Blockchain Interoperability and the Bridging Process

Before we explain how to bridge crypto on MetaMask Portfolio, it’s worth examining (or reexamining) the reason that bridging is becoming a common process within the crypto ecosystem. Essentially, bridging is one solution that is ameliorating the issue of disparate and isolated blockchain ecosystems. Blockchains may be great at what they were designed to do, but most had the inability to interact with other blockchain ecosystems. For this reason, they are often called “siloed blockchains” as they can’t communicate with other protocols.

For example, it isn’t possible to send native bitcoin (BTC) to the Ethereum blockchain. However, through a process known as wrapping, wrapped BTC (wBTC) can be used as collateral within Ethereum’s expansive DeFi ecosystem. Bridging accomplishes this interoperability via a similar process. Both bridging and wrapping are helping to connect blockchain ecosystems and their associated cryptos. Called blockchain interoperability, this functionality is something that is continuing to improve as the wider blockchain ecosystem leverages the benefits of interconnected blockchain protocols.

Benefits of Bridging To and From Ethereum

Ethereum is known as the global super computer and uses what is known as the Ethereum Virtual Machine (EVM). As perhaps the most popular blockchain within DeFi, many subsequent blockchains were designed from inception to interact with Ethereum. Commonly referred to as EVM-compatible blockchains, these protocols have the potential to interact with Ethereum more easily due to the design similarities inherent within their protocols.

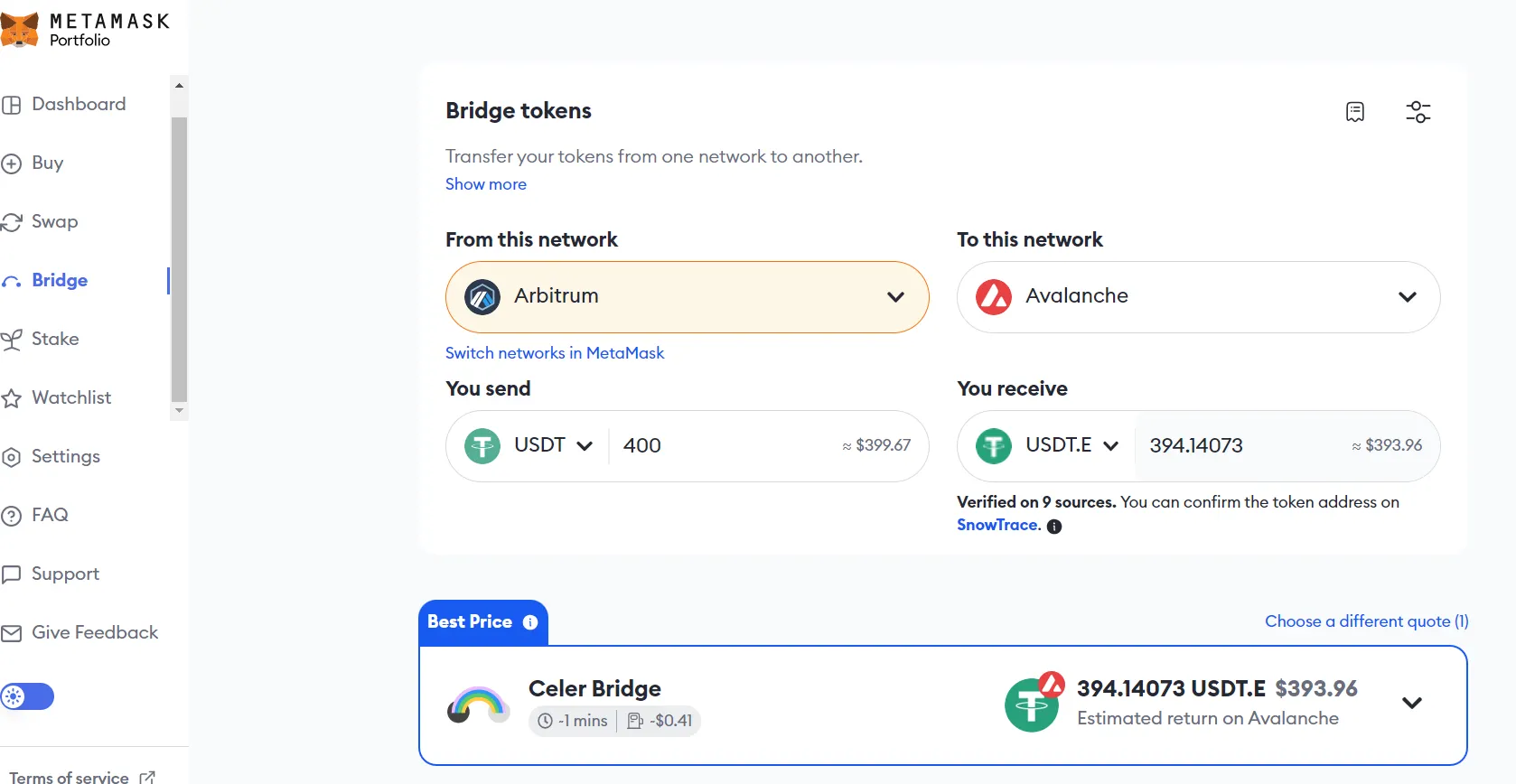

Via bridging, the tokens remain, but the blockchain changes. There are a few reasons you may want to bridge some — or all — of a crypto from one blockchain to another. First, you may want to purchase or acquire a niche crypto asset that is only available on that specific blockchain. Another common reason is that the fees for swaps and smart contract execution can vary between blockchains (as seen below in the USDT bridging quotes).

MetaMask’s Bridging Process

In our buy tutorial from two articles ago, our example was a fiat-to-crypto buy on MetaMask where we ended up purchasing $1,000 USD worth of ether (ETH) on the Ethereum protocol. In the previous article, we used this ETH to execute swap transactions that diversified our portfolio into ETH, wBTC, and APE. Let’s instead use our ETH to execute a bridge transaction in lieu of the aforementioned swapping examples.

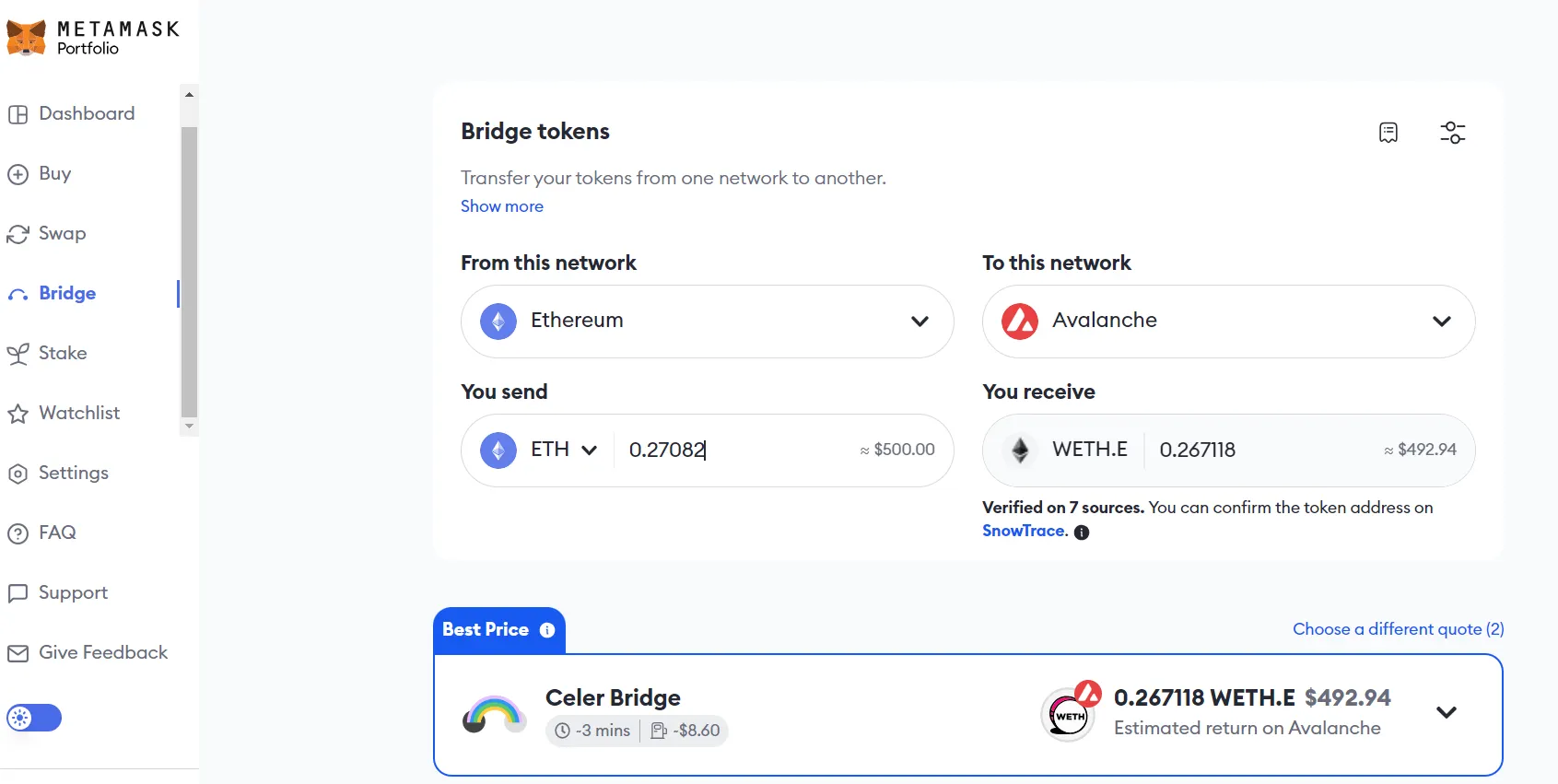

In our bridging scenario, we want to bridge some of our example ETH-only holdings to the Avalanche protocol in order to execute a swap to acquire its AVAX token (because it isn’t found on Ethereum). While our tokens will still be ETH, they will have been bridged (or transferred) to an entirely new blockchain.

The process is as follows:

Step 1: Select Bridge from the homescreen of MetaMask Portfolio.

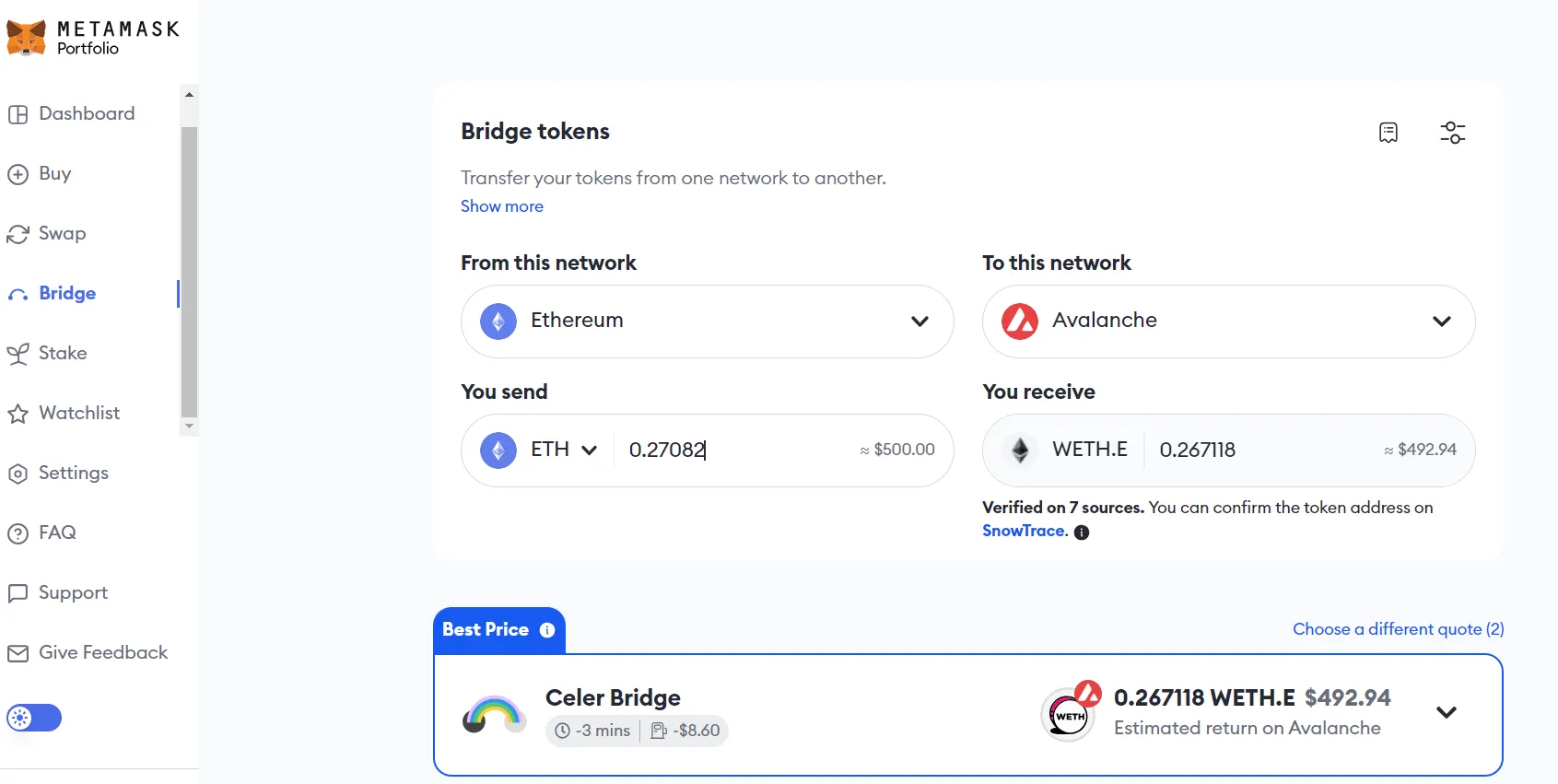

Step 2: Select the blockchain you’re bridging from and bridging to (the blockchain you are leaving and then going to). Then, select the token to be bridged and the amount. In this case, we’re bridging half of our ETH ($500) from Ethereum to Avalanche.

Step 3: Once you are happy with the quoted price and you have checked that the details you have inputted are correct, you can hit “Confirm” to execute the bridging transaction. You now have sent your ETH to Avalanche for WETH.E (ETH that is now located on the Avalanche protocol).

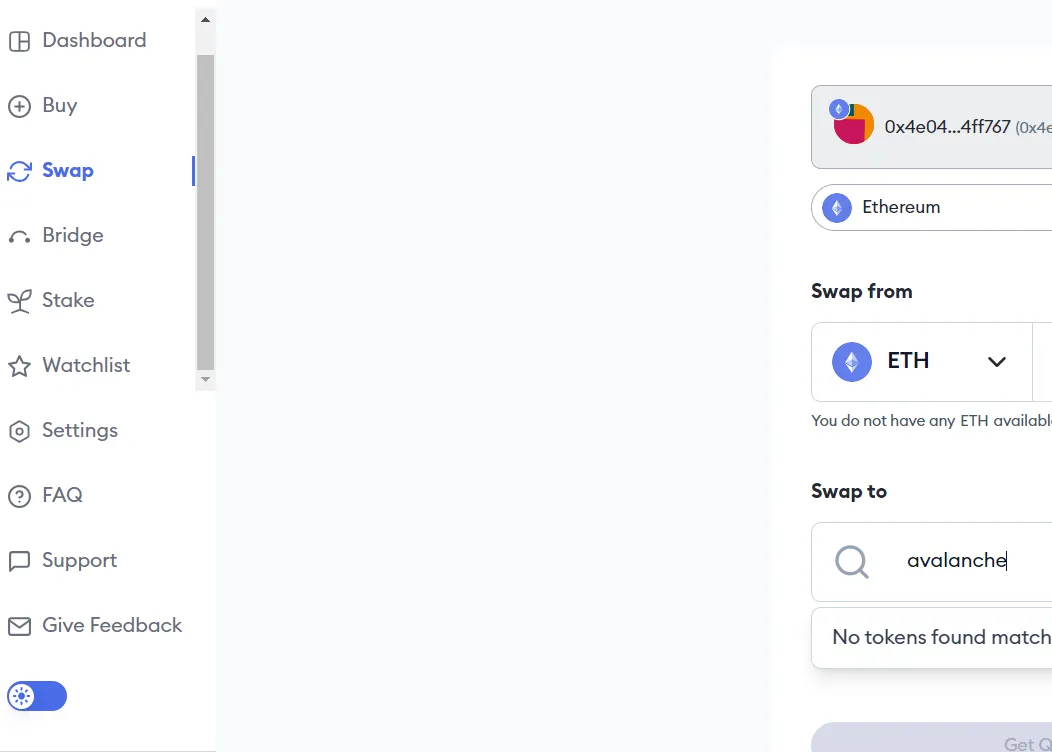

Step 4: Now, you can go back to the Buy option and convert half of this WETH.E for AVAX. You now have AVAX (on Avalanche) as well as ETH on two separate blockchains (Ethereum and Avalanche).

Step 5: Please note that in this example, we couldn’t go straight to an ETH-for-AVAX swap transaction. This is because AVAX is not available on Ethereum. Therefore, we first needed to execute a bridge that sent some ETH to Avalanche in order to execute a swap on the Avalanche protocol. For other crypto swaps, bridging may not be necessary — provided they can both be found on the same blockchain protocol.

Step 6: Like the ability to swap back tokens, you also have the ability to bridge your tokens back to their original chain (again, minus fees that will lower your balance). If you want to have all your ETH back on Ethereum, you can simply bridge the ETH that was originally bridged to Avalanche right back where it was before (on the Ethereum blockchain).

Step 7: In this scenario, you’d now be left with just two token balances. You’d have AVAX on Avalanche and ETH on Ethereum.

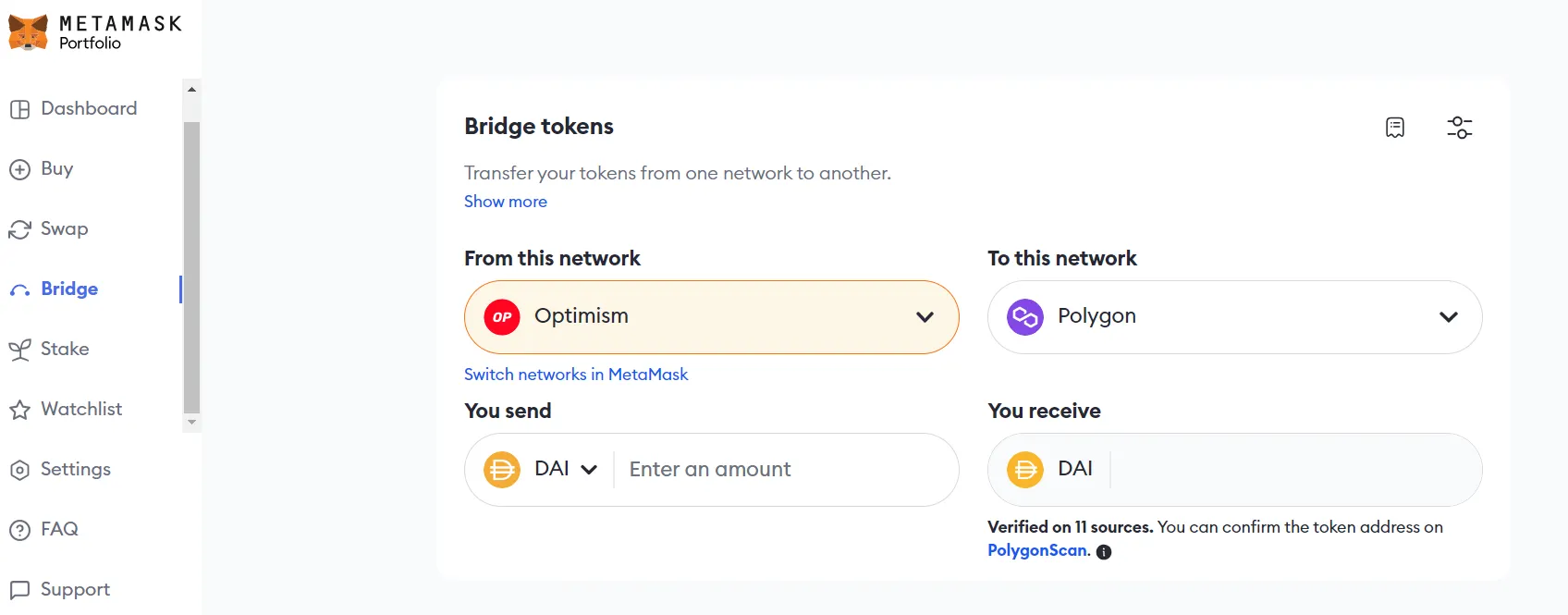

At the time of writing, MetaMask Portfolio allows you to bridge between six different protocols (Arbitrum, Avalanche, BNB Chain, Ethereum, Optimism, and Polygon) using a host of different tokens. It is expected that more bridging destinations (new EVM-compatible blockchains) and token options will be added as Metamask Portfolio continues to adapt to the ever-changing crypto ecosystem. In the final article of our MetaMask Portfolio breakdown, we’re going to cover the staking processes and options that are available to MetaMask users.

Cheat Sheet:

- Bridging allows you to send tokens from one blockchain protocol to another.

- Bridging tokens may allow you to swap them for niche assets; bridged tokens may also be cheaper to use after being bridged to a lower-cost blockchain.

- MetaMask Portfolio allows you to bridge between Ethereum and five additional EVM-compatible blockchains.

- Bridging processes are reversible. You can bridge your tokens back to their original chain — or bridge them to alternative compatible protocols at any time.