Why Stake Your Cryptocurrency?

Before we break down the process for staking crypto through MetaMask Portfolio, it’s worth understanding what Proof of Stake (PoS) is, how it differs from Proof of Work (PoW), and why people may want to stake some of their crypto holdings that are found on these PoS networks.

Bitcoin uses a PoW consensus mechanism to secure its network. With PoW, crypto miners use electricity and efficient hardware to try to solve the cryptographic puzzle that will provide them with mining rewards in bitcoin (BTC). This cryptoeconomic incentive has made Bitcoin arguably the most secure network in the world.

However, other protocols chose a different security apparatus called PoS for their consensus mechanism (how they secure their network). With PoS, crypto holders can stake or delegate their crypto stake in order to secure a blockchain network. You can stake with a staking pool or validator in order to earn staking rewards — the PoS equivalent to mining rewards. One benefit of PoS networks is that they tend to be far more energy efficient.

From the crypto staker’s viewpoint, the primary benefit is that you can earn staking rewards over time. Popular PoS networks include Polygon, Cardano, and Ethereum (which originally started with PoW before upgrading to PoS). Staking rewards can vary widely from 1–20%+ and also get adjusted periodically. For most major PoS chains, rewards tend to hover from 3–7%. These awards are calculated on an annual basis. Further, your staking rewards are typically denominated in the crypto you are staking. If you are staking Ethereum’s ether (ETH), you’ll receive additional ETH as your staking reward. The same receive-what-you-stake reward structure holds true for staking Polygon’s MATIC, Cardano’s ADA, and a host of other crypto staking options.

The other benefit is that you are also supporting the security of the blockchain you are staking on (although this may depend on the network and your staking method). Like an increase in miners (or their computing power) increases the security of Bitcoin and other PoW networks, an increase in stakers (or staking pools or staking validators) should increase the protocol security of PoS networks.

How to Stake Crypto Using MetaMask Portfolio

At the time of writing, MetaMask Portfolio users in the USA can only stake ETH. Users in other countries may have the option to stake additional cryptos (such as MATIC). Now that you understand the PoS basics, let’s run through the straightforward process for staking ETH via MetaMask Portfolio. We’re going to assume that you already have a passing familiarity with MetaMask Portfolio, so let’s get your staking journey started!

Step 1: First, you’re going to need some ETH (if you have some, please skip to step 2). If you need some ETH to stake, you can exchange some of your existing crypto for ETH using MetaMask Portfolio’s Swap feature. You can also buy ETH with fiat currency using the Buy functionality.

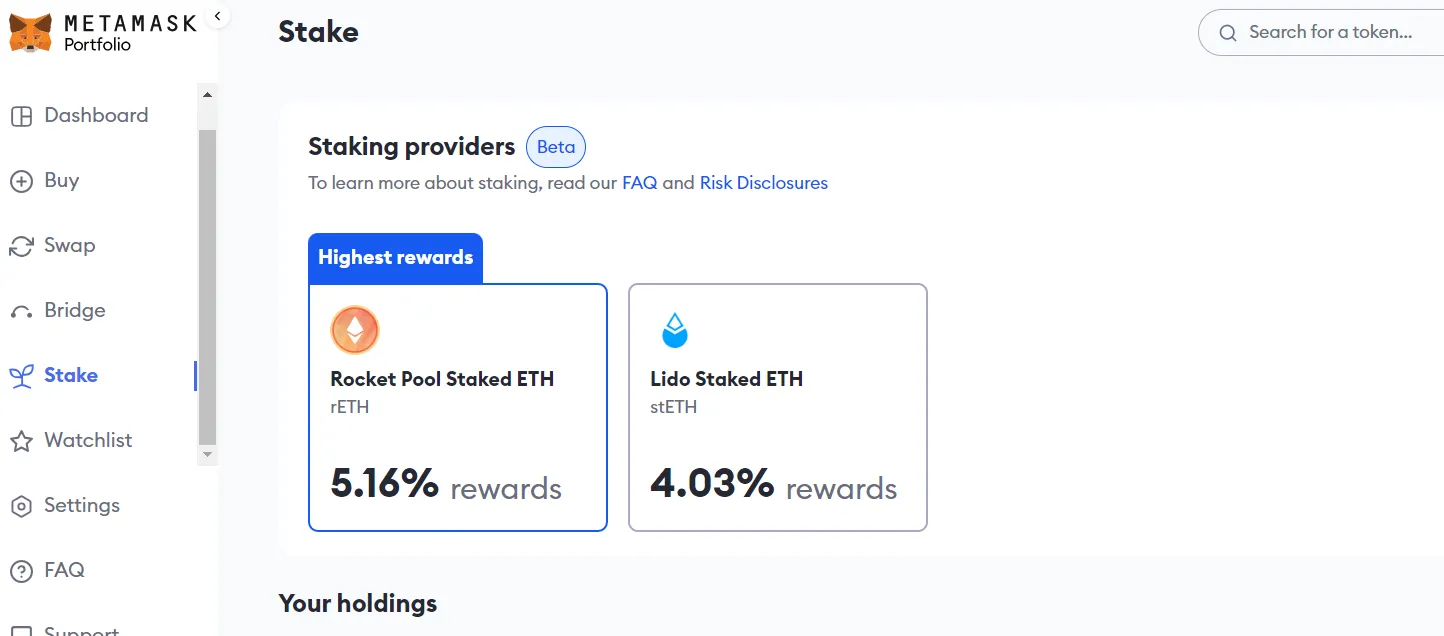

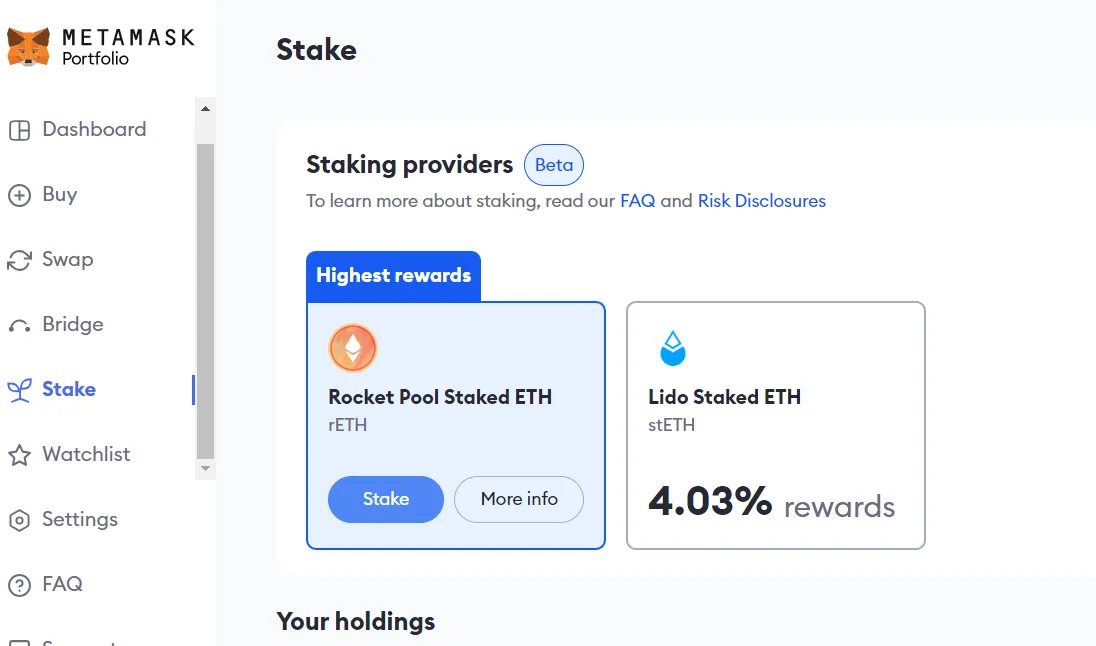

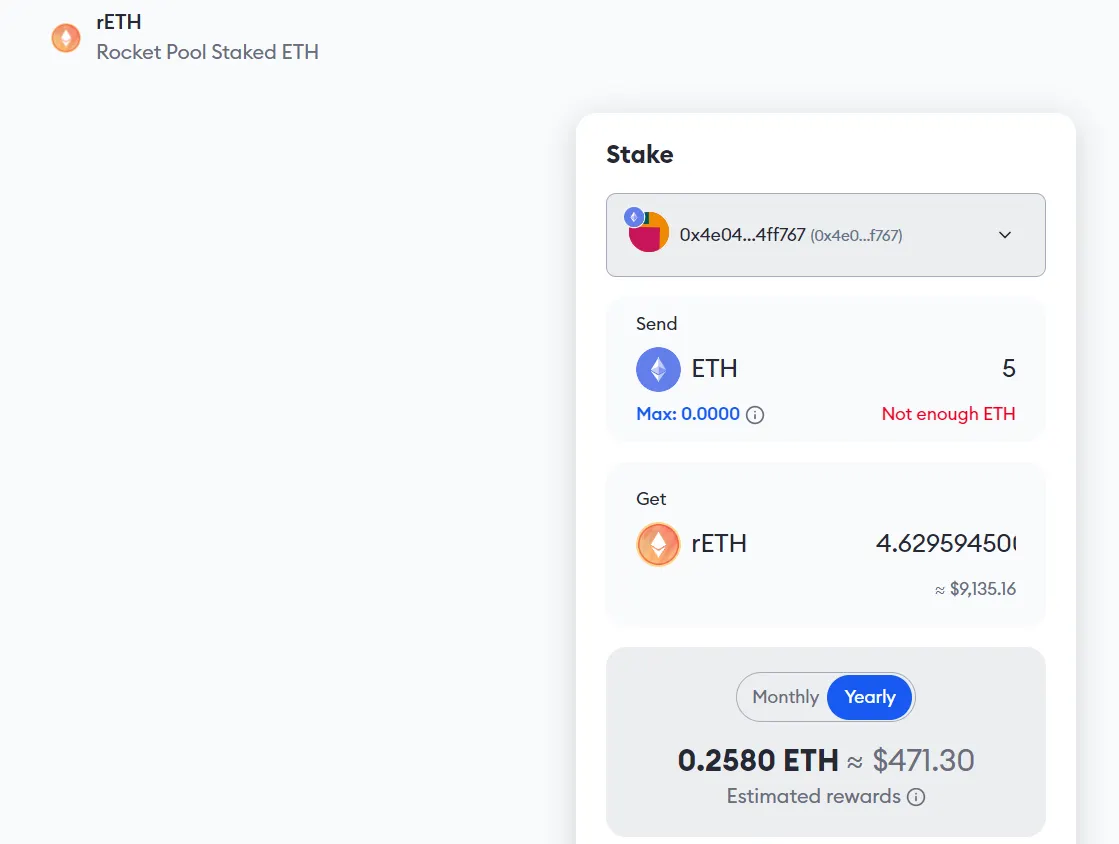

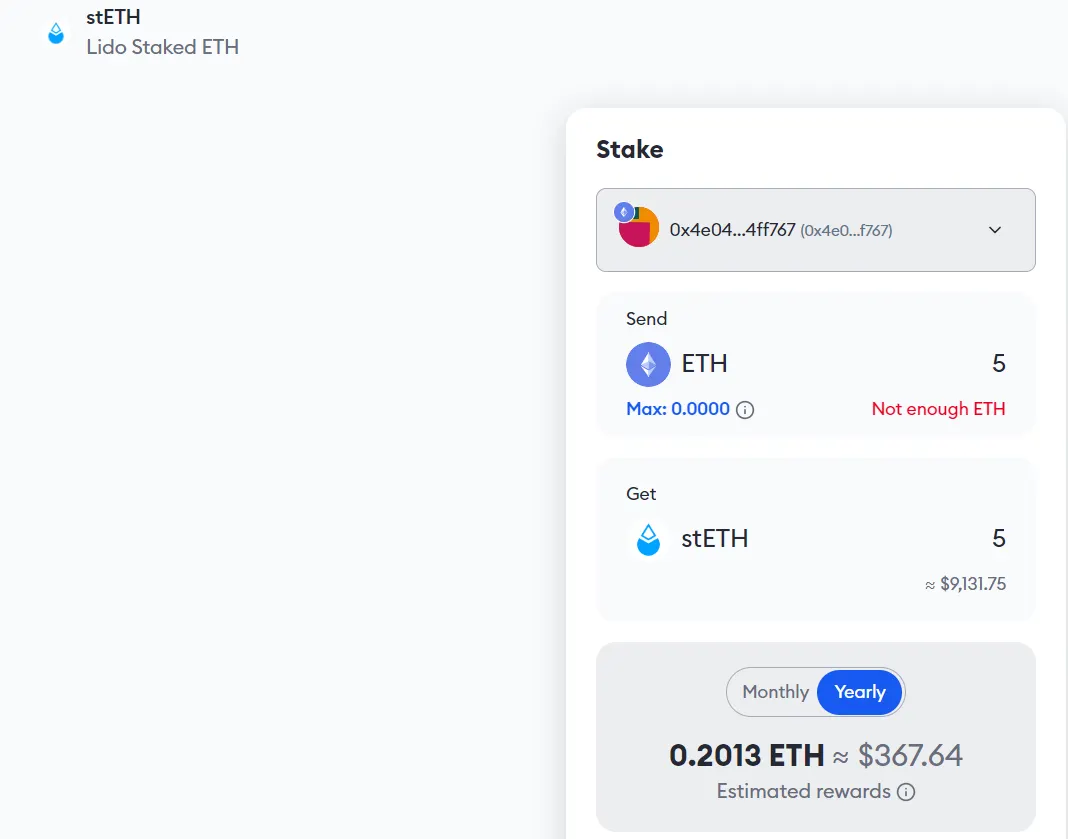

Step 2: With ETH in wallet, select “Stake” from the Metamask Portofolio main screen. You should see two staking options appear (from Lido and Rocket Pool). Select your desired staking option. These choices may have some slight differences (different rewards percentage, staking minimum requirements, and so on). These ETH staking options are called Liquid Staking Derivatives (LSDs); they allow you to earn staking rewards in a simple manner while lowering staking minimums (such as Ethereum’s 32 ETH staking minimum).

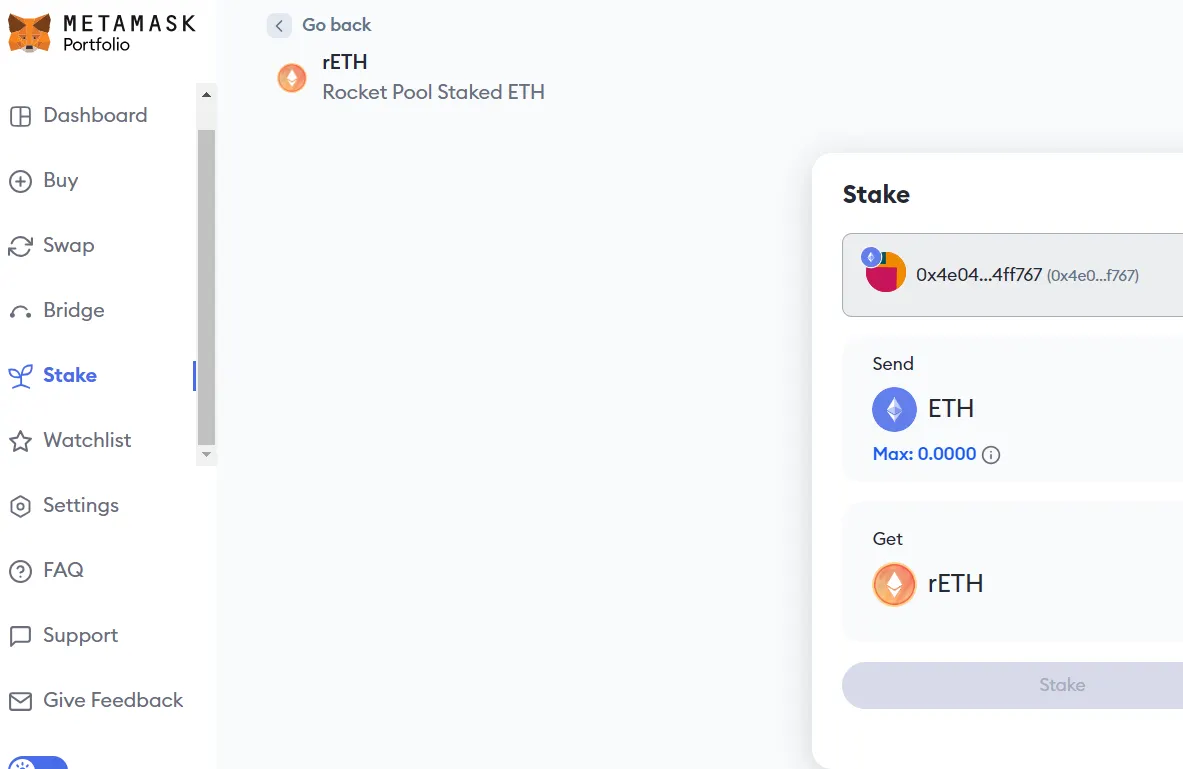

Step 3: Hover over one of the choices to select the “Stake” option. You’ll then be taken to a staking calculator that allows you to see the conversion rate and your annual staking rewards.

Step 4: Though not necessary, you can do a comparison between the two options prior to having any crypto on your wallet. This can help you decide if you’d like to stake — and which option would best suit your needs.

Step 5: When you’ve ultimately decided to stake, choose your staking option and your staking amount. You can stake all (by choosing “Max”) or a portion of your ETH holdings. Enter the amount you would like to stake and select “Review” to look over your transaction.

Step 6: If everything looks correct, click “Confirm” to finalize the staking process. After a short wait, you’ll receive a notification that your transaction has been completed.

Step 7: You should then be able to check your new staked ETH balance (of stETH or rETH) in the MetaMask Portfolio Dashboard.

MetaMask Staking ETH To Earn Crypto Rewards

Once you have staked your ETH, you can earn passive crypto rewards for as long as you desire. This is a good way to earn crypto without the demands — and costs — of crypto mining. When you want to redeem your staked ETH for native unstaked ETH, you have the option to later withdraw this stake (or unstake your ETH) using a similar process to the initial staking process. When this is finalized, you’ll receive your original staking deposit plus any rewards you acquired during the duration it was being staked.

When viewing your tokens, you’ll select “Withdraw” and the amount, click “Review” to check your transaction, and then “Confirm” to finalize it (in a similar manner to the staking initiation process). It is likely that there will be more staking options on MetaMask Portfolio as the crypto ecosystem develops and gets more regulatory clarity.

You should now have a solid understanding of how to use MetaMask Portfolio to buy, sell, swap, bridge, and stake crypto. For those that desire to trade within the Ethereum and EVM-compatible crypto landscape, it’s hard to go wrong with MetaMask as it is one of the original Ethereum wallets. While early to the wallet game, it has continued to innovate and iterate to provide a better user experience (UX) and adapt to changes in Ethereum (NFTs, LSDs, and more). Through the synergistic pairing of MetaMask with MetaMask Portfolio, it has made it much simpler and easier for crypto newbies to enter this exciting space — while retaining all the features and options that made it popular with crypto OGs.

Cheat Sheet:

- Staking crypto allows you to earn crypto returns that are typically 3–7% per annum.

- You can stake ether (ETH) and matic (MATIC) on MetaMask Portfolio; staking options may vary based on your country or region.

- When you’re finished staking, you can withdraw your crypto stake to receive your initial staking deposit plus any accrued staking rewards.