We do the research, you get the alpha!

Unpacking the Otherdeed minting frenzy

Thanks for burning over 55,000 ETH in 24 hours apes! pic.twitter.com/85HJ6nAl1Z

— sassal.eth 🦇🔊🐼 (@sassal0x) May 1, 2022

What is ‘burned’ Ethereum?

$68,027.00

6.33%$2,062.42

11.58%$1.63

31.66%$1.43

6.40%$630.89

8.10%$1.00

0.01%$88.35

11.95%$0.285122

0.36%$0.100743

10.32%$1.031

-0.25%$0.298357

15.51%$50.81

5.71%$0.999949

-0.01%$493.12

1.71%$8.77

2.14%$27.85

2.58%$9.27

13.20%$0.169032

5.90%$345.59

7.21%$0.999352

-0.04%$0.16265

8.74%$0.999052

-0.09%$0.00948548

2.15%$0.101716

7.08%$56.79

11.07%$0.999795

-0.04%$9.56

15.49%$244.61

0.82%$0.968864

12.88%$0.00000623

5.56%$0.078493

6.12%$0.116333

4.57%$1.28

-0.30%$5,140.04

0.21%$4.04

20.98%$5,174.52

0.22%$1.31

-7.74%$0.622418

5.20%$1.00

0.00%$1.12

0.01%$119.38

4.59%$0.997507

-0.02%$0.00000414

4.94%$0.70683

2.00%$180.30

8.60%$1.00

0.00%$77.34

4.67%$0.068992

4.54%$2.26

2.74%$0.999848

0.01%$0.16834

3.26%$1.18

21.83%$0.00000165

0.10%$9.19

10.64%$0.27605

12.06%$2.42

14.11%$0.999344

-0.05%$0.113757

0.75%$0.414553

10.35%$11.00

0.01%$8.68

3.97%$7.14

5.08%$0.00187641

10.78%$0.060017

6.08%$0.01757124

8.91%$1.94

-2.81%$64.89

4.82%$0.109142

11.52%$0.873584

6.84%$1.00

0.04%$0.03096127

6.37%$0.00971562

6.23%$3.53

5.23%$0.091024

8.91%$1.061

20.57%$0.996915

21.07%$1.49

10.37%$1.24

0.33%$1.00

0.03%$114.41

0.01%$0.743585

-7.44%$1.027

0.00%$1.12

1.09%$0.03442578

3.09%$0.00784279

10.33%$1.83

7.00%$0.080984

1.12%$0.100412

8.88%$1.096

0.01%$0.03155898

8.16%$0.00000642

12.07%$0.998867

0.03%$1.00

0.00%$0.160658

10.76%$0.01299894

3.67%$0.282121

9.40%$28.74

1.22%$0.999945

0.09%$0.264827

11.45%$0.071237

8.23%$1.087

-0.03%$0.999968

-0.01%$1.18

0.33%$0.69376

14.59%$0.007241

12.37%$34.88

7.76%$1.33

10.88%$0.395799

7.86%$166.12

0.32%$0.0446501

-2.92%$1.001

0.04%$0.519144

4.61%$0.167124

9.40%$0.253688

12.63%$1.056

3.16%$0.084737

8.39%$1.46

1.92%$0.03539207

6.05%$0.999842

-0.00%$129.96

8.56%$0.058175

9.43%$0.367498

8.43%$1.019

-0.10%$0.00000034

4.20%$0.00000033

0.55%$16.48

5.94%$3.25

3.84%$0.01647052

0.09%$3.20

1.35%$0.349247

16.34%$0.054069

7.60%$1.52

-0.22%$0.070969

7.84%$0.02786503

8.57%$0.31747

11.14%$0.00003032

8.66%$1.003

0.78%$0.00587145

5.98%$0.327182

9.42%$0.994545

0.27%$17.53

2.83%$0.232794

10.33%$0.051844

7.69%$0.123956

5.23%$0.075914

9.06%$1.40

-3.36%$1.60

-1.60%$0.00272194

8.25%$0.35113

7.24%$6.62

10.18%$0.00248789

0.11%$0.04446313

6.79%$0.132403

-8.77%$0.088261

13.33%$1.37

9.34%$0.02153552

6.90%$0.10336

18.76%$0.998376

-0.13%$1.79

6.06%$1.00

0.00%$0.985671

-0.29%$1.00

0.01%$1.075

0.01%$0.214731

10.43%$0.510444

2.33%$0.0021627

2.86%$1.29

8.52%$22.79

0.00%$0.00000096

0.74%$0.097994

-0.31%$0.00003669

5.43%$0.199234

10.65%$5,236.23

-6.17%$2.81

7.67%$0.892363

23.76%$0.100042

11.46%$0.053559

3.91%$0.196255

2.99%$0.190176

8.82%$1.00

0.00%$0.079904

0.46%$0.00502545

6.61%$0.829288

6.89%$0.123281

5.17%$0.00387293

10.98%$0.01994396

4.04%$9.35

7.86%$18.57

4.49%$1.00

0.00%$1.92

10.85%$3.88

6.93%$0.638867

9.00%$0.999766

-0.00%$0.054818

8.98%$2.10

1.70%$2.15

9.64%$3.57

7.95%$1.81

1.16%$0.166167

10.71%$0.02269142

-1.23%$48.01

0.01%$0.04266687

9.12%$0.02007931

1.14%$0.00000798

6.70%$0.994774

-0.10%$1.26

0.77%$0.150502

1.98%$0.999541

0.01%$0.330833

8.40%$0.998319

-0.02%$0.174169

9.67%$0.414152

6.66%$1.012

-0.10%$0.307551

0.79%$0.661697

2.17%$0.096557

10.24%$4.61

8.17%$0.083315

6.86%$0.621039

4.90%$0.133323

6.16%$0.263486

5.10%$0.131375

5.01%$1,096.94

-0.09%$0.294488

5.70%$0.02249802

-14.75%$0.073775

-0.90%$0.080562

10.63%$0.312731

-2.30%$0.00149726

4.02%$0.254755

2.42%$0.365454

1.00%$11.14

-2.45%$0.00403954

3.66%$0.995751

0.10%$0.218026

2.32%$0.129042

-0.91%$1.001

0.00%$2.41

8.71%$0.1971

2.75%$1.49

5.63%$0.344609

4.61%$1.78

-4.18%$12.06

8.58%$1.00

0.03%$0.999889

0.01%$1.062

-0.04%$0.999949

0.01%$1.001

1.60%

The mad rush to buy Otherdeed NFTs over the weekend spiked gas fees on the number two crypto network, and burned 55,843 Ethereum in the process, worth approximately $157 million, making it the sixth-largest source of burned ETH ever.

Saturday’s minting event managed to top the all-time burns of OpenSea's exchange contract, the largest NFT marketplace; a Uniswap V3 router, the largest decentralized crypto exchange by volume; and MetaMask, one of the most popular Ethereum software wallets.

As of Monday morning, Otherdeed still held the 30-day top spot on the Ultra Sound Money leaderboard.

The Otherdeed NFTs that caused fees to skyrocket over the weekend are required to buy plots of land in Yuga Labs’ Otherside metaverse project, an extension of the wildly popular Bored Ape Yacht Club (BAYC) collection.

All blockchain transactions require gas, or fees, to be validated and added to the distributed ledger that underpins a blockchain.

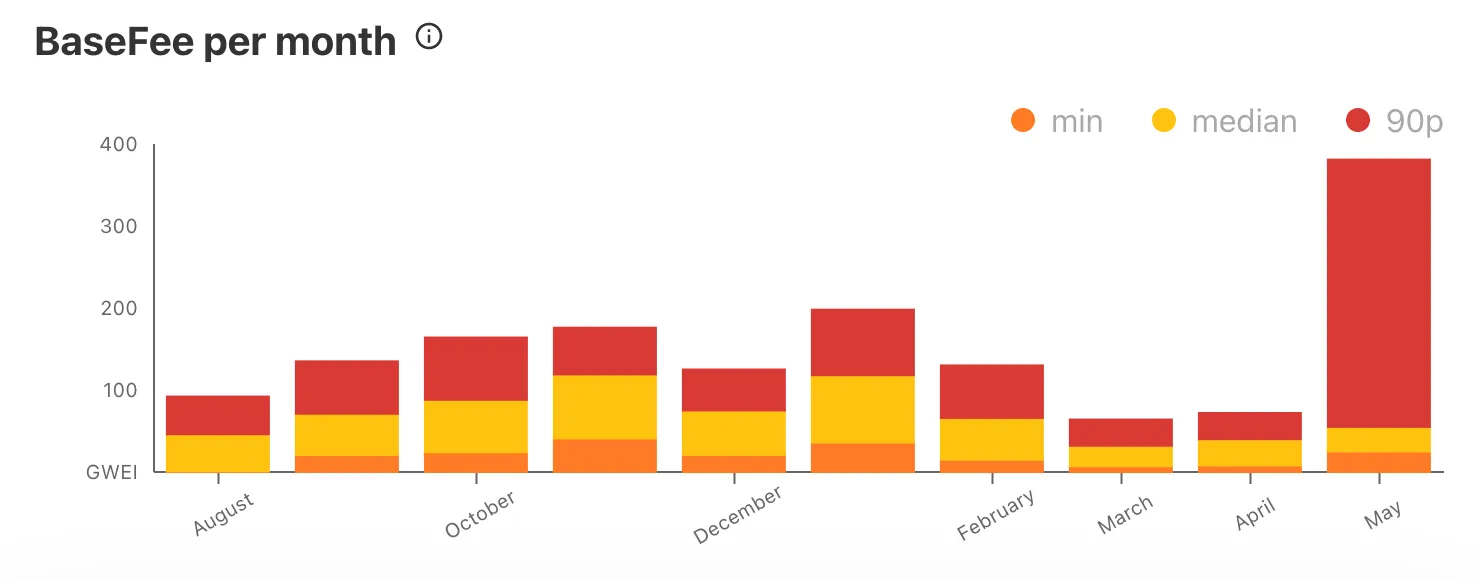

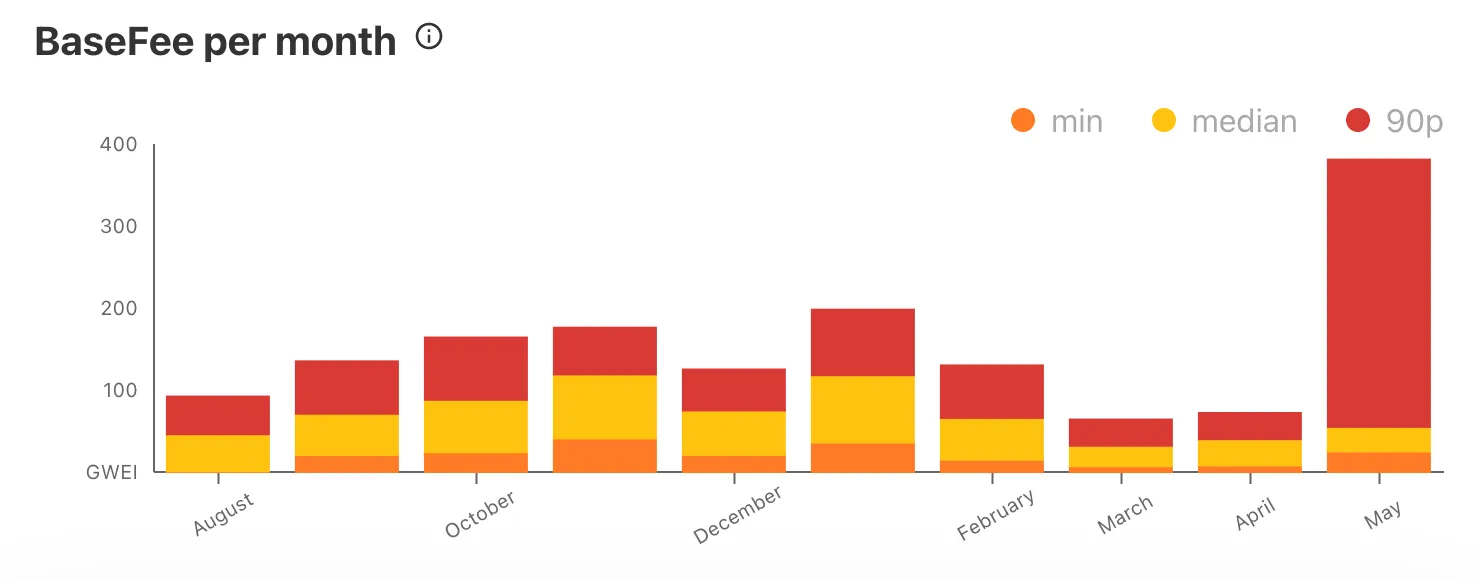

For every Ethereum transaction, there’s a base fee that’s always paid. When the network is particularly busy or when a user wants to expedite a transaction, the fees can vary by a large margin.

As the Otherdeed NFTs were minted, people started paying more in gas fees to bump their transactions to the front of the line.

Thanks for burning over 55,000 ETH in 24 hours apes! pic.twitter.com/85HJ6nAl1Z

— sassal.eth 🦇🔊🐼 (@sassal0x) May 1, 2022

That clogged the Ethereum mainnet, making it both slow and incredibly expensive to complete transactions on Saturday night. But Otherdeed buyers with the means to do so paid extra gas fees to get their transactions processed faster.

In one specific example, an interested buyer spent more than $14,000 in Ethereum gas to mint just two of the Otherdeed NFTs.

The burn mechanism, introduced by EIP-1559 last August, takes base fees generated by Ethereum transactions out of circulation by sending them to a defunct wallet address rather than paying them to Ethereum miners for validating transactions.

It’s meant to help the network transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus model, a more energy-efficient algorithm that requires less actual compute power. Granted, the transition has lasted a lot longer than originally planned.

When it was launched last year, EIP-1559 was expected to take about $30 million worth of Ethereum (or about 10,630 ETH) out of circulation per day.

However, the Overdeed minting event took far more than that out of circulation.

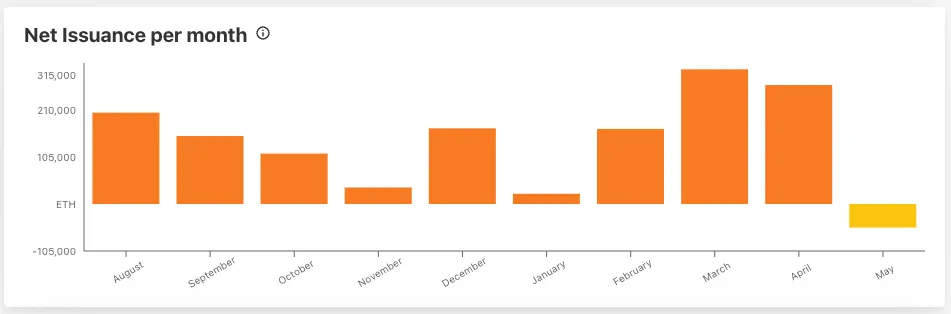

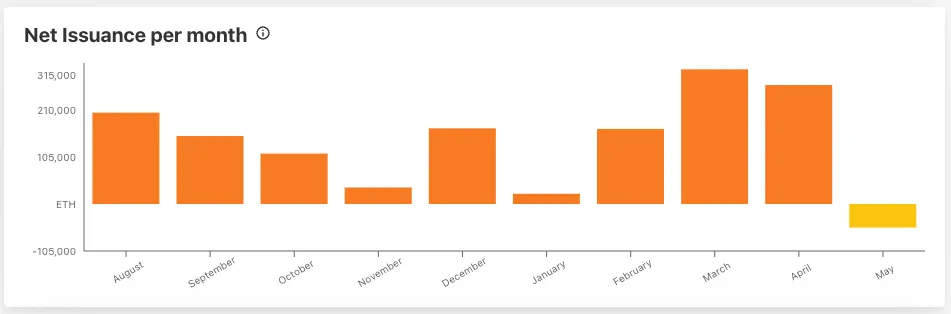

As it stands now, the network’s net issuance (the amount of Ethereum created minus the amount burned) is negative 52,899 ETH.

This effectively means that the Ethereum network has undergone a massive deflationary shock, providing another example of the popular meme “ultra-sound money.”

This weekend’s activity also means that May has already seen the highest base fees since the burn started last August on only the second day of the month.

Since it began, 2.3 million ETH, worth approximately $6.3 billion, has been burned. According to the Watch the Burn dashboard, that’s resulted in a 62% net reduction of ETH in circulation.