001

0.20%$1.36

7.63%$0.101815

16.87%$1.79

6.13%$1.00

0.00%$0.985704

-0.29%$1.00

0.01%$0.215518

9.66%$0.00219206

4.19%$1.075

0.01%$1.29

8.50%$0.509446

2.22%$22.79

0.00%$0.00000097

1.81%$0.097985

0.03%$0.00003646

4.89%$0.198652

10.03%$5,241.23

-6.32%$2.79

7.23%$0.94638

48.34%$0.099755

10.93%$0.196646

2.11%$0.05356

3.89%$1.00

0.00%$0.18882

7.44%$0.00502505

7.19%$0.079851

0.39%$0.122825

4.34%$0.01990192

1.52%$0.0038494

9.98%$9.24

7.47%$0.801307

3.45%$1.00

0.00%$18.50

3.67%$1.91

10.69%$0.054965

8.78%$3.89

5.40%$1.001

0.06%$0.635954

8.70%$2.10

1.55%$2.14

9.60%$1.81

1.24%$0.166224

10.70%$0.02011426

1.34%$0.02254714

-3.39%$48.01

0.01%$3.44

3.22%$0.04242153

7.85%$0.00000796

6.38%$0.9948

-0.10%$1.26

1.08%$0.15005

2.67%$0.995527

-0.54%$0.331286

8.38%$0.998368

0.00%$0.173375

9.09%$0.414013

6.44%$1.012

-0.25%$0.306715

0.31%$0.664708

1.98%$0.096255

9.84%$0.08302

6.27%$4.59

7.27%$0.133787

6.46%$0.26457

5.63%$0.131763

7.38%$0.614787

4.62%$1,096.75

-0.08%$0.293801

5.48%$0.08028

10.01%$0.073608

-1.46%$0.313879

-1.80%$0.367244

-0.19%$0.00150125

4.11%$0.02216037

-15.91%$0.254441

3.16%$0.00404528

3.39%$0.995596

0.08%$11.19

1.74%$0.218355

2.10%$0.12883

-1.18%$1.001

0.00%$2.40

8.01%$0.195982

2.44%$0.344516

4.56%$1.48

3.84%$1.75

-5.77%$11.92

6.15%$0.999736

-0.03%$1.064

0.13%$0.549286

10.62%$0.999669

-0.02%$0.997291

-3.01%

Over 85% of institutional investors holding Bitcoin and other cryptocurrencies plan to increase their allocation to the asset class over the next two years, a recent survey found.

The survey, shared with Decrypt by London-based crypto fund Nickel Digital Asset Management, recorded the answers in January 2021 of 50 wealth managers and 50 institutional investors—with a collective $110 billion under management—based in Germany, Switzerland, the US, and the UK.

A majority of the surveyed investors said that they expect Bitcoin and other cryptocurrencies to grow significantly in valuation over the next few years. 21% of investors said Bitcoin would continue to rise dramatically in 2021, while 56% said it would increase only slightly.

The opportunity for higher returns through investing in Bitcoin was a key factor for respondents; 40% considered Bitcoin as a hedge against widespread inflation and even currency debasement, a view that has gained popularity in recent times.

“There is also growing optimism about the sector’s infrastructure improving, and this too will result in more mainstream investors entering this market,” added Anatoly Crachilov, co-founder and CEO of Nickel Digital, in a press release.

Crachilov cautioned that Bitcoin’s infamous volatility would likely continue, but that such behavior is expected for a new technology in the early stage of its adoption curve. “The price action for such assets is never meant to be a straight line,” he said.

“Only professional investors with a long-term view on the underlying technology should have exposure to this asset class,” Crachilov said, adding they would also need “high-risk tolerance levels.”

The comment is not far-fetched: Bitcoin traded under $4,000 in May 2020, but trades hands at over $55,000 as of today, making it one of the most volatile financial instruments currently available on the market.

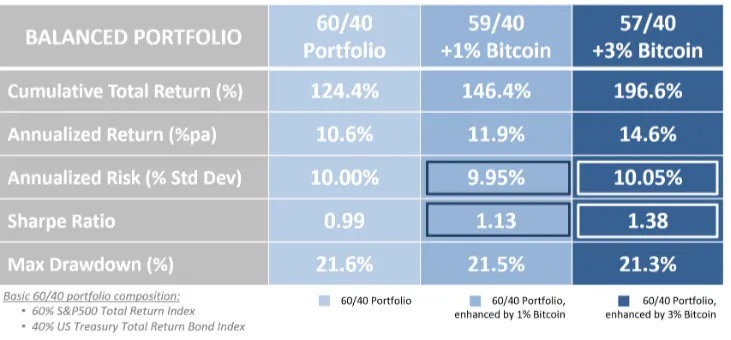

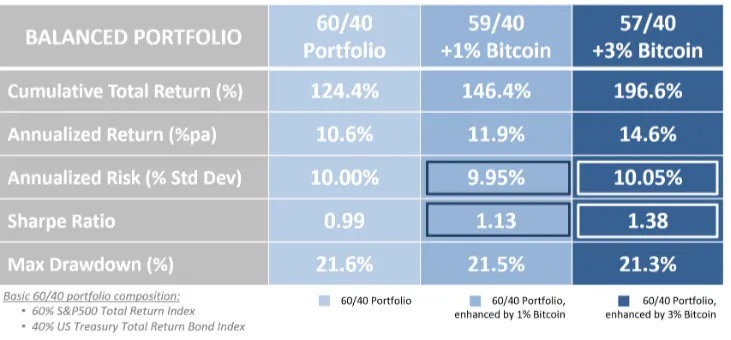

But for Nickel, Bitcoin remains an opportunity. The fund said a 1% allocation to Bitcoin within a well-diversified portfolio over an eight-year period (Dec 2012—Dec 2020) showed the asset worked as an uncorrelated, diversified instrument, as part of a bigger portfolio.

“Such allocation offered an important return contribution, without imposing a negative impact on the risk characteristics,” the fund concluded.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.